-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Jamie Crawley, CD Analytics|Edited by Parikshit Mishra

Sep 2, 2025, 12:22 p.m.

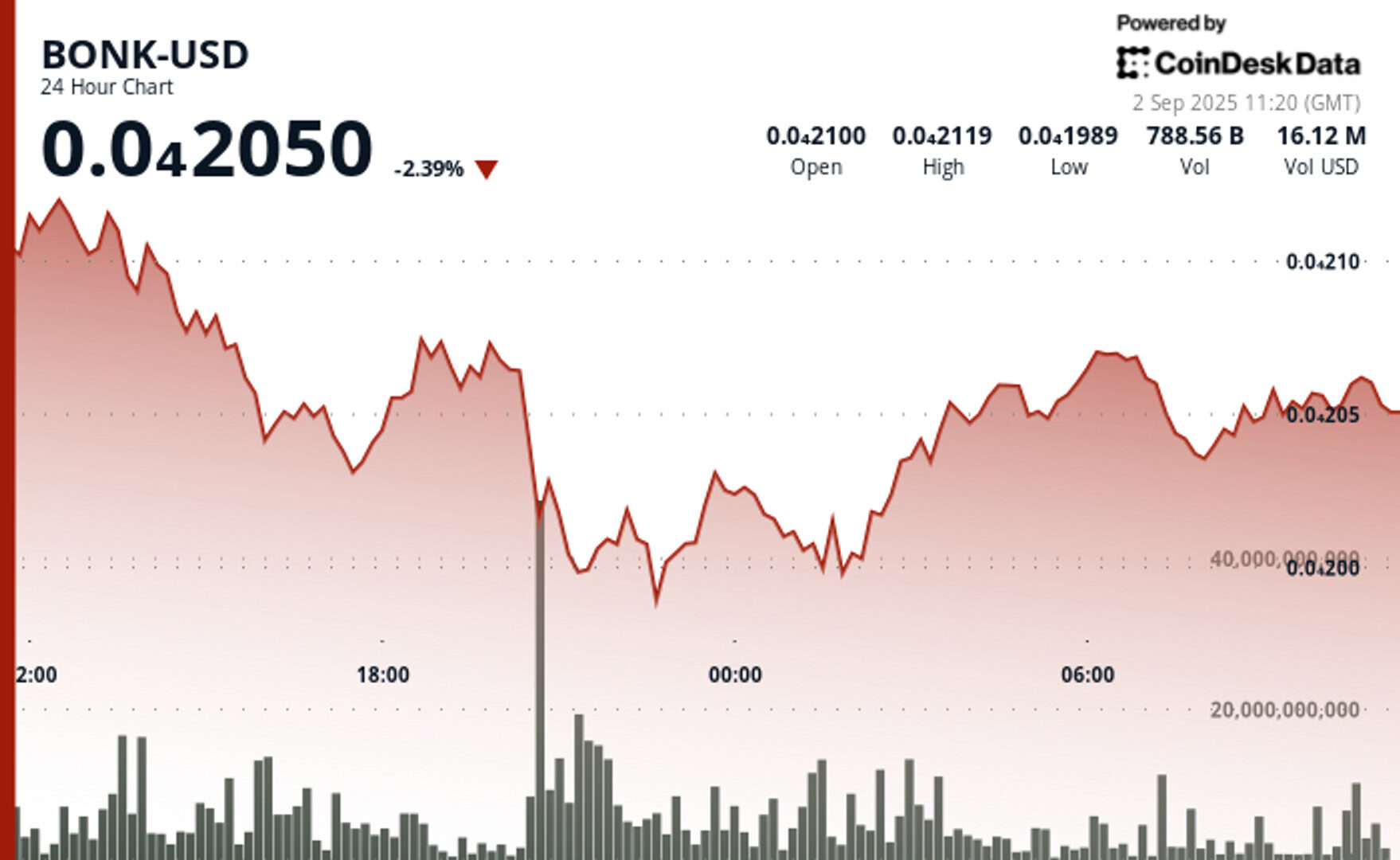

- BONK traded in a volatile 45% range between $0.00001991 and $0.00002123 from Sept. 1–2.

- Safety Shot’s $30M financing, with $25M denominated in BONK, highlights new corporate adoption.

- Token unlock worth $11.41M tested investor confidence but heavy buying reinforced support.

BONK navigated sharp swings over the last 24 hours, fluctuating between $0.00001991 and $0.00002123, a 45% trading spread that underscored heightened volatility.

Selling pressure intensified late on Tuesday amid a scheduled $11.41 million token unlock, with the token dropping from $0.00002102 to a low of $0.00001991 at 21:00 UTC. This move was accompanied by a volume spike surpassing 1.15 trillion tokens, according to CoinDesk Research’s technical analysis data model.

STORY CONTINUES BELOW

Despite the decline, BONK rebounded at the $0.00001990 support level. By the start of the European morning Tuesday, the token had recovered to $0.00002056, consolidating within a narrower range and signaling potential stabilization after the selloff.

Investor focus remains on Safety Shot’s $30 million financing deal, in which $25 million was funded through BONK tokens, a landmark move as the NASDAQ-listed company became the first to add the meme coin to its treasury.

- BONK traded in a 45% range between $0.00001991 and $0.00002123.

- Heavy selling Sept. 1 drove volume to 1.15 trillion tokens between 20:00–21:00 UTC.

- Support held at $0.00001990 amid strong institutional buying interest.

- Recovery saw price climb from $0.00002035 to $0.00002056 on Sept. 2.

- Resistance identified near $0.00002120 as sellers capped further upside.

- Short-term volatility narrowed to a 0.24% spread around $0.00002053–$0.00002058.

- Volume spikes above 27.3 billion tokens at 09:50 UTC suggested continued accumulation.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

By CD Analytics, Francisco Rodrigues|Edited by Sheldon Reback

20 minutes ago

The rebound from support was fueled by above-average activity and a clean break above nearby resistance could shift sentiment.

What to know:

- BNB’s price was little changed at $850 after dropping to around $840 and then rallying to $855.

- Buying interest emerged at the $840-$845 support zone.

- The rebound from support was fueled by above-average activity and a clean break above nearby resistance could shift sentiment.

- The token is now consolidating, with resistance near $855-$857, and a hold above current levels could set the stage for a test of higher levels.