Why is BNB Up Today? Price Jumps, Token Sees 35% Volume Spike After CZ Pardon

Trading volume for BNB increased nearly 35% above its seven-day average, with market analysts suggesting the price movement reflects long-term accumulation.

By CD Analytics, Francisco Rodrigues|Edited by Stephen Alpher

Oct 24, 2025, 1:25 p.m.

- BNB rose 3.3% to $1,126 after U.S. President Donald Trump pardoned Changpeng Zhao, co-founder and former CEO of Binance.

- Trading volume for BNB increased nearly 35% above its seven-day average, with market analysts suggesting the price movement reflects long-term accumulation.

- Industry observers view the pardon as a potential turning point for Binance’s U.S. market access, with David Namdar of CEA Industries highlighting BNB’s strong fundamentals and global user base.

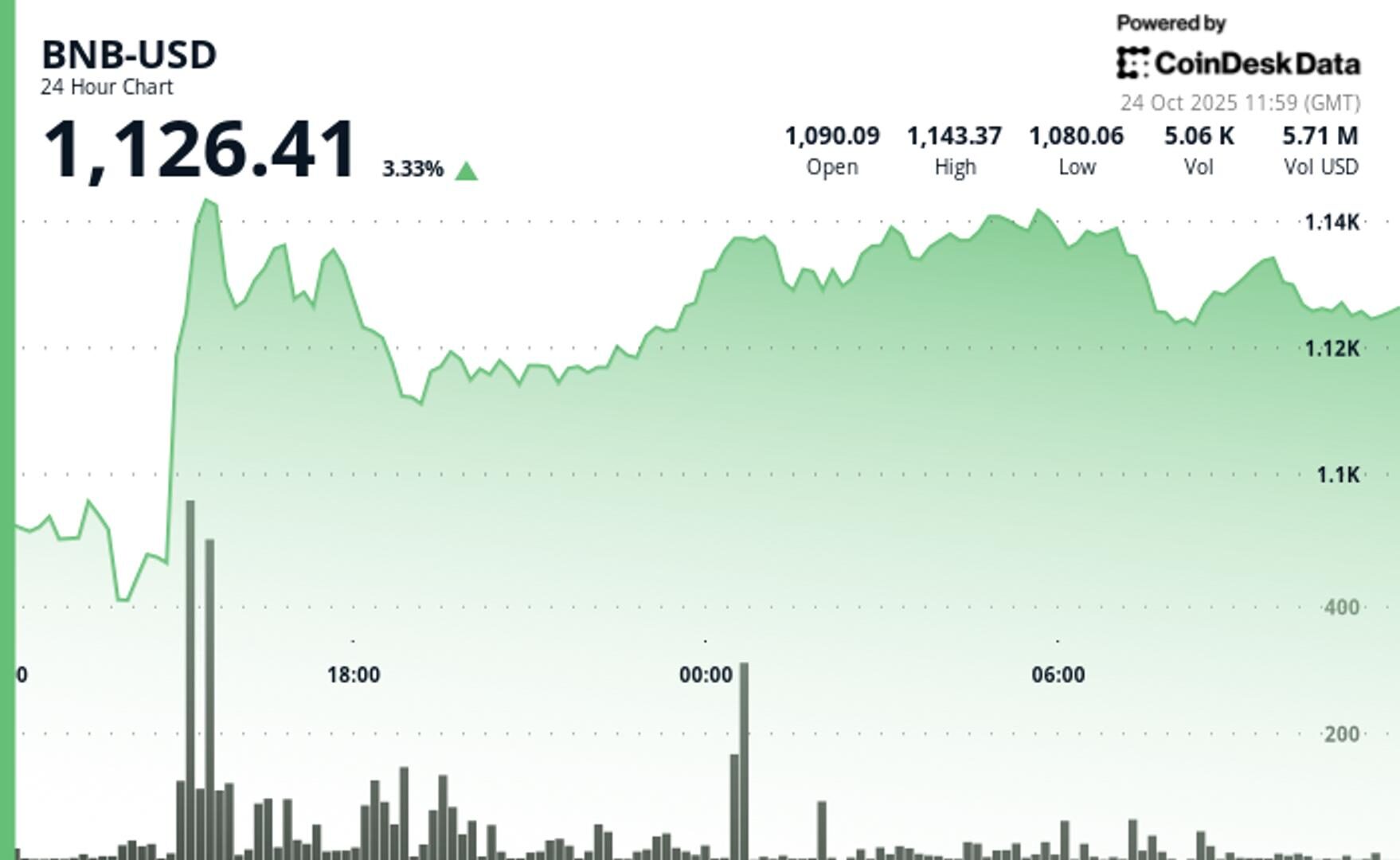

Binance Coin BNB$1,129.72 gained 3.3% in the last 24-hour period to trade at $1,126, outpacing broader crypto markets afterU.S. President Donald Trump issued a pardon for Changpeng Zhao, co-founder and former CEO of Binance.

Zhao pleaded guilty in November 2023 to violating the Bank Secrecy Act and agreed to step down from the exchange he founded. The attempt to imprison him for three years drew criticism across the crypto industry, and ultimately Zhao served four months.

STORY CONTINUES BELOW

In a statement, White House Press Secretary Karoline Leavitt characterized the prosecution under President Biden as a “war on cryptocurrency.”

“We believe CZ’s pardon is more than an inflection point for him personally, but also for BNB and potentially for Binance, paving the way for greater access to the US market,” said David Namdar, the CEO of CEA Industries, the largest publicly traded BNB treasury firm.

“The fundamentals for BNB have never looked better in our opinion: a vast global user base, deep real-world adoption, and consistent utility across DeFi and CeFi alike,” he added.

BNB’s rally was fueled by a spike in trading volume that jumped nearly 35% above its seven-day average, according to CoinDesk Research’s technical analysis data model. In the rally, the token surged from $1,085.96 to $1,130.25 before meeting resistance between $1,140 and $1,143. Market data suggest the buying pressure was more likely accumulation than short-term speculation.

Technically, the token appears to be consolidating. Short-term resistance at $1,128 has capped several intraday rallies, while support at $1,124 has held up despite multiple tests.

Traders are watching to see whether BNB can break higher toward $1,150, or if a failure at current levels will send it back toward $1,078.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

By James Van Straten, AI Boost|Edited by Stephen Alpher

50 minutes ago

The better than hoped inflation data cements market anticipation that the Fed is on track for rate cuts at its final two meetings of the year.

What to know:

- The U.S. Consumer Price Index (CPI) rose 0.3% in September versus estimates for 0.4%.

- The core CPI rose 0.2% against forecasts for 0.3%

- Up modestly ahead of the data, bitcoin added to gains, now trading at $111,600.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language