Chainlink (LINK) Price News: Rallies 4% Amid Crypto Rebound, Outperforming Bitcoin (BTC)

By CD Analytics, Krisztian Sandor|Edited by Stephen Alpher

Nov 18, 2025, 6:18 p.m.

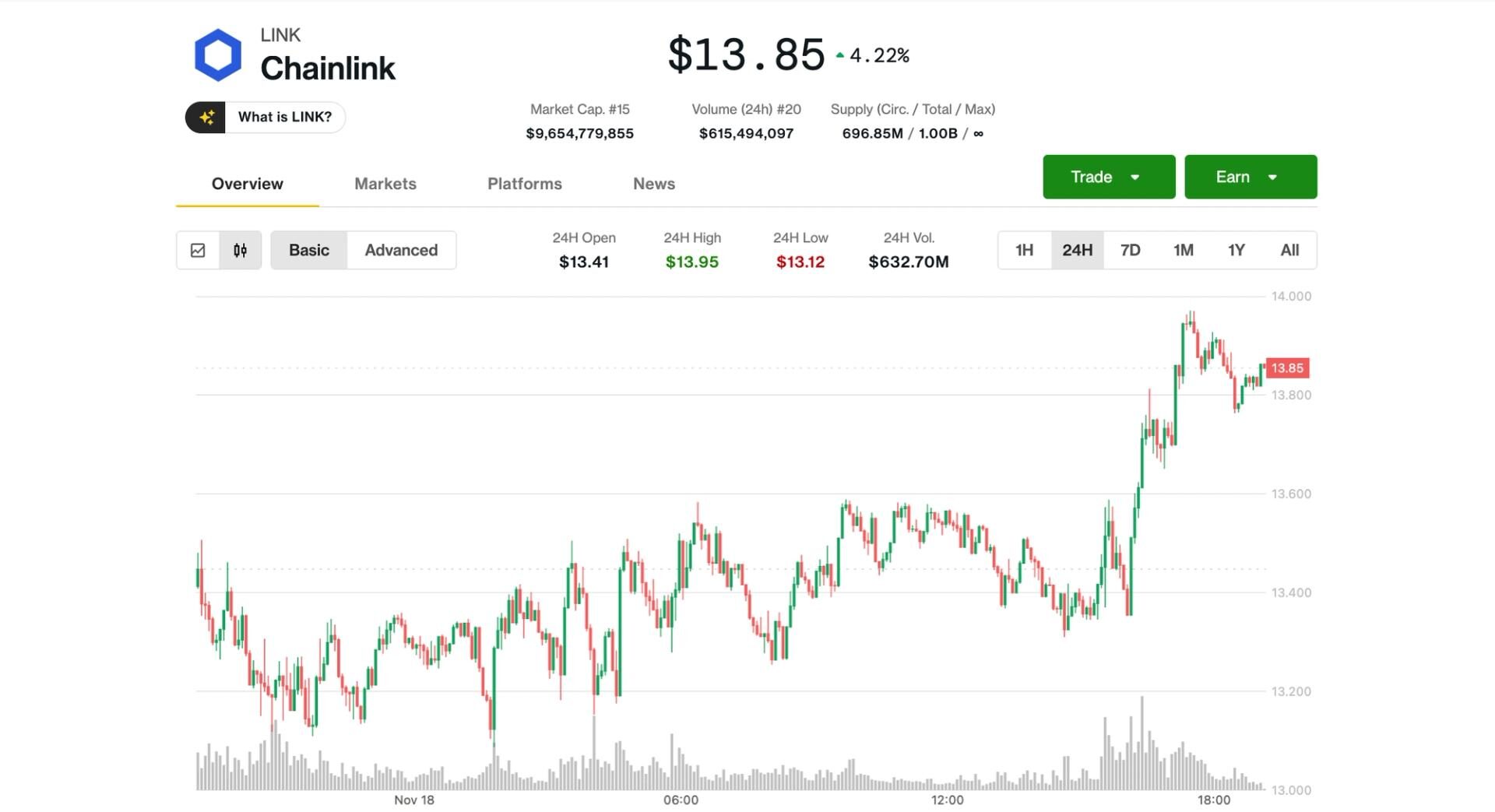

- LINK jumped 4.17% to a session high of $13.97, outperforming the broader crypto benchmark CoinDesk 5 Index.

- Breakout above $13.58 resistance level occurred with a 95% surge in volume, signaling institutional buying, CoinDesk Research’s technical analysis tool noted.

- The token now faces near-term resistance at $14.00 with upside targets around $14.5.

Chainlink’s LINK token surged 4.17% on Tuesday, climbing to just shy of $14 and breaking through multiple resistance levels as institutional demand for oracle infrastructure assets picked up.

The move marked a rare show of strength after recent headwinds, with LINK outperforming the advances of bitcoin BTC$90,470.56 and broader market benchmark CoinDesk 5 Index.

STORY CONTINUES BELOW

Trading volumes spiked sharply during the breakout above $13.58 resistance level, jumping 95% above the daily average, CoinDesk Research’s technical analysis tool noted. The rally gained steam with consistent buying pushing LINK with sustained volume throughout, suggesting deliberate accumulation rather than speculative hype, the tool suggested.

The pattern of higher lows and orderly breakouts formed a clean step-ladder structure, signaling strong technical momentum, CoinDesk Research’s tool noted. If LINK can break through the $14.00 psychological barrier, the next upside targets around $14.25-$14.50 if momentum holds.

- Support/Resistance: Immediate support at $13.30–$13.40; resistance near $14.00 and $14.25

- Volume Analysis: Breakout confirmed with 95% spike in volume; per-minute activity sustained above 65K

- Chart Patterns: Ascending structure with step-ladder breakout from $13.11 base

- Targets & Risk/Reward: Upside targets at $14.25–$14.50; downside risk protected by $13.70 support

Disclaimer: Parts of this article were generated with the assistance of AI tools and reviewed by our our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Lebih untuk Anda

Oleh CoinDesk Research

14 Nov 2025

Yang perlu diketahui:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

Lebih untuk Anda

Oleh James Van Straten|Diedit oleh Stephen Alpher

2 menit yang lalu

Futures prices for BTC are trading below spot prices, signaling “extreme fear,” which can sometimes be read as a contrarian buy signal.

Yang perlu diketahui:

- Bitcoin’s move into backwardation alongside a drop in the three month annualized basis to about 4% shows clear derivatives market stress.

- Previous backwardation episodes in November 2022, March 2023 and August 2023 aligned closely with major or local market bottoms, reinforcing the pattern that these structures often appear at points of capitulation.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language