Chainlink (LINK) Price News: Tumbles 6% as Technical Breakdown Trumps UBS, FTSE Partnership

By CD Analytics, Krisztian Sandor|Edited by Nikhilesh De

Nov 4, 2025, 6:38 p.m.

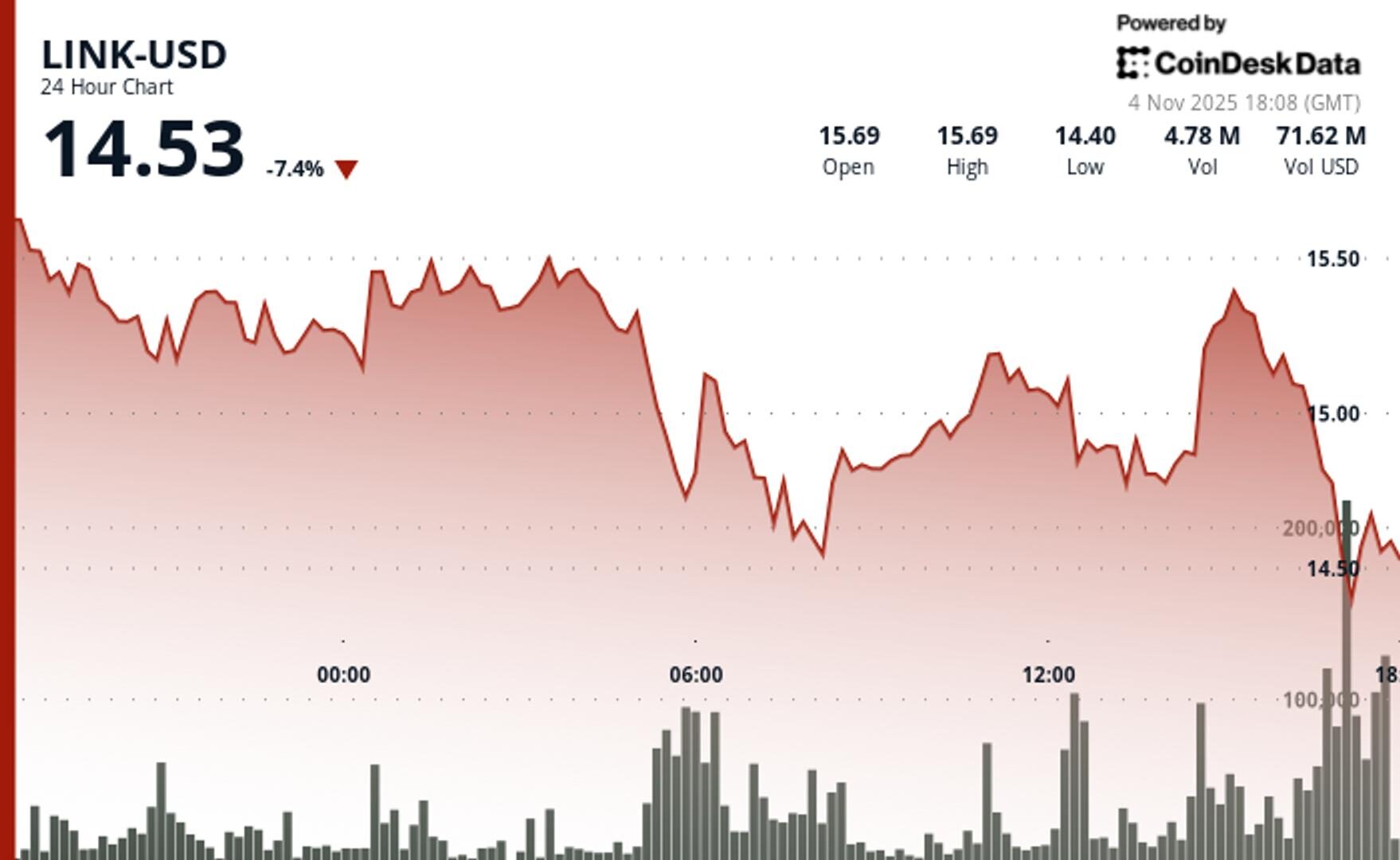

- Chainlink’s native token LINK plunged another 6% to $14.59 as heavy volume overwhelmed bullish developments.

- UBS tokenized fund transaction and FTSE Russell partnership couldn’t halt decline.

- Breakdown below $15.26 triggers descending channel on 154% volume spike, CoinDesk Research’s technical analysis model suggests.

Native token of oracle network Chainlink LINK$14.68 broke through key technical support levels on Tuesday, dropping 6% to below $14.50, CoinDesk data shows.

The decline accelerated on massive volume that surged 57.81% above the seven-day average, signaling aggressive distribution rather than thin-market selling, CoinDesk Research’s technical analysis model noted.

STORY CONTINUES BELOW

The weak price action went down despite major institutional partnership announcements that would typically fuel rallies.

Swiss banking giant UBS completed the world’s first end-to-end tokenized fund transaction using Chainlink’s Digital Transfer Agent standard. Meanwhile, FTSE Russell announced plans on Monday to bring Russell 1000, 2000, and 3000 indices onto blockchain rails tapping Chainlink’s DataLink services.

With major partnerships failing to prevent the support breakdown, LINK demonstrates how short-term technicals often override fundamental developments.

The decisive break below the $15.26 support level occurred during morning trading on exceptionally high volume of 4.69 million tokens, establishing a clear descending channel that accelerated into the close.

The final trading hour proved particularly destructive as LINK crashed from $15.22 to $14.70 on massive volume exceeding 3.5 million tokens. The breakdown confirmed the broader bearish structure while potentially creating oversold conditions for any recovery attempt.

- Support Zones: Critical test at $14.50-$14.60 demand zone following breakdown.

- Volume Analysis: 57.81% surge above seven-day average validates breakdown move.

- Chart Patterns: Descending channel formation confirms bearish momentum shift

- Targets & Risk: Further weakness toward $14.00 likely before stabilization occurs.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Nov 3, 2025

A deep dive into Zcash’s zero-knowledge architecture, shielded transaction growth, and its path to becoming encrypted Bitcoin at scale.

What to know:

In 2025, Zcash evolved from niche privacy tech into a functioning encrypted-money network:

- Shielded adoption surged, with 20–25% of circulating ZEC now held in encrypted addresses and 30% of transactions involving the shielded pool.

- The Zashi wallet made shielded transfers the default, pushing privacy from optional to standard practice.

- Project Tachyon, led by Sean Bowe, aims to boost throughput to thousands of private transactions per second.

- Zcash surpassed Monero in market share, becoming the largest privacy-focused cryptocurrency by capitalization.

More For You

By Shaurya Malwa, CD Analytics

1 hour ago

Trading volume surged 76% above the weekly average, indicating significant distribution rather than retail activity.

What to know:

• Dogecoin fell 6.7% to $0.1605, breaking key support levels as large investors sold off.

• Trading volume surged 76% above the weekly average, indicating significant distribution rather than retail activity.

• The price drop was exacerbated by a large 59 million DOGE sell-off, leading to a final-hour decline to $0.1600.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language