Chainlink (LINK) Price News: Bounces 4% as FOMC Volatility Drives Crypto Market

The oracle network token overcame selling pressure earlier Wednesday, but the technical picture remains mixed.

By CD Analytics, Krisztian Sandor|Edited by Nikhilesh De

Oct 29, 2025, 9:17 p.m.

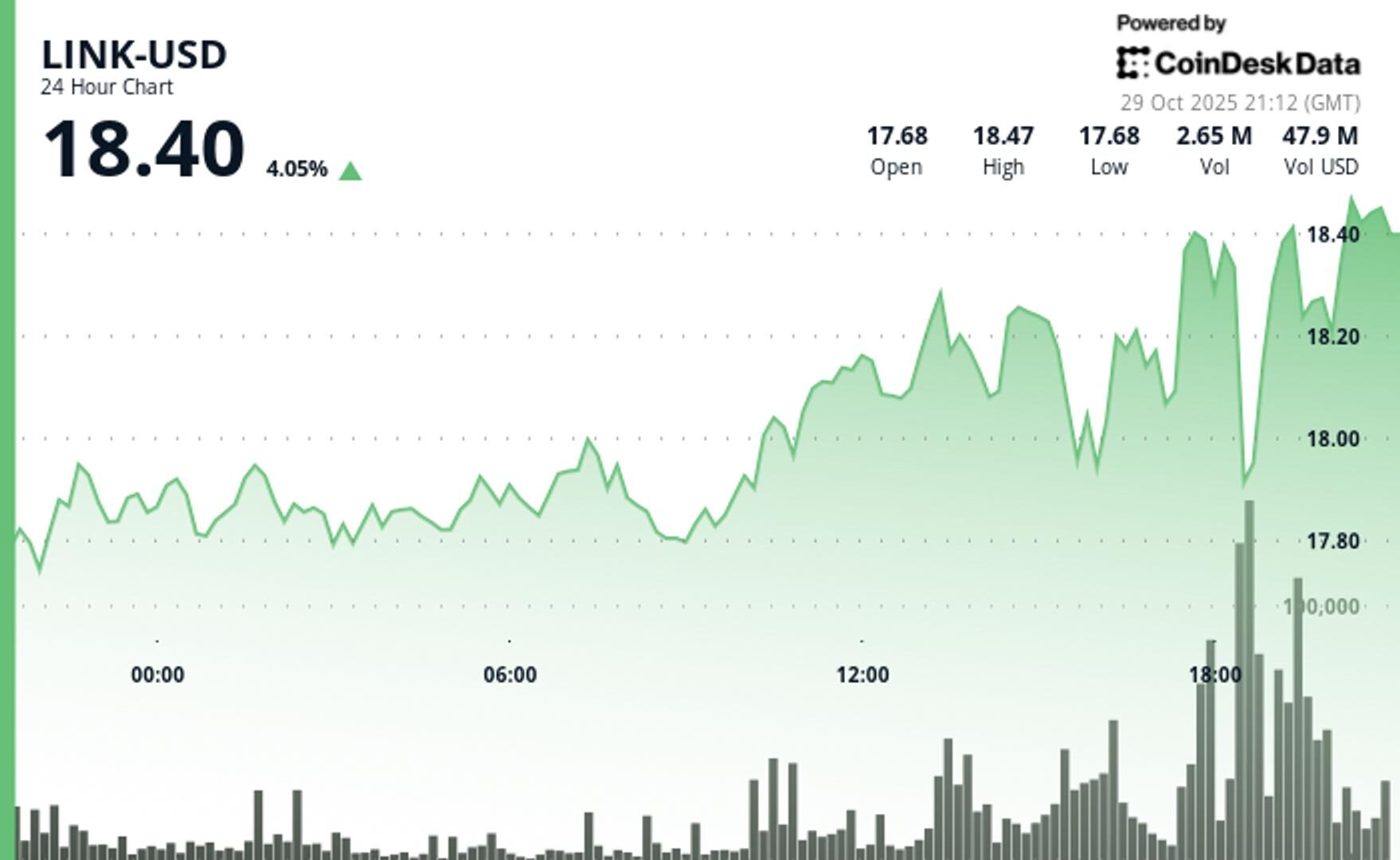

- LINK dropped to $17.96 Wednesday afternoon following volatile range-bound trading over the past 24 hours.

- Volume jumped 26% above weekly averages amid breakdown through $18 support.

- Technical analysis shows selling exhaustion near $17.60 with accumulation emerging.

Chainlink’s native token LINK LINK$17.96 recovered to $18.40 during the Wednesday session, reversing losses from a sharp intraday selloff that saw the price fall below the key $18 support level.

A sudden volume spike of 4.59 million tokens — 178% above the 24-hour average — confirmed the breakdown as sellers overpowered short-term support levels. The token briefly consolidated between $17.80 and $18.30 before buyers stepped in late in the day, CoinDesk Research’s market insight tool suggested.

STORY CONTINUES BELOW

The rebound coincided with the broader crypto markets stabilizing after a Federal Reserve Chairman Jerome Powell’s slightly hawkish speech, which saw bitcoin BTC$111,573.92 briefly dipping below $110,000.

LINK was up roughly 4% over the past 24 hours.

Despite the downside move, underlying accumulation trends remain in play. Since early October, approximately $188 million worth of LINK has been pulled off exchanges by whale wallets, indicating strategic long-term positioning. Still, recent price swings show that near-term resistance near $18.60 continues to trigger profit-taking, muddying the short-term outlook.

Volume rose 26% above the seven-day average as traders reacted to heightened volatility. The sharpest price decline occurred in the 60-minute window between $18.03 and $17.96, extending a bearish pattern that appears to have exhausted by the session close. Extremely light volume in the final trading hour points to a possible slowdown in institutional selling.

For now, LINK’s ability to hold above $18 will be a key signal. A sustained move higher could push the token back toward the $19 level, but failure to hold the line may expose downside toward the $17.60 support floor.

- Support/Resistance: Critical support established at $17.60 with immediate resistance at $18.50-$18.80.

- Volume Analysis: 26% surge above weekly averages confirms breakdown legitimacy, though diminishing activity suggests pause in selling.

- Chart Patterns: Range-bound consolidation between $17.80-$18.30 following initial breakdown through $18.00.

- Targets & Risk/Reward: Reclaiming the $18 level opens way to $18.50-$18.80 resistance zone, while failure to hold $17.60 may extend declines toward $17.00.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Oct 16, 2025

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

By Helene Braun|Edited by Nikhilesh De

57 minutes ago

The MetaMask maker’s public debut could be the biggest Ethereum-native listing yet, amid a wave of crypto firms hitting U.S. markets.

What to know:

- Consensys, creator of the MetaMask wallet, plans to go public with JPMorgan Chase and Goldman Sachs leading its IPO, Axios reported.

- The Ethereum developer also backs SharpLink, which this week said it will deploy $200 million into onchain yield strategies on Linea, Consensys’ Layer 2 network.

- The move follows a wave of crypto firms including Circle, Gemini and Bullish going public this year amid improving U.S. regulatory clarity.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language