BTC

$96,465.75

+

0.79%

ETH

$2,727.88

+

1.75%

XRP

$2.6273

+

1.44%

USDT

$1.0000

–

0.01%

BNB

$659.31

+

0.58%

SOL

$174.10

+

3.03%

USDC

$1.0002

+

0.00%

DOGE

$0.2559

+

1.44%

ADA

$0.7742

+

0.04%

TRX

$0.2437

+

3.19%

WBTC

$96,248.83

+

0.63%

LINK

$18.16

+

0.57%

XLM

$0.3396

+

4.00%

LTC

$135.89

+

8.59%

AVAX

$24.02

+

0.14%

SUI

$3.1983

+

4.00%

SHIB

$0.0₄1554

+

0.93%

TON

$3.6185

–

1.08%

HBAR

$0.2151

+

5.07%

LEO

$9.6048

+

0.67%

By Francisco Rodrigues, Oliver Knight|Edited by Sheldon Reback

Updated Feb 18, 2025, 8:39 p.m. UTCPublished Feb 19, 2025, 12:00 p.m. UTC

What to know:

You are viewing Crypto Daybook Americas, your new morning briefing on what happened in the crypto markets overnight and what’s expected during the coming day. In the coming weeks, this daily update will replace the First Mover Americas newsletter, and arrive in your inbox at 7 a.m. ET to kickstart your morning with comprehensive insights. If you’re not already subscribed, click here. You won’t want to start your day without it.

By Francisco Rodrigues (All times ET unless indicated otherwise)

Cryptocurrency investors seem to be adopting a “wait-and-see” approach to the plethora of conflicting headlines appearing. As a result, the BTC Volatility Index (DVOL) on popular options exchange Deribit has been dropping since Jan. 20, falling from a high of 72 to around 50.8.

STORY CONTINUES BELOW

The drop signals bitcoin’s maturation as an asset, according to Tracy Jin, COO of cryptocurrency trading platform MEXC. “Rather than reacting sharply to short-term market shocks, BTC is showing signs of stabilization, increasingly resembling the dynamics of commodity markets and traditional safe-haven assets,” Jin said.

While FTX creditor payouts have started rolling out, the Libra token debacle just keeps intensifying. The co-creator of the token, Hayden Davis, bragged about buying access to Argentine President Javier Milei’s inner circle ahead of the memecoin’s launch, according to messages reviewed by CoinDesk.

Meanwhile, Strategy, the largest corporate holder of bitcoin, is set to raise an additional $2 billion by selling zero-coupon convertible notes. The funds raised will mostly be used to accumulate more BTC.

As Brevan Howard Digital’s CEO and CIO — that’s just one person — stressed at Consensus Hong Kong, the cryptocurrency ecosystem has evolved since the collapse of FTX, but 24/7 risk management is still a necessity.

On the macro front, traders are focusing on minutes from the Federal Reserve’s January interest rate meeting. Indications of the potential impact of increased tariffs are a particular point of focus, given President Donald Trump’s comments on tariffs “in the neighborhood of 25% for automobiles, semiconductors, and pharmaceutical products.”

Recent U.S.-Russia talks in Riyadh have led to the appointing of teams to negotiate an end to the war in Ukraine and commitments to “normalize the operation” of their diplomatic missions. Still, excluding representatives from Ukraine and Europe remains a point of contention. Stay alert!

- Crypto:

- Feb. 19, 9:30 a.m.: Shares of bitcoin-focused financial services company Fold Holdings (FLD) start trading on Nasdaq.

- Feb. 19: High-performance blockchain Monad’s public testnet starts up.

- Feb. 19, 11:00 a.m.: The first official State of Sei (SEI) livestream.

- Feb. 19, 1:00 p.m.: Hedera (HBAR) mainnet upgrade to v0.58.

- Feb. 21: TON (The Open Network) becomes the exclusive blockchain infrastructure for messaging platform Telegram’s Mini App ecosystem.

- Feb. 24: At epoch 115968, testing of Ethereum’s Pecta upgrade on the Holesky testnet starts.

- Macro

- Feb. 19, 2:00 p.m.: The Fed releases minutes of the Jan. 28-29 FOMC Meeting.

- Feb. 20, 8:30 a.m.: Statistics Canada reports January’s producer price inflation data.

- PPI MoM Est. 0.8% vs. Prev. 0.2%

- PPI YoY Prev. 4.1%

- Feb. 20, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims report for the week ended Feb. 15.

- Initial Jobless Claims Est. 215K vs. Prev. 213K

- Feb. 20, 5:00 p.m.: Fed Governor Adriana D. Kugler giving a speech titled “Navigating Inflation Waves While Riding on the Phillips Curve” in Washington. Livestream link.

