BONK Price Slips 3.4% With Support Under Pressure Amid Solana Market Weakness

BONK broke $0.0000146 support on heavy volume but found buyers near $0.0000143 as traders eye potential base formation.

By Jamie Crawley, CD Analytics|Edited by Stephen Alpher

Oct 29, 2025, 3:19 p.m.

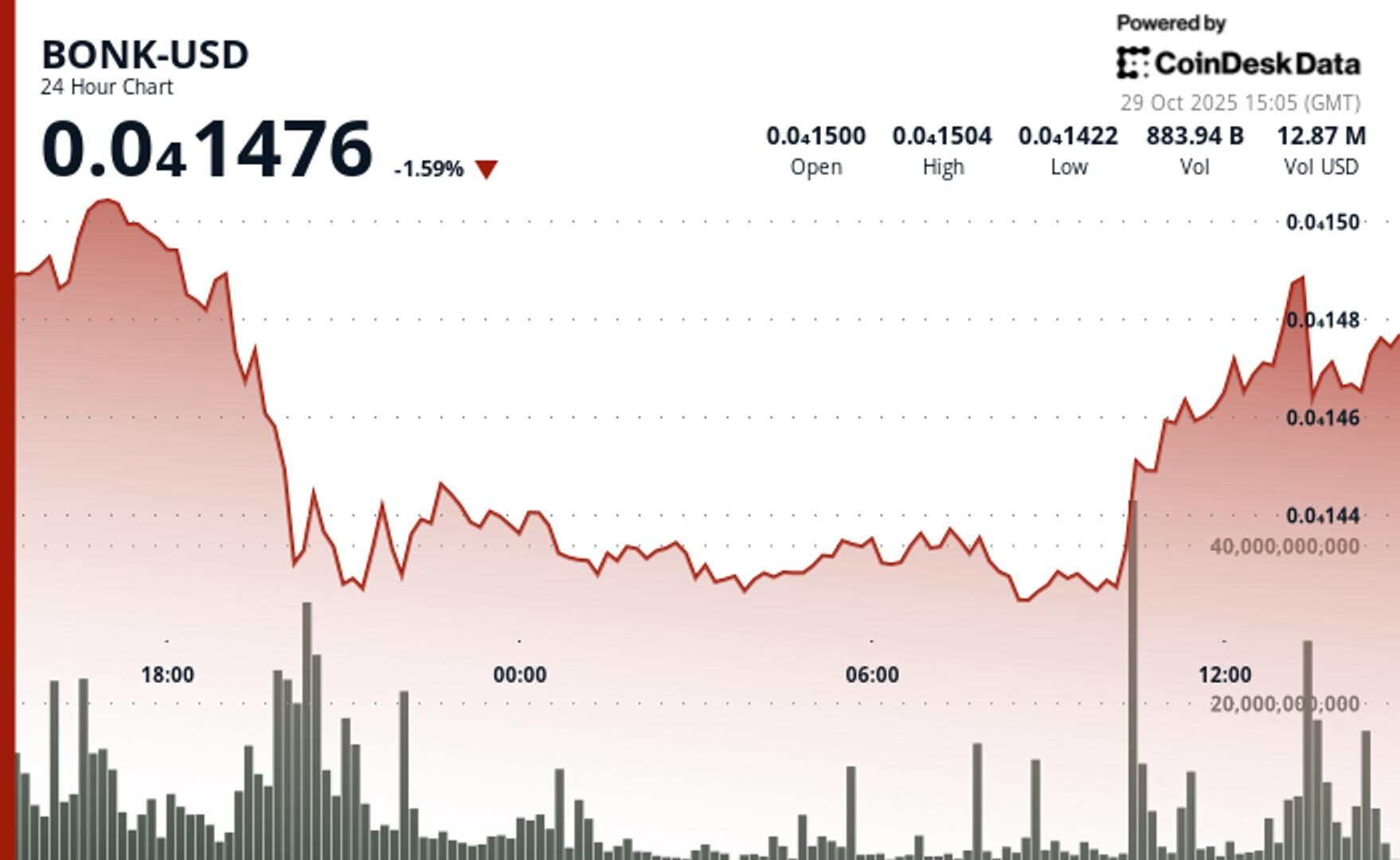

- BONK dropped 3.4% to $0.0000143, confirming a technical breakdown below $0.0000146.

- Trading volume jumped 122% above average, signaling aggressive repositioning.

- Resistance formed around $0.0000143, suggesting potential near-term consolidation zone.

BONK-USD extended its slide Tuesday, falling 3.4% to $0.0000143 as the Solana-based meme token succumbed to renewed downard pressure across the broader ecosystem.

The decline marked a decisive break below $0.0000146 support, a key level that had held for much of the past week, confirming a short-term bearish structure, according to CoinDesk Research’s technical analysis data model.

STORY CONTINUES BELOW

The 24-hour trading range spanned roughly $0.0000090, reflecting 6.2% intraday volatility typical of BONK’s highly speculative nature. Volume surged to 1.26 trillion tokens around 20:00 GMT, representing a 122% increase over the 24-hour average — a signal that institutional and algorithmic traders were active during the breakdown.

After peaking near $0.0000152, BONK failed to sustain its gains, printing a series of lower highs between 19:00 and 21:00 GMT before cascading toward the $0.0000143 zone.

Despite the weakness, buying interest emerged late in the session as volume spikes between 01:32 and 01:50 GMT brought modest relief. The token rebounded slightly to $0.0000143291, forming a higher low near $0.0000142930, which suggests early base-building at support.

The token’s immediate focus now lies within the $0.0000143–$0.0000144 consolidation band, with upside momentum capped by resistance at $0.0000144018 and $0.0000146.

Traders expect continued range-bound activity, with tactical opportunities for accumulation near current levels.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Oct 16, 2025

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

By CD Analytics, Francisco Rodrigues|Edited by Jamie Crawley

41 minutes ago

The decline was part of a broader crypto market drop, with traders focusing on technical cues and selling dominating

What to know:

- BNB’s price dropped 2.7% to $1,105 after a brief rise following BNB Chain’s largest-ever quarterly token burn, which removed 1.44 million BNB from circulation.

- The decline was part of a broader crypto market drop, with traders focusing on technical cues and selling dominating.

- Despite the short-term bearish trend, a report from Binance founder’s family office YZi Labs framed BNB as a long-term structural asset.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language