BTC

105,105.43

+1.54%

ETH

3,328.25

+0.72%

XRP

3.27

+3.32%

USDT

0.99983326

+0.08%

SOL

257.07

+7.82%

BNB

699.08

+1.56%

DOGE

0.36787678

-4.46%

USDC

1.00

-0.02%

ADA

1.02

+1.34%

TRX

0.25335628

+4.82%

LINK

25.94

+0.90%

AVAX

37.73

+2.93%

SUI

4.58

+3.45%

WBTC

104,943.00

+1.49%

XLM

0.44453022

-0.31%

TON

5.20

+2.71%

HBAR

0.33341833

-1.90%

SHIB

0.0₄20743

-0.99%

BCH

447.49

+1.88%

LEO

9.54

-1.98%

By Omkar Godbole, Shaurya Malwa|Edited by Sheldon Reback

Updated Jan 21, 2025, 8:23 p.m. UTCPublished Jan 22, 2025, 12:00 p.m. UTC

What to know:

You are viewing Crypto Daybook Americas, your new morning briefing on what happened in the crypto markets overnight and what’s expected during the coming day. In the coming weeks, this daily update will replace the First Mover Americas newsletter, and arrive in your inbox at 7 a.m. ET to kickstart your morning with comprehensive insights. If you’re not already subscribed, click here. You won’t want to start your day without it.

By Omkar Godbole (All times ET unless indicated otherwise)

Bitcoin remains well supported above $100,000 as it eyes record highs, buoyed by reports that the new SEC leadership has established a task force to develop a framework for crypto assets. Pundits have long said regulatory clarity could pave the way for further price appreciation.

Gold’s price rebound from December lows has also gathered pace and is now just 1% shy of setting new highs above $2,790 per ounce. That’s unusual: Bitcoin typically rallies when the price of gold stagnates.

Perhaps gold is saying the Fed will walk back on its hawkish December bias that signaled fewer rate cuts, helping keep BTC bid. And why not? Reports indicate that Trump’s tariffs will be lighter than anticipated and research from MacroMicro shows that their inflationary impact during his previous presidency was minimal.

In the broader crypto market, on-chain data from IntoTheBlock reveals that 80% of addresses holding LINK, one of the recent top performers, are in profit at the going market rate of $25.70. Key resistance levels have been identified at $27 and $29, which acted as barriers last year.

The movement of XRP, another recent outperformer, between addresses owned by whales and centralized exchanges has slowed considerably from the record levels earlier this month. That may be a sign these large holders have slowed their profit-taking activity.

Meanwhile, traders are expressing enthusiasm with sentiments like “we are so back,” especially after Bloomberg’s James Seyffart shared filings for ETF applications involving coins including LTC, SOL, DOGE, XRP and others. It seems the momentum in both the crypto and traditional markets could be setting the stage for an exciting period ahead. Stay alert!

- Crypto

- Jan. 22, 10:30 a.m.: Solana-powered decentralized exchange (DEX) aggregator Jupiter’s JUP airdrop claim goes live. Jupiter’s users have three months to claim.

- Jan. 22, 10:25 p.m.: dYdX Chain (DYDX) will undergo a software upgrade to v8.0 on block 35,602,000.

- Jan. 23: First deadline for SEC decision on NYSE Arca’s proposal to list and trade shares of Grayscale Solana Trust (GSOL), a closed-end trust, as an ETF.

- Jan. 25: First deadline for SEC decisions on proposals for four spot solana ETFs: Bitwise Solana ETF, Canary Solana ETF, 21Shares Core Solana ETF and VanEck Solana Trust, which are all sponsored by Cboe BZX Exchange.

- Jan. 29: Ice Open Network (ION) mainnet launch.

- Feb. 4: MicroStrategy Inc. (MSTR) reports Q4 2024 earnings.

- Feb. 4: Pepecoin (PEPE) halving. At block 400,000, the reward will drop to 31,250 pepecoin.

