Standard Chartered predicted XRP could rise to $8 by 2026 in an April note, supported by improved U.S. regulatory clarity and institutional interest.

By Shaurya Malwa, CD Analytics

Updated Dec 31, 2025, 5:37 a.m. Published Dec 31, 2025, 5:37 a.m.

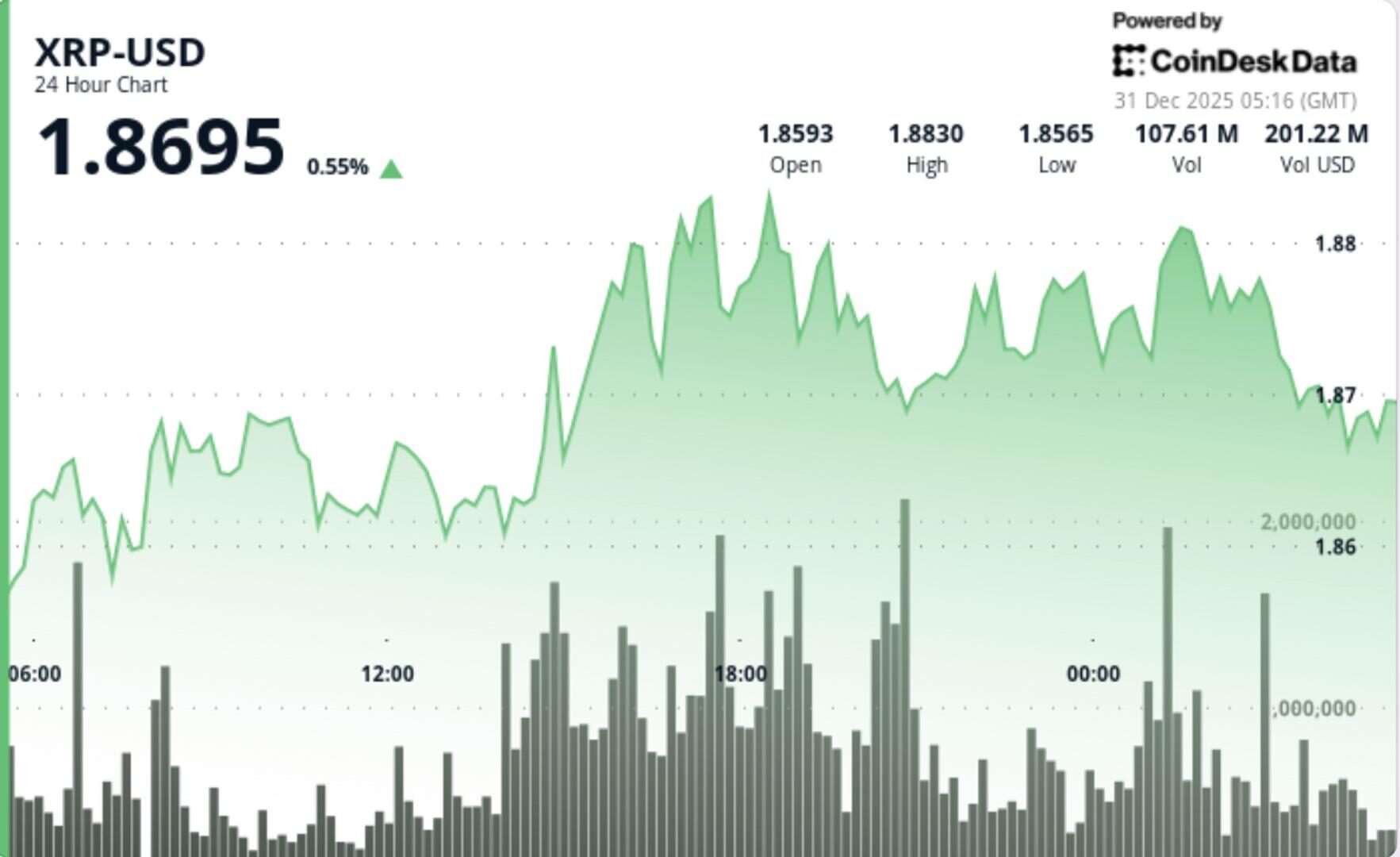

- XRP’s price remained stable around $1.87 despite increased trading volume, indicating market positioning rather than panic.

- Standard Chartered predicts XRP could rise to $8 by 2026, supported by improved U.S. regulatory clarity and institutional interest.

- The upcoming January escrow unlock could trigger sharp price movements, with $1.85 being a critical support level to watch.

