BTC

$109,296.58

+

0.77%

ETH

$2,660.22

+

3.26%

USDT

$1.0001

–

0.00%

XRP

$2.3777

+

3.86%

BNB

$662.97

+

0.66%

SOL

$154.57

+

2.62%

USDC

$0.9999

+

0.00%

TRX

$0.2875

+

0.45%

DOGE

$0.1735

+

2.10%

ADA

$0.6091

+

4.74%

HYPE

$39.24

+

3.76%

SUI

$2.9650

+

2.79%

BCH

$507.18

+

0.81%

WBT

$45.97

+

2.79%

LINK

$14.01

+

3.12%

XLM

$0.2905

+

14.09%

LEO

$9.0413

–

0.33%

AVAX

$18.64

+

2.95%

HBAR

$0.1701

+

6.69%

SHIB

$0.0₄1212

+

2.41%

By Helene Braun, AI Boost|Edited by Stephen Alpher

Jul 9, 2025, 4:32 p.m.

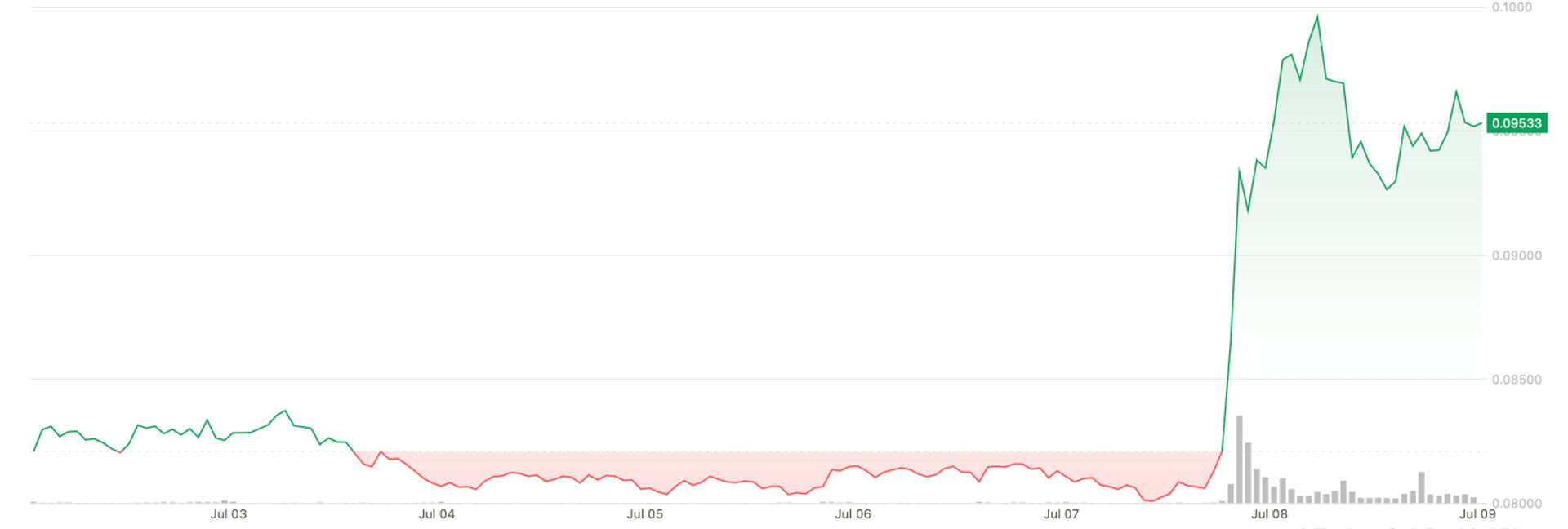

- CRO rose to $0.095, significantly outperforming the broader crypto market over the past 24 hours.

- Trump Media’s proposed ETF would include CRO with a 5% weight if it receives approval from the SEC.

- Despite the price jump, CRO remains well below its all-time high of $0.69 reached in November 2021.

Cronos (CRO), the native token of the Crypto.com blockchain, surged nearly 18% to $0.095 Wednesday following news that it could be included in a new exchange-traded fund (ETF) backed by Trump Media & Technology Group.

STORY CONTINUES BELOW

The proposed ETF, which is awaiting approval from the U.S. Securities and Exchange Commission, would track a basket of five cryptocurrencies: bitcoin

, ether(ETH), solana(SOL), XRP(XRP)and cronos(CRO). If approved, CRO would make up 5% of the fund’s weighting—its smallest component, but still a notable addition for a token that’s rarely featured in major institutional products.

That news sent CRO soaring from about $0.08 Tuesday morning, outpacing the broader crypto market. The CoinDesk 20 Index, which tracks the top digital assets, rose just 2.8% over the same period.

While the bump is significant, CRO remains a shadow of its former self. The token peaked at $0.69 in November 2021 during the last bull market. It saw a short-lived revival in December 2024, rising to $0.21 amid a market rally that followed Donald Trump’s election to a second term. That rally, however, faded fast.

The ETF development has brought new attention to CRO, a token that powers Crypto.com’s ecosystem including its exchange and payments app. Still, the token has a long climb to reach its former highs. Traders appear to be reacting to the possibility of increased institutional exposure, but the SEC has yet to approve the fund.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Helene is a New York-based markets reporter at CoinDesk, covering the latest news from Wall Street, the rise of the spot bitcoin exchange-traded funds and updates on crypto markets. She is a graduate of New York University’s business and economic reporting program and has appeared on CBS News, YahooFinance and Nasdaq TradeTalks. She holds BTC and ETH.

“AI Boost” indicates a generative text tool, typically an AI chatbot, contributed to the article. In each and every case, the article was edited, fact-checked and published by a human. Read more about CoinDesk’s AI Policy.