-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

Underlying network activity surged, with daily active wallet addresses on BNB Chain more than doubling to 2.5 million, but transaction volumes have been dropping steadily since late June.

By CD Analytics, Francisco Rodrigues|Edited by Aoyon Ashraf

Sep 1, 2025, 5:10 p.m.

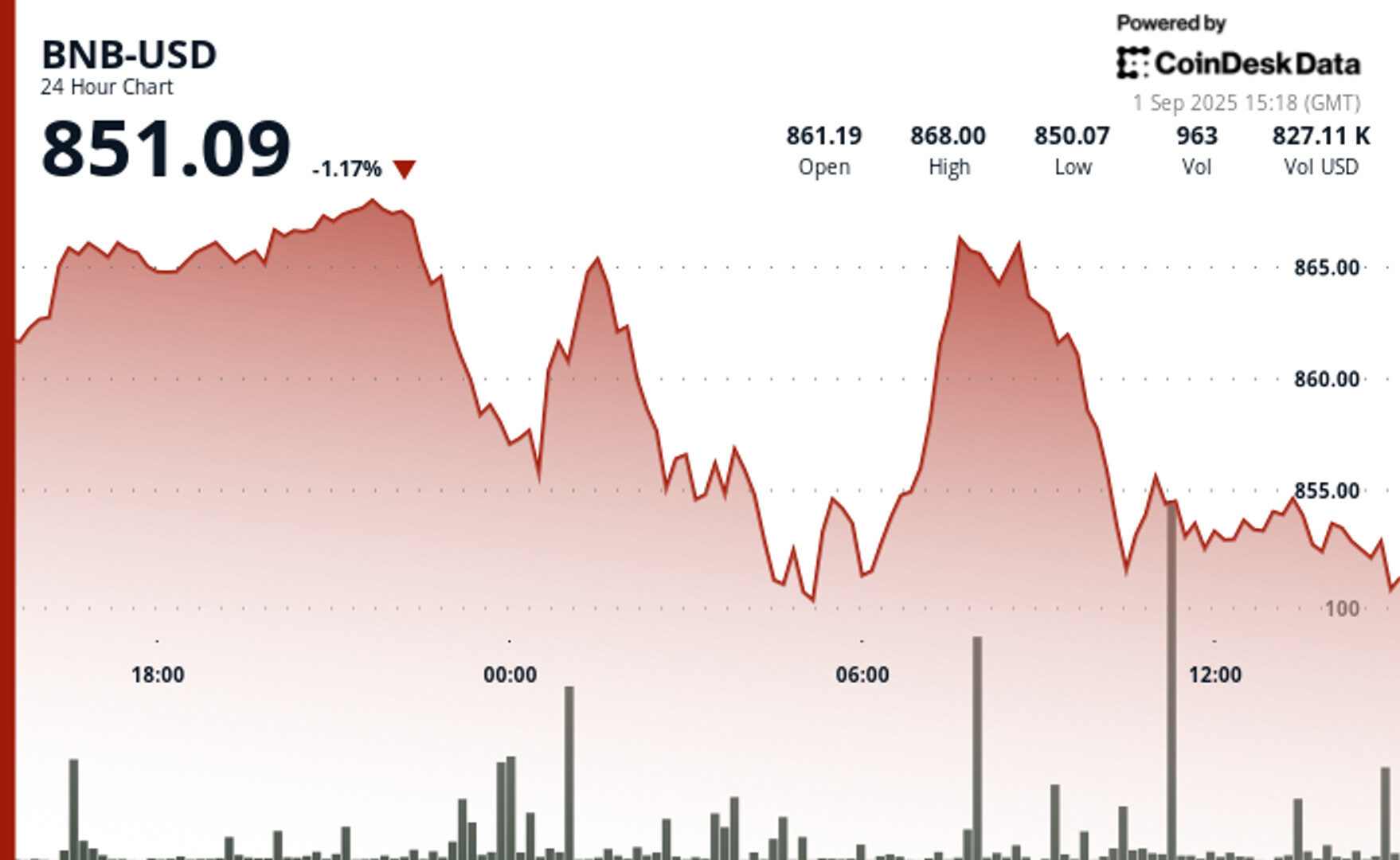

- BNB’s price saw sharp intraday swings, trading between $849.88 and $868.76, but ultimately failed to hold gains.

- Underlying network activity surged, with daily active wallet addresses on BNB Chain more than doubling to 2.5 million, but transaction volumes have been dropping steadily since late June.

- The price action is ahead of key economic data from the US, including jobs data, which could influence the Federal Reserve’s interest rate decision, with a near 90% chance of a 25 bps cut currently priced in.

The price of BNB saw sharp intraday swings over the past 24-hour period as it continued to drop from an all-time high of $900 seen late last month.

Over a 24-hour window, the asset traded between $849.88 and $868.76, a 2% move that began with bullish momentum but ended with signs of fatigue near resistance.

STORY CONTINUES BELOW

The volatility follows filings with the U.S. Securities and Exchange Commission by REX Shares late last month, along with the rise of BNB-focused treasury firms. The latest, B Strategy, aims to hold up to $1 billion worth of BNB with backing from the investment firm led by Binance co-founders Changpeng Zhao and Yi He.

While BNB failed to hold on to its gains from earlier, underlying network activity surged. Daily active wallet addresses on BNB Chain more than doubled, climbing to near 2.5 million according to DeFiLlama data.

Yet, transaction volumes have been dropping steadily since late June, data from the same source shows. BNB’s price drop also comes ahead of key economic data from the U.S. this week, including surveys of manufacturing and services and August payroll figures.

Jobs data could influence the odds of the Federal Reserve cutting interest rates this month. As it stands, the CME’s FedWatch tool weighs a near 90% chance of a 25 bps cut, while Polymarket traders put the odds at 82%.

BNB entered the session with a surge from $860.30 to $868.08, but the rally quickly lost steam. Heavy selling pressure emerged around the $867–$868 level, a zone that has now established itself as a key resistance ceiling, according to CoinDesk Research’s technical analysis model.

Volume surged during this attempt, peaking at 72,000 tokens, well above the average of 54,000, indicating a high level of participation during the failed breakout.

After the rejection, BNB retraced toward the $850–$855 range, where buying interest emerged. This was most visible as the token dipped to $851.40, triggering a volume spike. This response pointed to solid demand at these lower levels.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

By CD Analytics, Oliver Knight

49 minutes ago

Network upgrades trigger exchange halts while African expansion fuels institutional buying amid volatile price action.

What to know:

- XLM faced sharp volatility, trading between $0.34 and $0.36 in a 24-hour window, with heavy selloffs and volume spikes exceeding 70 million units.

- Bithumb will suspend deposits Sept. 3 as Stellar undergoes critical network upgrades, even as Ripple’s bank pilots boost sector confidence.

- Stellar is expanding in Africa, pushing mobile money integrations in Nigeria, Kenya and Ghana, with analysts still eyeing long-term targets of $0.62–$0.95 despite recent declines.