XRP edged lower to $1.87 even as trading activity picked up sharply, keeping the token pinned to a narrow range around the $1.85 support zone.

The setup reads like positioning rather than panic: price isn’t moving much, but volume is rising — a combination that often shows the market is preparing for a bigger move.

STORY CONTINUES BELOW

- Standard Chartered has reiterated one of the most bullish mainstream forecasts for XRP, calling for the token to reach $8 by the end of 2026 — roughly 330% upside from current levels — as it argues XRP can now expand without the legal overhang that defined much of the last cycle.

- Geoff Kendrick, the bank’s global head of digital assets research, said improving U.S. regulatory clarity has made it easier for institutions to take exposure and has given Ripple and the XRP ecosystem room to build without constant litigation risk.

- That institutional interest has shown up through market structure: U.S.-listed spot XRP ETFs have pulled in roughly $1.25 billion in net inflows since their November launch, a steadier allocation profile than the stop-start flow patterns seen in bitcoin and ether ETFs.

- At the same time, XRP exchange balances have fallen toward multi-year lows — a dynamic traders often read as reduced liquid supply available on venues.

- That doesn’t guarantee price upside, but it can magnify moves if demand holds steady and sellers become less willing to provide liquidity.

- XRP slipped 0.79% to $1.87 while volume ran roughly 20.8% above weekly norms, an imbalance that typically reflects distribution or rotation rather than clean accumulation.

- The most active window hit at 14:00, when about 57.2 million units traded as XRP failed to extend above $1.8792 — reinforcing that sellers are still leaning on rallies rather than letting price reclaim higher ranges.

- The $1.85 handle remains the line that matters. Price tested the area and held, but the broader structure stays heavy: moving averages remain stacked bearishly and sloping lower, which continues to cap upside attempts and keeps the tape biased toward selling into strength.

- Derivatives signals add complexity. Open interest climbed to $3.43 billion while spot netflows were negative by around $10.7 million, a mix that suggests leverage is building even as spot flows do not confirm aggressive demand.

- That combination can tighten ranges, but it also raises the risk of sharp moves if the market has to unwind quickly.

- The next near-term catalyst is calendar-driven: January’s scheduled 1 billion XRP escrow unlock. Even if a large portion is re-escrowed, the event tends to heighten sensitivity to supply and liquidity, particularly when price is already sitting on a major technical shelf.

- XRP slipped to $1.87 after failing to build above $1.8792 resistance

- Volume rose about 20.8% above weekly averages, but price stayed range-bound

- The $1.85 support zone held, keeping the market from cascading lower

- Trading activity concentrated around rejection points, consistent with selling into rallies

- This is a support-defense market with supply overhead.

- If $1.85 holds and XRP can reclaim the $1.88–$1.89 zone, the next test is $1.92–$1.93, where sellers have repeatedly stepped in. A close above that area would shift the short-term tone back toward recovery and open room to $2.00 and the downtrend line near $2.08.

- If $1.85 breaks decisively, the market likely rotates into the next demand pocket around $1.77, with deeper support levels in focus near $1.60–$1.55.

- In the immediate term, rising volume with muted price movement suggests positioning ahead of the January escrow unlock rather than a clean directional trend — but the compression around $1.85 makes the next break more likely to be sharp than gradual.

More For You

Dec 19, 2025

L1 tokens broadly underperformed in 2025 despite a backdrop of regulatory and institutional wins. Explore the key trends defining ten major blockchains below.

What to know:

2025 was defined by a stark divergence: structural progress collided with stagnant price action. Institutional milestones were reached and TVL increased across most major ecosystems, yet the majority of large-cap Layer-1 tokens finished the year with negative or flat returns.

This report analyzes the structural decoupling between network usage and token performance. We examine 10 major blockchain ecosystems, exploring protocol versus application revenues, key ecosystem narratives, mechanics driving institutional adoption, and the trends to watch as we head into 2026.

More For You

By Shaurya Malwa|Edited by Sam Reynolds

15 minutes ago

The market’s focus is now on whether bitcoin can maintain its support levels into the new year, as the failed rally may signal a need for a deeper market reset.

What to know:

- Bitcoin and ether ended December without the expected year-end rally, highlighting the fragility of crypto markets when liquidity is low and risk appetite declines.

- Repeated attempts by bitcoin to reclaim key levels were unsuccessful, and the quarter ended with a negative performance, contrasting with the strong performance of precious metals like gold.

- The market’s focus is now on whether bitcoin can maintain its support levels into the new year, as the failed rally may signal a need for a deeper market reset.