- Feb. 20, 6:30 p.m.: Japan’s Ministry of Internal Affairs & Communications reports January’s consumer price inflation data.

- Core Inflation Rate YoY Est. 3.1% vs. Prev. 3%

- Inflation Rate YoY Prev. 3.6%

- Inflation Rate MoM Prev. 0.6%

- Earnings

- Governance

- Compound DAO is discussing evolving Compound Sandbox into Compound V4 to introduce streamlined governance, dynamic market parameters, enhance the liquidation mechanism, and improve cross-chain reward distribution.

- Aave DAO is discussing expanding the AAVE governance token integration on the platform by adding AAVE collateral option to Base.

- Uniswap DAO is discussing funding liquidity incentives for Uniswap V4 on the Unichain network to attract liquidity providers and traders to the protocol.

- Unlocks

- Feb. 21: Fast Token (FTN) to unlock 4.66% of circulating supply worth $78.6 million.

- Feb. 28: Optimism (OP) to unlock 1.92% of circulating supply worth $34.23 million.

- Token Launches

- Feb. 20: Pi Network (PI) to be listed on MEXC, OKX, Bitget, Gate.io, CoinW, DigiFinex and others.

CoinDesk’s Consensus to take place in Hong Kong on Feb. 18-20 and in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Day 2 of 3: Consensus Hong Kong

- Feb. 23-March 2: ETHDenver 2025 (Denver)

- Feb. 24: RWA London Summit 2025

- Feb. 25: HederaCon 2025 (Denver)

- March 2-3: Crypto Expo Europe (Bucharest, Romania)

- March 8: Bitcoin Alive (Sydney, Australia)

By Oliver Knight

- Sonic, the recently rebranded token that used to be called Fantom, has risen by 37% in the past week. The surge has been attributed to an increase in on-chain activity and a boost in general sentiment following the rebrand.

- The memecoin sector is reeling from the controversy over Argentine President Javier Milei and the Libra token. The market cap of the sector is down 4.4% in 24 hours to $72.9 billion as traders begin to pull liquidity and question the legitimacy of a market many view as an endless cycle of “pump and dumps.”

- More than $35 billion worth of value has exited decentralized finance (DeFi) protocols since mid-December. Part of the slump is tied to dwindling asset prices, but there has also been a disproportionate amount of outflows from Solana-based liquid staking protocols this week, DefiLlama data shows.

- BTC’s CME futures premium has compressed to an annualized 6%, according to data tracked by Paradigm. That’s a sign of bullish expectations becoming tempered amid continued sideways price movement.

- LTC, TRX and HYPE lead growth in perpetual futures open interest.

- BTC and ETH options due for settlement after February continue to exhibit bullish sentiment, although the premium for calls has reduced to some extent.

- Block flows have been mixed with puts bought in the February expiry.

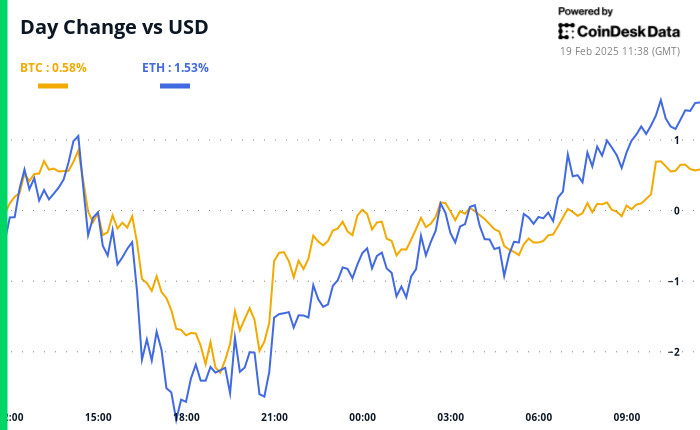

- BTC is up 1.34% from 4 p.m. ET Tuesday to $96,356.41 (24hrs: +0.79%)

- ETH is up 3.25% at $2,735.66 (24hrs: +1.54%)

- CoinDesk 20 is down 2.80% to 3,195.66 (24hrs: +1.12%)

- Ether CESR Composite Staking Rate is down 13 bps to 3.05%

- BTC funding rate is at 0.0205% (7.4657% annualized) on Binance

- DXY is up 0.14% at 107.20

- Gold is up 0.31% at $2,944.53/oz

- Silver is up 0.59% to $33.05/oz

- Nikkei 225 closed -0.27% at 39,164.61

- Hang Seng closed -0.14% at 22,944.24

- FTSE is down 0.28% at 8,742.27

- Euro Stoxx 50 is down 0.48 at 5,507.77

- DJIA closed Tuesday unchanged at 44,556.34

- S&P 500 closed +0.24% at 6,129.58

- Nasdaq closed +0.07% at 20,041.26

- S&P/TSX Composite Index closed +0.65% at 25,648.84

- S&P 40 Latin America closed +0.28% at 2,497.37

- U.S. 10-year Treasury rate was up 1 bps at 4.56%

- E-mini S&P 500 futures are down 0.1% to 6,140.5

- E-mini Nasdaq-100 futures are down 0.1% at 22,219

- E-mini Dow Jones Industrial Average Index futures are down 0.16% to 44,571

- BTC Dominance: 61.08 (-0.32%)