- Feb. 5, 3:00 p.m.: Boba Network’s Holocene hard fork network upgrade for its Ethereum-based L2 mainnet.

- Feb. 12: Hut 8 Corp. (HUT) reports Q4 2024 earnings.

- Feb. 15: Qtum (QTUM) hard fork network upgrade is scheduled to take place at block 4,590,000.

- Feb. 20: Coinbase Global (COIN) reports Q4 2024 earnings.

- Macro

- Jan. 22, 8:30 a.m.: Statistics Canada releases December’s Industrial Product Price Index.

- PPI MoM Est. 0.8% vs. Prev. 0.6%.

- PPI YoY Prev. 2.2%.

- Jan. 22, 10:00 a.m.: The Conference Board releases December’s Leading Economic Index (LEI) report for the U.S.

- MoM Est. -0.1% vs. Prev. 0.3%.

- Jan. 23, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims Report for the week ended Jan. 18.

- Initial Jobless Claims Est. 215K vs. Prev. 217K.

- Jan. 23, 10:00 a.m.: The National Association of Realtors releases December 2024 U.S. Existing Home Sales report.

- Existing Home Sales Est. 4.16M vs. Prev. 4.15M.

- Existing Home Sales MoM Prev. 4.8%.

- Jan. 23, 4:30 p.m.: The Fed releases the H.4.1 report, the central bank balance sheet, for the week ended Jan. 22.

- Total Reserves Prev. $6.83T.

- Jan. 23, 6:30 p.m.: Japan’s Ministry of Internal Affairs and Communications releases December 2024’s Consumer Price Index (CPI) report.

- Inflation Rate MoM Prev. 0.6%.

- Core Inflation Rate YoY Est. 3% vs. Prev. 2.7%.

- Inflation Rate YoY Prev. 2.9%.

- Jan. 23, 10:00 p.m.: The Bank of Japan (BoJ) releases Statement on Monetary Policy.

- Interest Rate Decision Est. 0.5% vs. Prev. 0.25%.

- Jan. 22, 8:30 a.m.: Statistics Canada releases December’s Industrial Product Price Index.

- Governance votes & calls

- CoW DAO is discussing the potential allocation of 80 million COW to empower the core treasury team for further liquidity provisioning, economic opportunities, and the development of the DAO’s product roadmap from 2025 to 2028.

- Morpho DAO is discussing reducing incentives by 30% across all networks and assets.

- Yearn DAO is discussing funding and endorsing a subDAO called Bearn to focus on building and launching products on Berachain.

- Jan. 22: Mantle (MNT) will host a livestream with updates on its 2025 roadmap at 8 a.m.

- Jan. 23: Pendle (PENDLE) is hosting Pendle Swing Hour at 7 a.m.

- Unlocks

- Jan. 31: Jupiter (JUP) to unlock 41.5% of circulating supply worth $626 million.

- Token Launches

- Jan. 22: Jambo (J) is listing on OKX, Gate.io, Bitfinex and Bybit.

- Jan. 22: Liquity (LQTY) and Gravity (G) are being listed on Kraken.

- Jan. 22: Telegram Gifts are launching as NFTs on TON.

- Day 10 of 12: Swiss WEB3FEST Winter Edition 2025 (Zug, Zurich, St. Moritz, Davos)

- Day 3 of 5: World Economic Forum Annual Meeting (Davos-Klosters, Switzerland)

- Jan. 24-25: Adopting Bitcoin (Cape Town, South Africa)

- Jan. 25-26: Catstanbul 2025 (Istanbul). The first community conference for Jupiter, a decentralized exchange (DEX) aggregator built on Solana.

- Jan. 30, 12:30 p.m. to 5:00 p.m.: International DeFi Day 2025 (online)

- Jan 30-31: Plan B Forum (San Salvador, El Salvador)

- Jan. 30 to Feb. 4: The Satoshi Roundtable (Dubai)

- Feb. 3: Digital Assets Forum (London)

- Feb. 5-6: The 14th Global Blockchain Congress (Dubai)

- Feb. 7: Solana APEX (Mexico City)

- Feb. 13-14: The 4th Edition of NFT Paris.

