-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

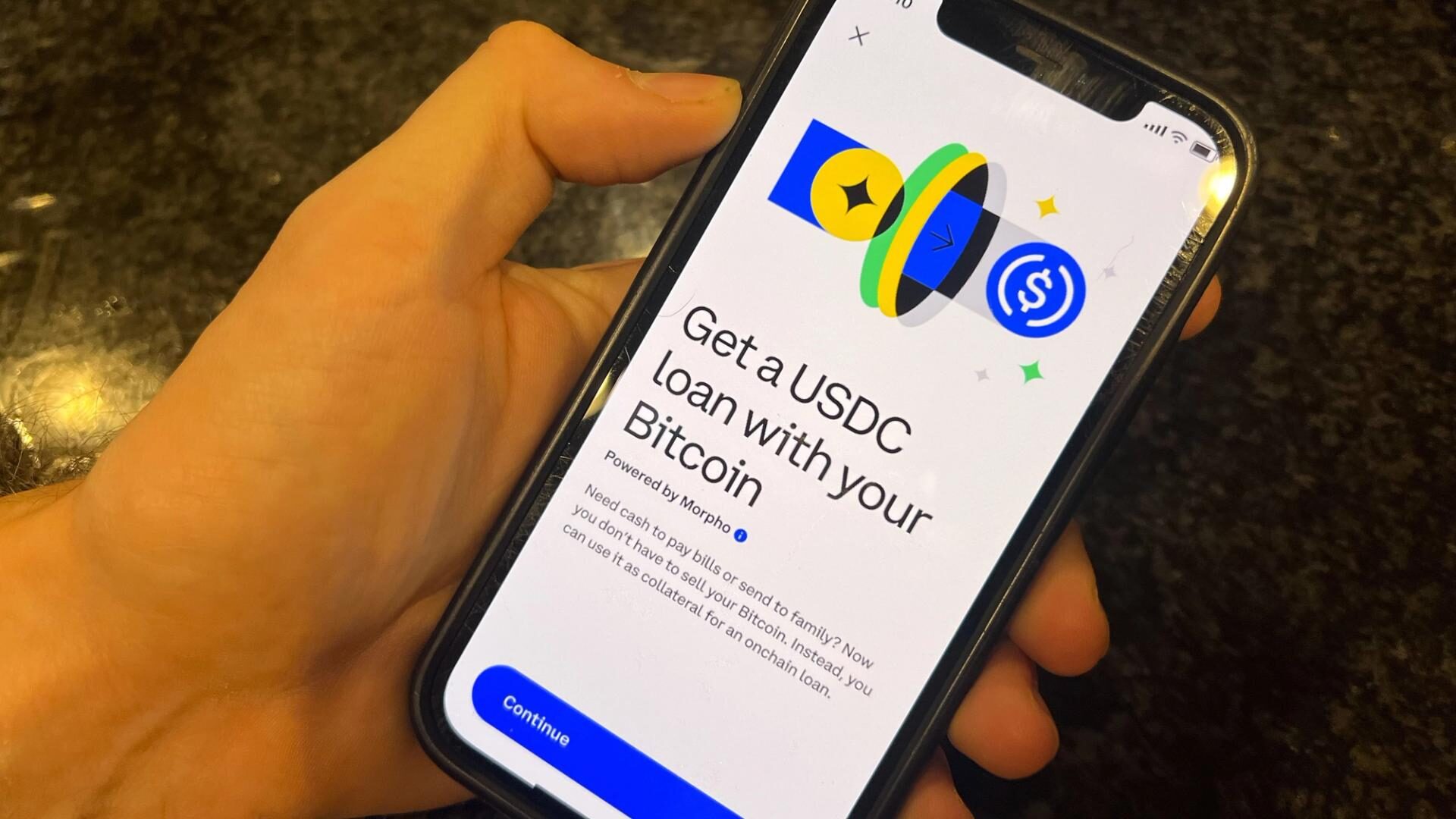

The feature lets Coinbase users earn yield on USDC deposits while powering the platform’s crypto-backed loan market.

By Ian Allison, AI Boost|Edited by Nikhilesh De

Sep 18, 2025, 5:49 p.m.

- Coinbase launched USDC lending powered by DeFi protocol Morpho

- Users earn interest from borrowers, including Coinbase’s crypto-backed loan customers

- The move builds Coinbase’s first full onchain lending and borrowing ecosystem

U.S.-listed cryptocurrency exchange Coinbase (COIN) has rolled out a USDC lending product that allows its customers to earn yield directly from the exchange’s app, deepening its integration with decentralized finance (DeFi).

The feature is powered by Morpho, a protocol that routes deposits through curated “vaults” managed by Steakhouse Financial, according to a blogpost on Thursday

STORY CONTINUES BELOW

When users deposit USDC, their funds are lent out to borrowers — including those already tapping Coinbase’s crypto-backed loans secured by bitcoin. The interest borrowers pay generates returns for depositors, who can withdraw anytime without lockups.

Coinbase said the setup creates a flywheel effect where its lending and borrowing products reinforce each other. The launch follows more than $900 million in loans originated through Coinbase’s crypto-backed loan service. Together, the two offerings form what the company calls its first complete onchain lending and borrowing ecosystem.

By outsourcing the backend to Morpho’s smart contracts while keeping the Coinbase interface, the company is betting on what it calls the “DeFi mullet” approach: a familiar fintech user experience at the front, powered by open, decentralized infrastructure in the back.

For users, the product offers an easier way into decentralized lending markets without leaving Coinbase’s platform. For Morpho, it underscores the argument that the future of finance will be built on open networks, but accessed through trusted gateways.

AI Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

By Oliver Knight|Edited by Nikhilesh De

1 hour ago

The NBA champion is launching an on-chain experience this October that tokenizes player value in real time.

What to know:

- The project will tokenize NBA players, letting fans speculate on rising talent and earn rewards tied to sentiment and performance.

- Built on Somnia, a new Layer 1 that launched September 2, the platform leans on speed, scalability and billions in early trading volume.

- Co-founder Hadi Teherany says the app avoids native token dependence, focusing instead on infrastructure, gamification and fan empowerment.