Chainlink (LINK) Price News: Modest Bounce as Stellar Integration Expands RWA Reach

Stellar is integrating Chainlink’s CCIP, Data Feeds, and Streams to enable tokenized asset flow across chains.

By CD Analytics, Krisztian Sandor|Edited by Stephen Alpher

Oct 31, 2025, 6:39 p.m.

- LINK rebounded 3.6% above with strong trading volume and institutional dip-buying.

- Weak U.S. session saw the token reverting below $17, but still holding above key support levels.

- The oracle network’s enterprise partnerships expands as Stellar taps Chainlink services.

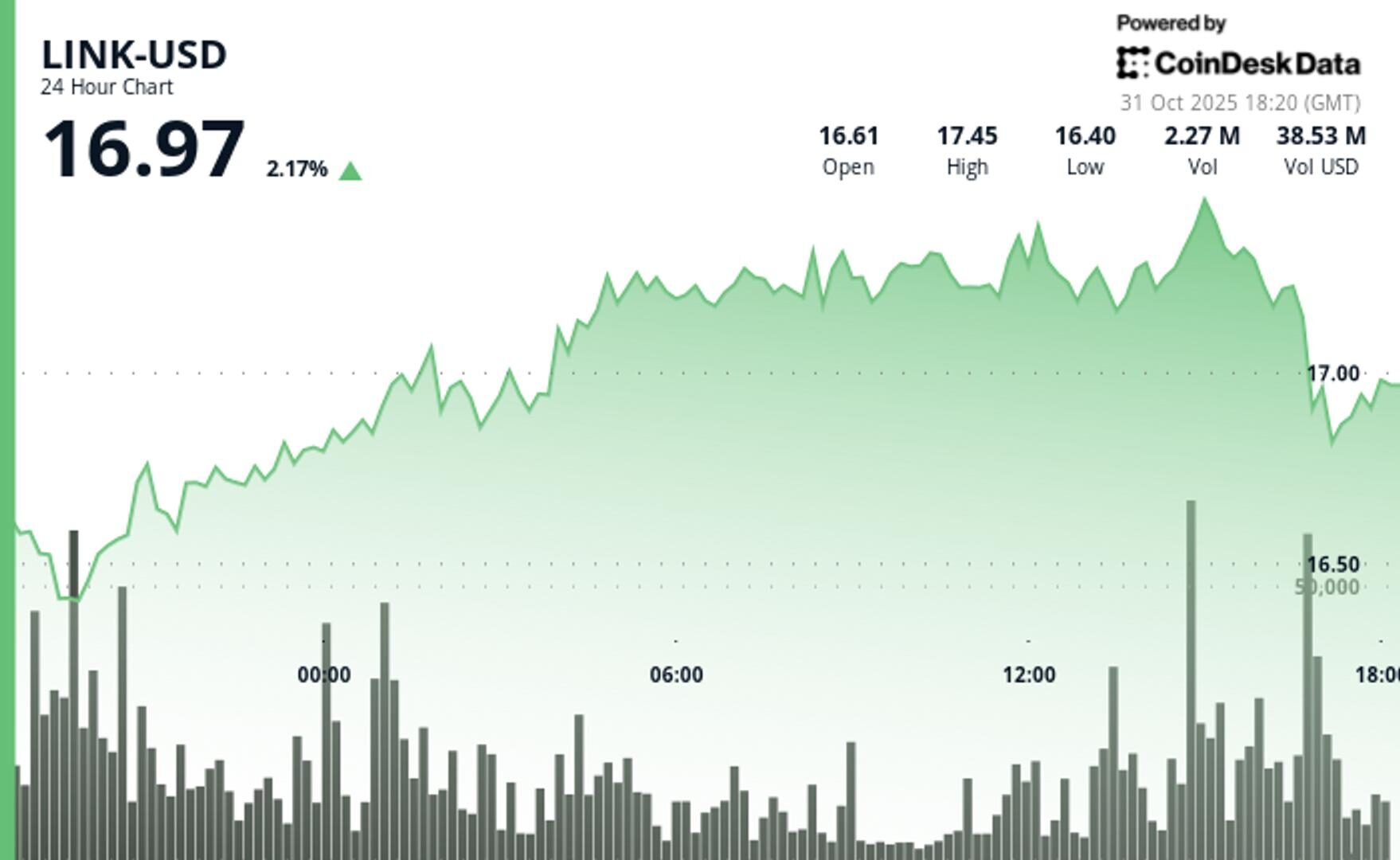

The native token of oracle network Chainlink LINK$17.21 bounced 3.6% on Friday, reversing some of Thursday’s losses as traders stepped in around key support level.

LINK briefly cleared the $17 level with a surge in trading volume — some 3 million tokens changed hands during a morning breakout up —, pointing to renewed accumulation, CoinDesk Research’s market insight tool suggested. However, weakness during the U.S. trading hours drove LINK back below $17. Recently, the token traded at $16.96.

STORY CONTINUES BELOW

On the news front, payments-focused Stellar (XLM) announced to integrate Chainlink’s Cross-Chain Interoperability Protocol (CCIP), Data Feeds, and Data Streams. The move enables developers and institutions building on Stellar to access real-time data and trusted cross-chain infrastructure for tokenized assets.

With over $5.4 billion in quarterly RWA volume and a fast-growing DeFi footprint, Stellar’s adoption of Chainlink tooling signals expanding demand for secure, interoperable financial infrastructure.

LINK now holds near-term support at $16.37 with upside targets at $17.46 and $18.00. Whether the token can build on Friday’s rebound may depend on broader market flows and follow-through from dip-buying.

- Support/Resistance: Solid support holds at $16.37 after multiple successful tests, while $17.46 resistance shows repeated rejection patterns.

- Volume Analysis: 78% volume surge during breakout attempt confirms institutional interest, explosive selling volume indicates position rebalancing.

- Chart Patterns: Late-session flush-out pattern creates classic oversold setup for accumulation strategies.

- Targets & Risk/Reward: Holding above $16.89 targets $17.46 retest with upside to $18.00, downside risk limited to $16.37 support.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Oct 16, 2025

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

By Siamak Masnavi, CD Analytics|Edited by Aoyon Ashraf

1 hour ago

A fast rebound met heavier trading, but rallies stalled near resistance as advocates shared Halloween-themed comments on X.

What to know:

- Dip buying lifted bitcoin off support, but rallies stalled at nearby resistance.

- Volume increased on the rebound and then cooled as trading narrowed into a tighter range.

- Focus remains on a clear break from the current band to signal the next directional move.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language