- Feb. 18-20: Consensus Hong Kong

- Feb. 23 to March 2: ETHDenver 2025 (Denver, Colorado)

By Shaurya Malwa

- Uniswap to begin v4 deployments this week for builders to test hooks and integrations on-chain. The new architecture of v4, including the singleton contract and flash accounting system, is designed to reduce transaction costs and improve efficiency, which could attract more developers and users to the platform, increasing the overall usage of Uniswap, and, in turn, demand for UNI tokens.

- AI16Z and AI Rig Complex’s ARC rallied over 30% on Tuesday while GRIFFAIN, ZEREBRO also booked double-digit advances. President Trump unveiled a $500 billion investment in private sector AI infrastructure investment with firms such as OpenAI, Oracle and Softbank involved.

- TRX, SHIB, PEPE and DOGE lead perpetual futures open interest growth in large-cap tokens. However, TRX is the only one with a positive cumulative volume delta, representing net buying pressure in the past 24 hours.

- Front-end call bias in BTC and ETH options on Deribit continues to moderate while on the CME, call skew jumped to highest since the U.S. election Tuesday.

- Block flows featured long positions in BTC calls at $110K and $115K strikes and bull call spreads in ETH.

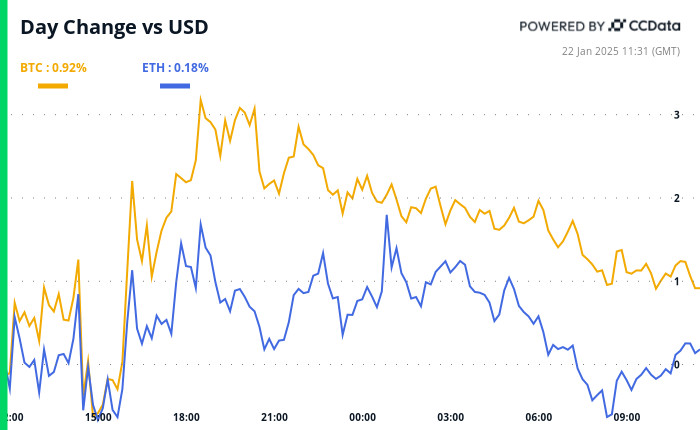

- BTC is down 0.9% from 4 p.m. ET Tuesday at $105,161.32 (24hrs: +1.32%)

- ETH is unchanged at $3,312.58 (24hrs: +0.28%)

- CoinDesk 20 is up 0.6% at 4,000.99 (24hrs: +2.27%)

- Ether staking yield is down 28 bps at 3.3%

- BTC funding rate is at 0.0045% (4.9% annualized) on OKX

- DXY is down 0.23% at 107.81

- Gold is up 0.56% at $2,759.03/oz

- Silver is up 0.33% at $30.88/oz

- Nikkei 225 closed +1.58% to 39,646.25

- Hang Seng closed -1.63% to 19,778.77

- FTSE is up 0.41% at 8,583.19

- Euro Stoxx 50 is up 0.83% at 5,209.04

- DJIA closed on Tuesday +1.24% to 44,025.81

- S&P 500 closed +0.88% to 6,049.24

- Nasdaq closed +0.64% to 19,756.78

- S&P/TSX Composite Index closed +0.44% to 25,281.63

- S&P 40 Latin America closed +0.51% to 2,269.78

- U.S. 10-year Treasury is unchanged at 4.58%

- E-mini S&P 500 futures are up 0.49% at 6,114.25

- E-mini Nasdaq-100 futures are up 0.88% at 21,900.00

- E-mini Dow Jones Industrial Average Index futures are up 0.19% at 44,320.00

- BTC Dominance: 58.67

- Ethereum to bitcoin ratio: 0.031

- Hashrate (seven-day moving average): 769 EH/s

- Hashprice (spot): $60.7

- Total Fees: 10.2 BTC / $1.1 million

- CME Futures Open Interest: 502,406

- BTC priced in gold: 38.1 oz

- BTC vs gold market cap: 10.83%

- The dollar index (DXY) looks south, having dived out of a bullish trendline from late September lows near 100.