- Ethereum to bitcoin ratio: 0.02836 (1.54%)

- Hashrate (seven-day moving average): 784 EH/s

- Hashprice (spot): $53.61

- Total Fees: 4.7 BTC / $452,182

- CME Futures Open Interest: 172,530 BTC

- BTC priced in gold:32.6 oz

- BTC vs gold market cap: 9.26%

- The SOL-BTC ratio has dropped out of a multiweek consolidation range.

- The technical breakdown suggests the possibility of a continued underperformance by the Solana blockchain’s token.

- MicroStrategy (MSTR): closed on Tuesday at $333.97 (-1.11%), up 0.87% at $336.88 in pre-market.

- Coinbase Global (COIN): closed at $264.63 (-3.53%), up 1.27% at $268.

- Galaxy Digital Holdings (GLXY): closed at C$26.31 (-4.58%).

- MARA Holdings (MARA): closed at $16.05 (-5.03%), up 1.56% at $16.30.

- Riot Platforms (RIOT): closed at $11.56 (-5.79%), up 1.12% at $11.69.

- Core Scientific (CORZ): closed at $12.39 (-0.96%), down 1.05% at $12.26.

- CleanSpark (CLSK): closed at $10.08 (-4.00%), up 1.39% at $10.22.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $22.84 (-2.39%), up 0.31% at $22.91.

- Semler Scientific (SMLR): closed at $50.72 (+2.11%), up 2.09% at $51.78.

- Exodus Movement (EXOD): closed at $46.55 (-6.90%), up 5% at $49.00.

Spot BTC ETFs:

- Daily net flow: -$60.7 million

- Cumulative net flows: $40.06 billion

- Total BTC holdings ~ 1.163 million.

Spot ETH ETFs

- Daily net flow: $4.6 million

- Cumulative net flows: $3.16 billion

- Total ETH holdings ~ 3.784 million.

Source: Farside Investors

- The U.S. dollar-backed stablecoin Agora Dollar (AUSD), which debuted on Solana at the end of January, has surpassed $100 million in market capitalization.

- The next stop could be $1 billion, according to Artemis.

- Wintermute Looking to Expand in U.S., Open Office in New York (Bloomberg): At Consensus Hong Kong, Wintermute Trading CEO Evgeny Gaevoy announced plans to offer over-the-counter products in the U.S. and expressed optimism about forthcoming regulatory changes.

- Crypto Has Moved Past FTX, but Still Needs 24/7 Risk Management, Brevan Howard’s CIO Believes (CoinDesk): Three experts from traditional finance speaking at Consensus Hong Kong acknowledged crypto’s technological advances since the FTX collapse while emphasizing the need for round-the-clock risk management.

- Private Jets, Political Cash Among $1B in Sam Bankman-Fried’s Forfeited Assets: Court (CoinDesk): As initial FTX bankruptcy repayments began, a U.S. federal court issued its final order of forfeiture against the convicted CEO of the now-defunct exchange, seizing around $1 billion in assets.

- Donald Trump’s Late-Night Posts Send Currency Traders to Asian Markets (Financial Times): The president’s late-night and weekend announcements have disrupted regular trading patterns, prompting some U.S. and European FX traders to hedge in Asian markets.

- U.K. Inflation Reaches 10-Month High, Complicating Bank of England’s Rate Path (The Wall Street Journal): The U.K.’s annual inflation rate hit 3% in January, up 0.5 percentage points from December, making it tougher for the central bank to cut rates.

- BOJ Policymaker Calls for More Rate Hikes, Warns of Inflation Risk (Reuters): Hajime Takata said persistent inflationary pressures and rising wages suggest the need for further interest-rate increases. Analysts see the short-term interest rate jumping to 0.75% in July.

Francisco is a reporter for CoinDesk with a passion for cryptocurrencies and personal finance. Before joining CoinDesk he worked at major financial and crypto publications. He owns bitcoin, ether, solana, and PAXG above CoinDesk’s $1,000 disclosure threshold.

Oliver Knight is the co-leader of CoinDesk data tokens and data team. Before joining CoinDesk in 2022 Oliver spent three years as the chief reporter at Coin Rivet. He first started investing in bitcoin in 2013 and spent a period of his career working at a market making firm in the UK. He does not currently have any crypto holdings.