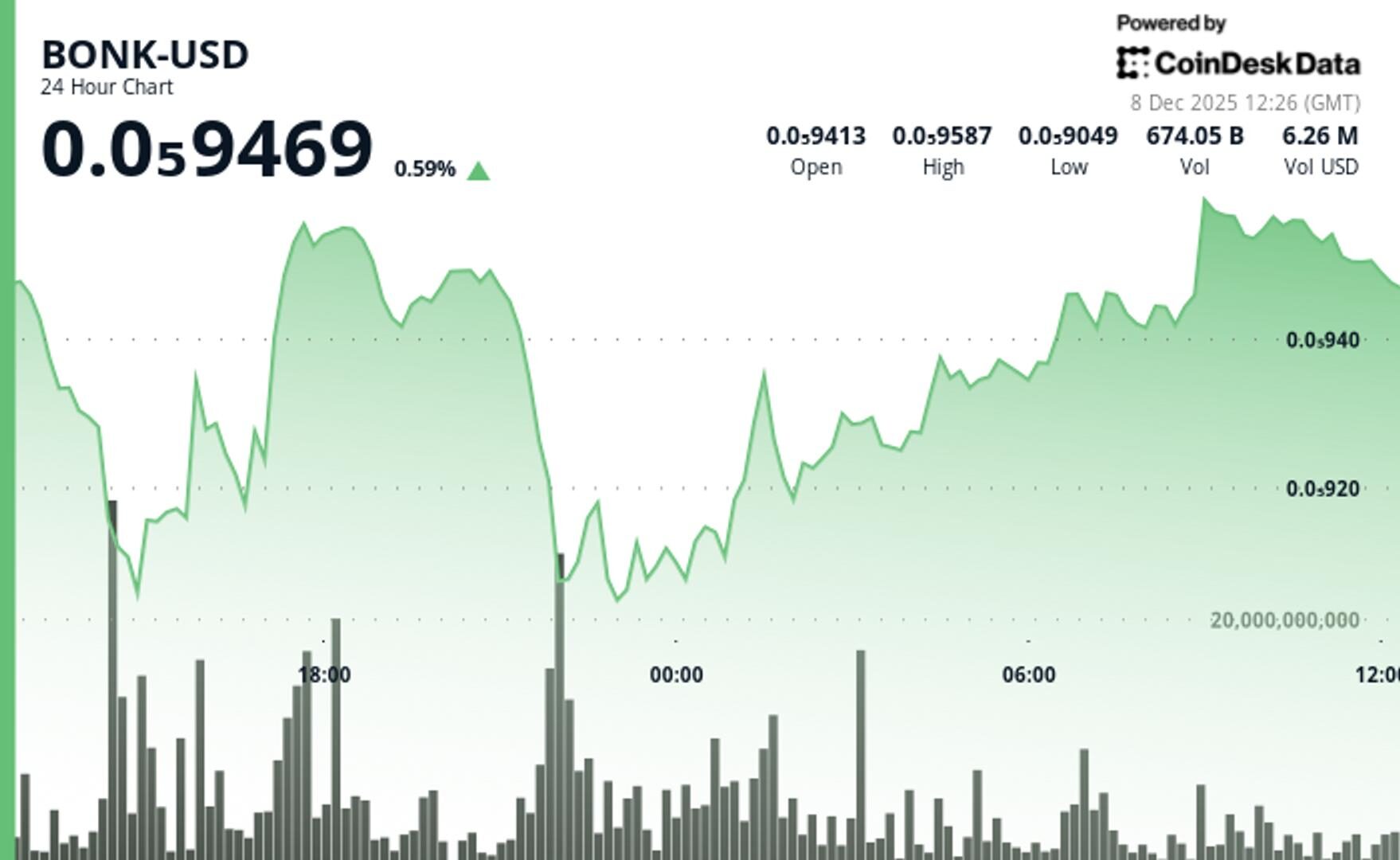

BONK Rises 4% Since Friday as Volume Builds Below $0.00001 Resistance

The Solana memecoin posted steady gains but continued to lag broader crypto markets as trading clustered just below a major psychological barrier.

By Jamie Crawley, CD Analytics

Dec 8, 2025, 12:42 p.m.

- BONK rose 1.47% to $0.00000954 but remains capped below the key $0.00001000 resistance zone.

- Volume jumped to 1.06 trillion tokens — 78% above the 24-hour average — confirming support at $0.00000900.

- Resistance at $0.00000958–$0.00000962 remains the barrier to a breakout, while support near $0.00000951 guides downside risk.

BONK added 1.47% over the past 24 hours to reach $0.00000954, extending a 4.2% rise since Friday while trading just below the psychological $0.00001 level.

The memecoin climbed from $0.00000940 but met consistent resistance near $0.00000958, underperforming the CD5 crypto index by roughly 2% as traders focused on tight-range positioning rather than broad momentum, according to CoinDesk Research’s technical analysis data model.

STORY CONTINUES BELOW

Volume patterns shaped much of the session’s structure. Activity surged 78% above the 24-hour moving average late on December 7, reaching 1.06 trillion tokens as BONK confirmed support at $0.00000900.

Trading then compressed into a narrow band, with multiple 60-minute intervals testing the $0.00000952–$0.00000956 zone. A short-term descending pattern formed after rejection from $0.00000962, while a sequence of higher lows preserved a mild upward bias.

Absent major catalysts, BONK’s immediate outlook hinges on whether it can decisively clear resistance. A move above $0.00000962 would refocus attention on the $0.00001000 threshold, while a failure to hold support near $0.00000951 risks a return toward the reinforced $0.00000900 floor.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By Olivier Acuna|Edited by Sheldon Reback

17 minutes ago

U.S. spot XRP ETFs approaching $1 billion are the most significant altcoin launch yet, validating a regulatory blueprint for all utility tokens and signaling Wall Street’s post-lawsuit conviction.

What to know:

- U.S. spot XRP ETFs are on track to surpass $1 billion in inflows soon, following a 15-day streak of net investments.

- The ETFs have benefited from the resolution of Ripple’s court case with the SEC, which clarified XRP’s regulatory status.

- Institutional interest in XRP ETFs is driven by their stability and liquidity, distinguishing them from other crypto ETFs.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language