Chainlink (LINK) Price News: 10% Decline Amid Crypto Selloff; Rewards Season 1 Coming

The oracle network’s token hit its weakest price since the October 10 crash, breaking key support levels after multiple failed breakout last week.

By CD Analytics, Krisztian Sandor|Edited by Nikhilesh De

Nov 3, 2025, 5:51 p.m.

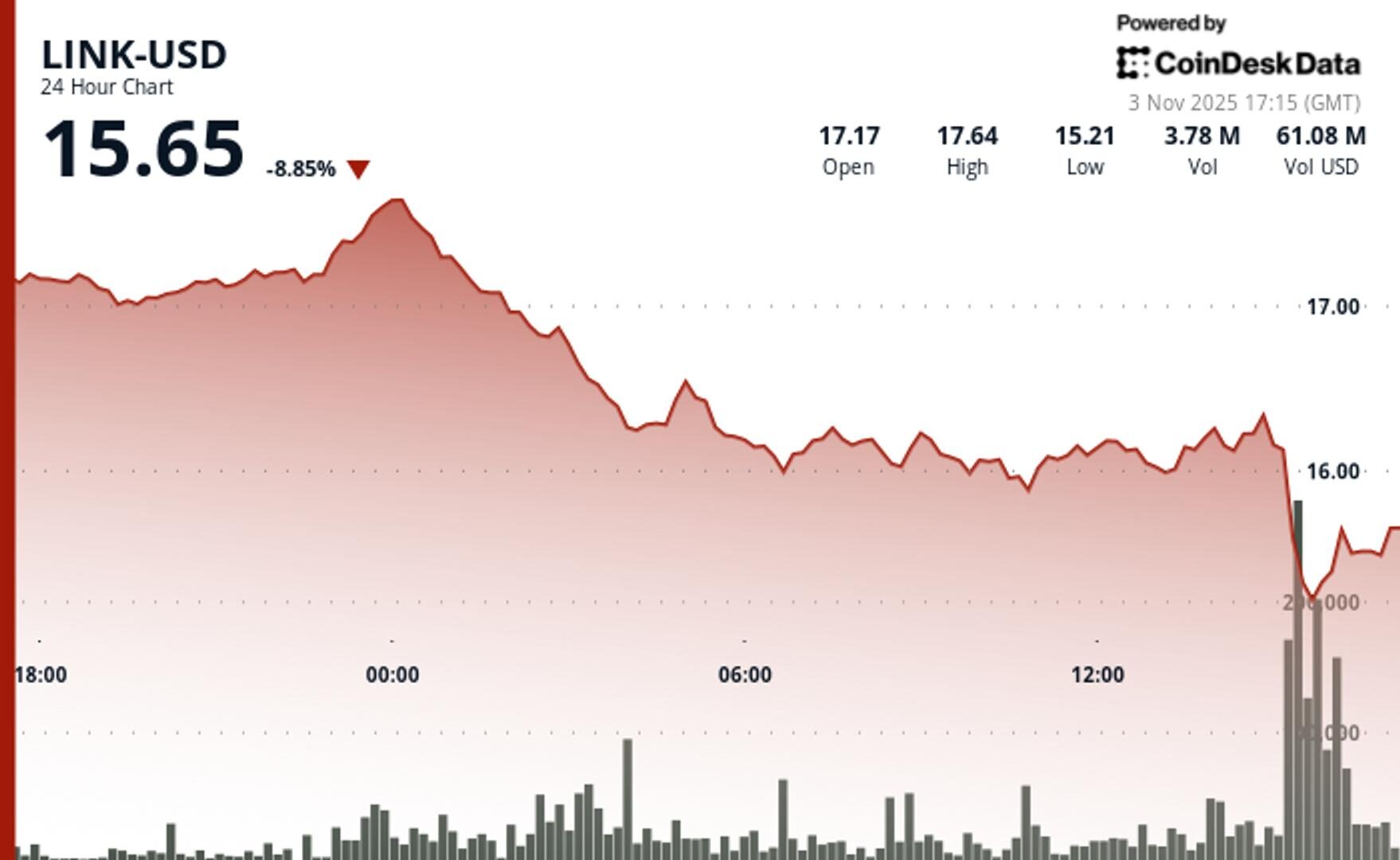

- LINK fell over 10% to $15 on Monday morning, hitting its lowest since October crash amid heavy trading.

- Downside risk to fall to $14.5 persists if token fails to reclaim $16, CoinDesk Research’s technical model says.

- Chainlink announced Rewards Season 1, offering token incentives to eligible LINK stakers starting next week.

Chainlink’s LINK token fell 10% on Monday, plunging to its weakest price since the October 10 flash crash breaking down key support levels.

Trading activity spiked 674% above the 24-hour average at the height of the breakdown, with over 12 million LINK changing hands as the token dropped from $16.21 to $15.02 in under 30 minutes, CoinDesk Research’s technical model said.

STORY CONTINUES BELOW

The token underperformed the CoinDesk 5 index by more than 5.8%, signaling technical weakness amid heavy volume.

The CoinDesk Research model pointed to a failed breakout earlier in the week and lack of fresh catalysts as reasons for the move. LINK now faces critical support around $15.25, with technical downside risk toward $14.50 if buyers fail to stabilize the current range.

The selloff came as Chainlink unveiled “Rewards Season 1,” a new incentive program launching on November 11. The initiative will allow eligible LINK stakers to earn token rewards from nine participating Chainlink BUILD projects, including Dolomite, Space and Time, Truflation-linked Truf Network and others, the Monday blog post said.

Participants can earn Cubes — non-transferable reward points — based on prior staking activity, which they can allocate to projects of their choice before rewards begin unlocking in mid-December.

- Support/Resistance: Immediate support at $15.25–15.30; resistance sits at $17.66

- Volume Analysis: Volume peaked at 12.4 million tokens, up 674% from the daily average.

- Chart Patterns: Breakdown confirmed with lower highs following failed breakout.

- Targets & Risk/Reward: If $16 fails to hold, downside extends to $14.50; recovery faces strong resistance at $20.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Oct 16, 2025

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

By CD Analytics, Oliver Knight

53 minutes ago

XLM steadies after a sharp 5.5% sell-off, with traders watching the $0.277 level as the critical line between recovery and renewed downside pressure.

What to know:

- Stellar’s price rebounded from a $0.277 low after heavy liquidation, confirming the level as pivotal short-term support.

- Volume surged 887% during the breakdown before normalizing, hinting at short-term stabilization.

- XLM faces strong resistance at $0.3014, with consolidation near $0.281 suggesting a balanced but fragile market.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language