- The decline in DXY could add to the bullish momentum in risky assets.

- MicroStrategy (MSTR): closed on Tuesday at $389.10 (-1.87%), down 0.63% at $386.58 in pre-market.

- Coinbase Global (COIN): closed at $294.19 (-0.44%), down 1% at $291.26 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$31.25 (+0.32%)

- MARA Holdings (MARA): closed at $19.56 (-1.76%), down 1.07% at $19.35 in pre-market.

- Riot Platforms (RIOT): closed at $12.74 (-4.85%), down 0.24% at $12.71 in pre-market.

- Core Scientific (CORZ): closed at $15.27 (+1.8%), down 0.79% at $15.15 n pre-market.

- CleanSpark (CLSK): closed at $10.96 (-7.67%), up 0.36% at $11 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $24.97 (-1.58%).

- Semler Scientific (SMLR): closed at $64.94 (+0.4%), down 4.22% at $62.20 in pre-market.

- Exodus Movement (EXOD): closed at $40 (+3.87%), down 2.35% at $39.06 in pre-market.

Spot BTC ETFs:

- Daily net flow: $802.6 million

- Cumulative net flows: $39.98 billion

- Total BTC holdings ~ 1.155 million.

Spot ETH ETFs

- Daily net flow: $74.4 million

- Cumulative net flows: $2.74 billion

- Total ETH holdings ~ 3.622 million.

Source: Farside Investors

- The chart shows XRP’s exchange reserve or balance held in wallets tied to centralized exchanges since June 2024.

- The balance has dropped sharply since Jan. 16, signaling a resumption of the broader downtrend.

- The renewed exodus of coins from exchanges indicates investor bias for holding.

- Deribit’s Crypto Trading Volume Nearly Doubled to Over $1T in 2024 (CoinDesk): Cryptocurrency exchange Deribit’s total trading volume rose 95% year-on-year to $1.185T in 2024, driven by a 99% surge in options trading to $743B, reflecting institutional adoption and market maturity.

- Trump Pardons Silk Road Creator Ross Ulbricht (Cointelegraph): President Trump granted a full pardon to Ross Ulbricht, sentenced to life without parole in 2015 for creating and operating Silk Road, an online marketplace shut down in 2013 that used bitcoin for payments.

- Trump-Affiliated World Liberty Financial Makes Another TRX Buy (CoinDesk): World Liberty Financial, a crypto project linked to Trump’s family, added 10.8 million TRX ($2.6 million) to its treasury, raising total TRX holdings to $7.5 million. Sources say WLFI plans to further increase its TRX holdings.

- Dollar Could Fall if U.S. Tariffs Less Stringent Than Threatened (The Wall Street Journal): The dollar may weaken if Trump’s tariffs are milder than expected, analysts say. The yuan shows resilience as markets adjust to a potential 10% tariff on Chinese imports, lower than Trump’s campaign pledges of 60%.

- BOJ Heads Toward Rate Hike as Markets Take Trump in Stride (Bloomberg): The Bank of Japan is expected to raise rates by 25 basis points to 0.5% on Friday, the highest since 2008, with swaps pricing a 90% chance and 74% of analysts expecting the move.

- The Market Is Wrong About US Rates Under Trump in 2025 (Financial Times): In an op-ed, the founder of ABP Invest argues markets are wrong to expect Fed rate cuts in 2025. He predicts robust U.S. growth and Trump’s policies will drive rate hikes from September.

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team based in Mumbai, holds a masters degree in Finance and a Chartered Market Technician (CMT) member. Omkar previously worked at FXStreet, writing research on currency markets and as fundamental analyst at currency and commodities desk at Mumbai-based brokerage houses. Omkar holds small amounts of bitcoin, ether, BitTorrent, tron and dot.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM,

BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.