Chainlink (LINK) Price News: Plunges 5% as Sellers Dominate. Can It Reclaim $15?

Technical breakdown occurred despite positive institutional developments as volume surged during selloff

By CD Analytics, Krisztian Sandor|Edited by Aoyon Ashraf

Nov 13, 2025, 6:55 p.m.

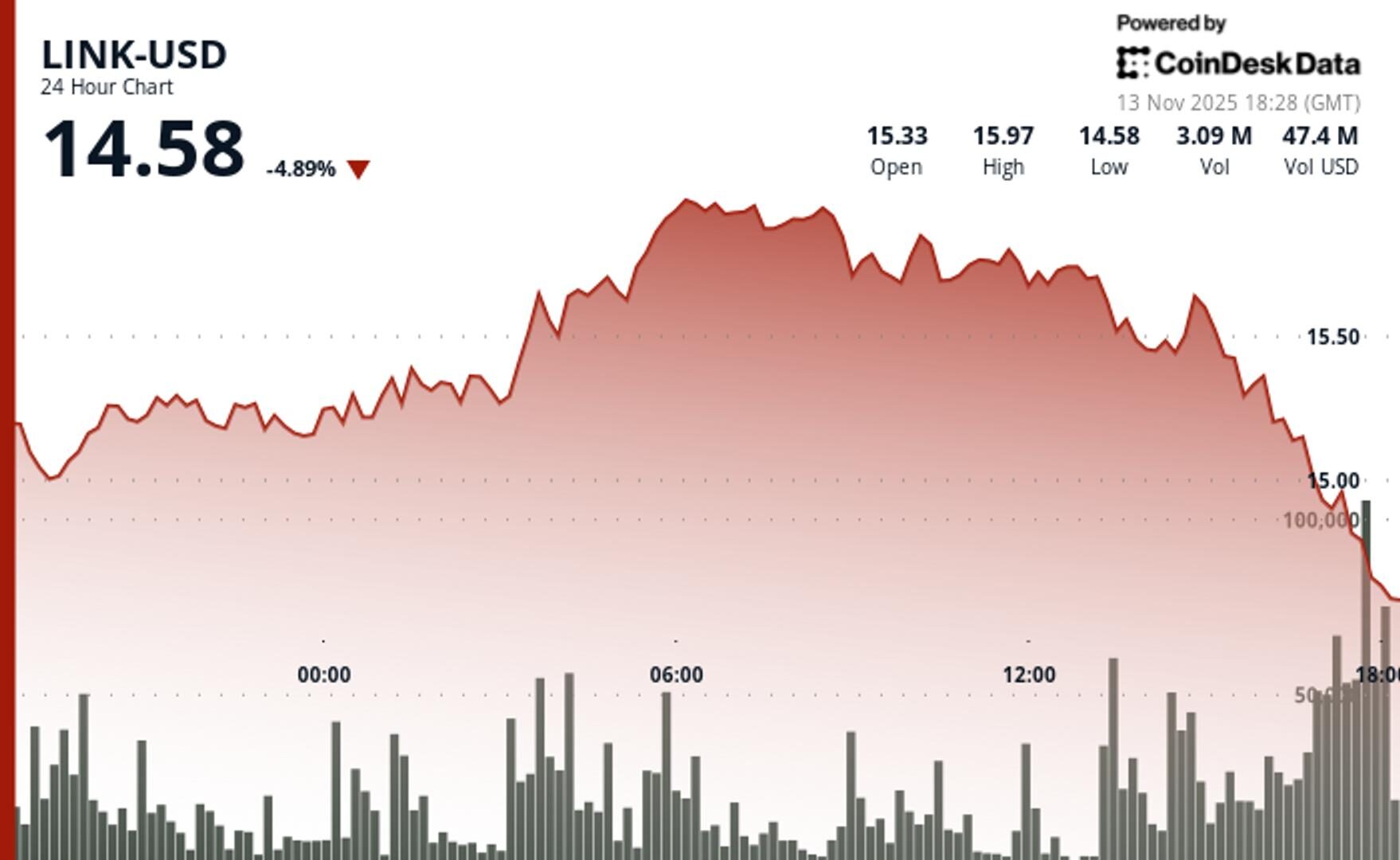

- LINK fell from $15.26 to below $14.50, breaking key ascending support amid a 118% volume surge, CoinDesk data showed.

- The Chainlink Reserve added 74,049 tokens on Thursday, now holding 800K+ LINK at a 27% unrealized loss.

- A three‑wave liquidation cascade confirmed bearish momentum as $15 flipped into firm resistance, CoinDesk Research’s technical analysis model suggested.

Chainlink’s LINK LINK$15.93 token extended its slide during Thursday, dropping nearly 5% over the past 24 hours and breaking below $14.50 as technical sellers overpowered buyers.

LINK fell from $15.26 to $14.73 during the day, then continued lower, marking its weakest level since late October, CoinDesk data showed. The token underperformed the CoinDesk 5 Index, which declined 3.7% over the past 24 hours.

STORY CONTINUES BELOW

Trading volume surged to 3.32 million tokens, some 118% above the daily average, during the breakdown, confirming a decisive rejection of the $15.00–$15.26 resistance range, CoinDesk Research’s technical analysis model said. A rapid three‑wave liquidation cascade between 17:05 and 17:41 UTC saw more than 360,000 tokens trade in minutes, pushing LINK toward new support near $14.40 as bearish momentum accelerated.

Even with the decline, onchain data shows continued protocol accumulation. The Chainlink Reserve purchased another 74,049 LINK on Thursday, lifting total holdings above 800,000 tokens, according to the reserve’s dashboard. Its average acquisition cost sits near $20, leaving the reserve roughly 27% underwater.

With LINK slipping under $14.50, traders now face a tighter risk window: losing the $14.40–$14.50 zone could open room toward $14.20, while reclaiming $15.00 remains the threshold for stabilizing short‑term momentum.

- Support/Resistance: $14.40–$14.50 acts as immediate support; resistance sits at $15.00 and $15.26.

- Volume Analysis: Breakdown volume surged 118% above average, signaling institutional‑driven sell pressure.

- Chart Patterns: Clear trendline break confirms bearish reversal from recent highs.

- Targets & Risk/Reward: Holding $14.40 keeps downside contained to $14.20; recovery requires a move above $15.26.

Disclaimer: Parts of this article were generated with the assistance of AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Oct 16, 2025

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

By CD Analytics, Oliver Knight

1 hour ago

XLM retreated to $0.281 as selling pressure intensified during afternoon trading, with volume surging amid failed resistance test.

What to know:

- Stellar dropped from $0.289 to $0.281 in 60-minute period, breaking key support.

- Trading volume peaked at 76.24M shares as price rejected resistance near $0.290.

- Token established trading range between $0.281 support and $0.294 resistance.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language