BONK Advances to $0.00001215 With Elevated Volume Amid Narrow Trading Range

BONK gains 2.84% to $0.00001215 as volume surges 134% above average, maintaining upward momentum within defined technical boundaries.

By Jamie Crawley, CD Analytics|Edited by Cheyenne Ligon

Nov 5, 2025, 3:59 p.m.

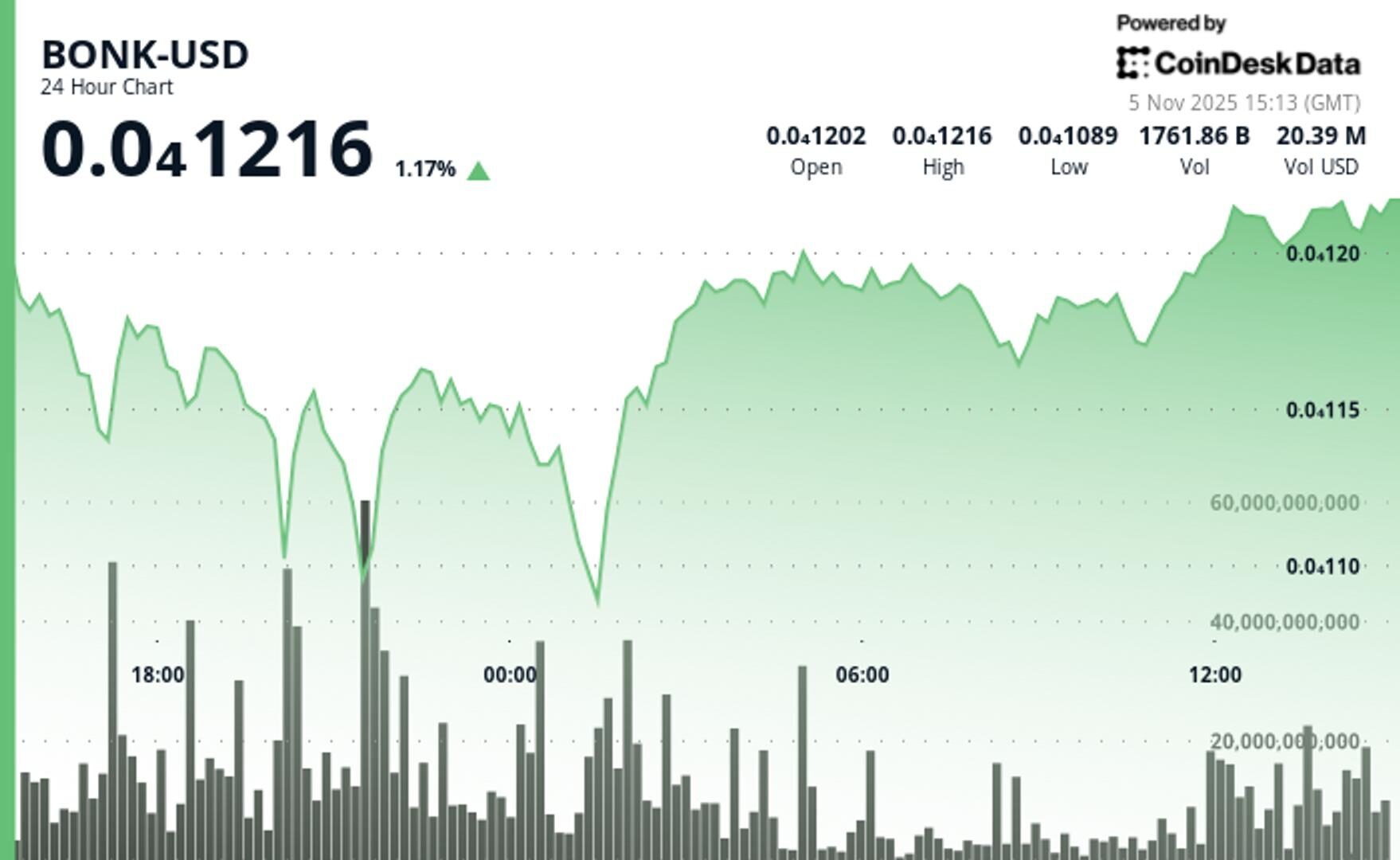

- BONK rose 2.84% to $0.00001215, holding steady within a tight intraday range.

- Trading volume reached 1.76T tokens, 134% higher than its 24-hour average.

- Support remains at $0.00001099, with resistance forming near $0.00001220.

BONK edged higher in the last 24 hours, rising 2.84% up at $0.00001215, establishing a well-defined consolidation range as price stabilized above key support levels, according to CoinDesk Research’s technical analysis data model.

Volume spiked to 2 trillion tokens at around 20:00 UTC Tuesday — roughly 134% above the daily average — as BONK rebounded from $0.00001099.

STORY CONTINUES BELOW

Following this surge in activity, the token held within the $0.00001170–$0.00001210 zone for most of the day before testing fresh intraday highs near $0.00001217.

The price movement may reflect an orderly consolidation phase following recent volatility across the meme token segment. Despite intermittent pullbacks, BONK maintained structure above its short-term support base, suggesting continued stabilization rather than renewed downside momentum. With volume levels remaining robust, the token continues to attract attention from traders monitoring for a potential breakout beyond its current range.

In the short term, BONK faces resistance between $0.00001217 and $0.00001225, a zone that has capped prior advances. A clean move above this band could validate a continuation pattern targeting higher levels. On the downside, $0.00001099 remains the critical support floor to watch, with a break below it potentially signaling a return to lower consolidation zones.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Nov 3, 2025

A deep dive into Zcash’s zero-knowledge architecture, shielded transaction growth, and its path to becoming encrypted Bitcoin at scale.

What to know:

In 2025, Zcash evolved from niche privacy tech into a functioning encrypted-money network:

- Shielded adoption surged, with 20–25% of circulating ZEC now held in encrypted addresses and 30% of transactions involving the shielded pool.

- The Zashi wallet made shielded transfers the default, pushing privacy from optional to standard practice.

- Project Tachyon, led by Sean Bowe, aims to boost throughput to thousands of private transactions per second.

- Zcash surpassed Monero in market share, becoming the largest privacy-focused cryptocurrency by capitalization.

More For You

By James Van Straten|Edited by Stephen Alpher

1 hour ago

Nearly 57% of all money ever invested in bitcoin is in the red at the $100,000 level according to James Check.

What to know:

- Around 57% of all invested capital is underwater at $100,000.

- Analyst Checkmate warns that a fall below $95,000 would mark a critical shift, and potentially signal the start of a bear market.

- Coinglass’ Fear & Greed Index has tumbled to “Extreme Fear” levels.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language