Jul 3, 2025, 4:43 p.m.

- BONK has surged more than 8% in the last 24 hours, leading the altcoin rally as bitcoin hovers near fresh highs.

- Tuttle Capital Management confirmed July 16 as the earliest possible launch date for its suite of leveraged crypto ETFs, including a 2X BONK ETF.

- BONK is approaching the 1 million holders milestone, which will trigger a 1 trillion token burn event, potentially creating positive price pressure.

As bitcoin

hovers near a fresh all-time high, the Solana-based memecoin, BONK

, is leading the major altcoin rally.

The surge coincides with renewed optimism in risk assets following bitcoin’s recovery above $110,000, which has triggered widespread gains across established cryptocurrencies.

STORY CONTINUES BELOW

BONK’s momentum appears sustainable as numerous crypto analysts express bullish sentiment, citing significant upside potential remaining.

Adding to BONK’s bullish case, the BONK foundation’s token launchpad, LetsBONK.fun, recently surpassed competitor Pump.fun in daily volume with a 126% increase. This development benefits BONK holders as 50% of the platform’s revenue is allocated to buying and burning BONK tokens, creating additional positive price pressure in a market already anticipating the upcoming 1 trillion token burn when the project reaches 1 million holders.

Meanwhile, Tuttle Capital Management confirmed July 16 as the earliest possible launch date for its suite of leveraged crypto ETFs, including a 2× BONK ETF, fueling bullish sentiment.

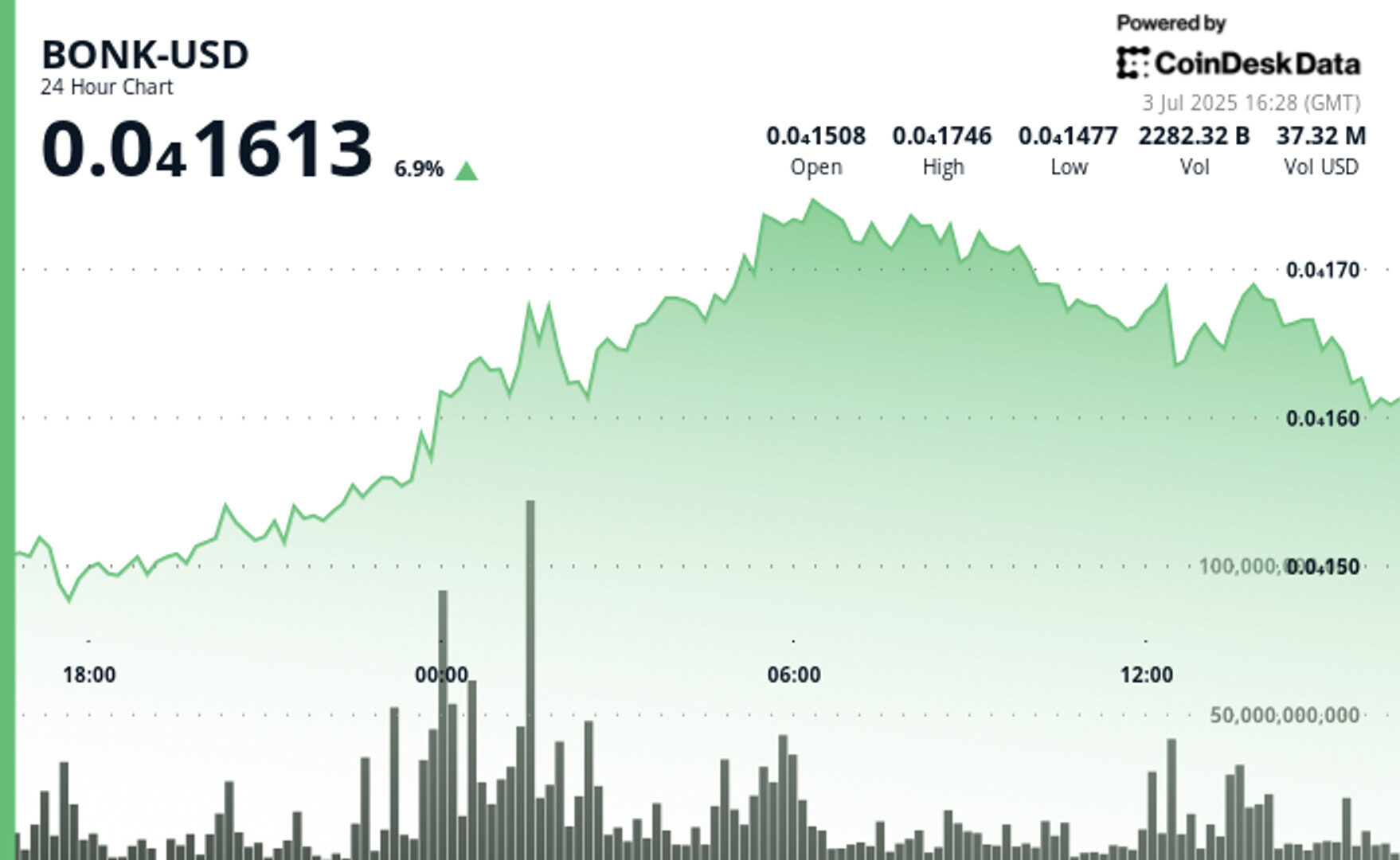

- The BONK-USD pair experienced increased buying pressure during the last 24 hours, from July 2, 16:00 UTC, to July 3, 15:00 UTC. It surged from $0.0000147 to a peak of $0.0000175, representing a 10.4% range, according to CoinDesk Research’s technical analysis model.

- A significant volume spike to 2.9 trillion at midnight on July 3 established strong support at the $0.0000157 level, while high-volume buying at the $0.0000168 level during the 05:00 UTC hour propelled prices higher despite late session profit-taking, the model showed.

- However, during the last 60 minutes from July 3 at 14:50 to 15:49 UTC, BONK-USD experienced significant volatility, dropping from $0.00001666 to a low of $0.00001619 before recovering to $0.00001624.

- A notable volume spike of 86.9 trillion at 15:35 coincided with the price bottoming at $0.00001619, establishing a key support level. The subsequent recovery formed an ascending trendline with increasing volumes, particularly at 15:49, where 22.5 trillion in volume pushed prices up by 2.7% from the session low, according to the model.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

Aoyon Ashraf is CoinDesk’s Head of Americas. He spent almost a decade at Bloomberg covering equities, commodities and tech. Prior to that, he spent several years on the sellside, financing small-cap companies. Aoyon graduated from University of Toronto with a degree in mining engineering. He holds ETH and BTC, as well as ADA, SOL, ATOM and some other altcoins that are below CoinDesk’s disclosure threshold of $1,000.