BTC

98,807.91

-5.87%

ETH

3,060.14

-7.54%

XRP

2.79

-11.19%

USDT

0.99958703

-0.02%

SOL

225.97

-12.32%

BNB

651.98

-5.03%

USDC

1.00

+0.01%

DOGE

0.31230849

-11.77%

ADA

0.88189814

-11.17%

TRX

0.23784138

-5.70%

LINK

22.46

-11.60%

AVAX

33.09

-12.55%

WBTC

98,792.90

-5.43%

TON

4.86

-3.78%

XLM

0.37663185

-12.16%

HBAR

0.29550424

-13.06%

SUI

3.59

-13.66%

SHIB

0.0₄17821

-11.73%

LEO

9.57

+0.47%

LTC

106.99

-12.55%

By Omkar Godbole, Shaurya Malwa|Edited by Sheldon Reback

Updated Jan 24, 2025, 5:33 p.m. UTCPublished Jan 27, 2025, 12:00 p.m. UTC

What to know:

You are viewing Crypto Daybook Americas, your new morning briefing on what happened in the crypto markets overnight and what’s expected during the coming day. In the coming weeks, this daily update will replace the First Mover Americas newsletter, and arrive in your inbox at 7 a.m. ET to kickstart your morning with comprehensive insights. If you’re not already subscribed, click here. You won’t want to start your day without it.

By Omkar Godbole (All times ET unless indicated otherwise)

Last week, we described bitcoin above $100,000 as a coiled spring ready to unleash energy in either direction. Unfortunately for the bulls, that energy is being released downward as market sentiment shifts in response to concerns over the impact of the low-cost Chinese AI startup DeepSeek on the U.S. AI sector and American technological leadership.

Bitcoin plummeted to $97,800 during Asian trading hours, with whales driving prices lower to liquidate overleveraged buyers on perpetual futures exchanges. GPU-heavy AI tokens saw sell-offs of up to 40%, with similar pressure affecting GameFi assets.

Nasdaq futures tanked 700 points, with shares in chipmaker Nvidia (NVDA) indicated 10% lower in pre-market trading. DeepSeek-R1 is expected to significantly reduce the costs of developing large language models, raising a questions on the validity of the rich valuations for AI-associated companies like Nvidia.

Trader and analyst Alex Kruger noted on X, “The problem is, few understand how DeepSeek changes things. it’s hard to quantify the issue—and when facing uncertainty, people derisk. When this happens in low liquidity conditions, the market flushes hard.”

Kruger is opting not to buy the dip, saying he prefers to short positions above $100,000 as he anticipates heightened volatility from the upcoming Fed meeting and potential political maneuvering from President Donald Trump. The Fed is expected to reiterate its wait-and-see approach, maintaining its hawkish December guidance on interest rates.

Still, all is not lost. Paul Howard, Senior Director at Wincent, said institutional participation could ramp up in the coming months.

“The next wave up will likely come from organic participation from institutions in the next 3-4 months. I’d be surprised to see a sharp bounce back to all-time highs before Q2,” he said in an email.

Howard identified newly launched layer-1 blockchains with a focus on security and transactions per second, like SUPRA, as valuable opportunities, while stressing that for long-biased funds, discovering alpha in a bearish market involves seeking out low market-cap layer-1s alongside their already established peers. Stay alert!

- Crypto:

- Jan. 27 (provisional): Abstract, an Ethereum L2, has its mainnet launch, which is expected to expand the reach of the Pudgy Penguins project beyond NFTs.

- Jan. 28, 1:00 p.m.: Hedera (HBAR) network upgrade to v0.57.5.

- Jan. 29: Cardano’s Plomin hard fork network upgrade.

- Jan. 29: Ice Open Network (ION) mainnet launch.

- Feb. 2, 8:00 p.m.: Core blockchain Athena hard fork network upgrade (v1.0.14)

- Feb. 4: MicroStrategy Inc. (MSTR) Q4 FY 2024 earnings report.

- Feb. 4: Pepecoin (PEPE) halving. At block 400,000, the reward will drop to 31,250 PEPE.

- Feb. 5, 3:00 p.m.: Boba Network’s Holocene hard fork network upgrade for its Ethereum-based L2 mainnet.

- Feb. 6, 8:00 a.m.: Shentu Chain network upgrade (v2.14.0).

- Feb. 12: Hut 8 Corp. (HUT) Q4 2024 earnings report.

- Feb. 15: Qtum (QTUM) hard fork network upgrade is scheduled to take place at block 4,590,000.

- Feb. 18 (after market close): Semler Scientific (SMLR) Q4 2024 earnings report.

- Feb. 20: Coinbase Global (COIN) Q4 2024 earnings report.

- Macro

- Jan. 27, 10:00 a.m.: The U.S. Census Bureau releases December 2024’s Monthly New Residential Sales report.

- New Home Sales Est. 0.67M vs. Prev. 0.664M.

- New Home Sales MoM Prev. 5.9%.

- Jan. 28, 8:30 a.m.: The U.S. Census Bureau releases December Monthly Advance Report on Durable Goods Manufacturers’ Shipments Inventories and Orders.

- MoM Est. 0.8% vs. Prev. -1.1%.

- Jan. 28, 1:00 p.m.: The Fed releases December’s H.6 (Money Stock Measures) report.

- Money Supply Prev. $21.45T.

- Jan. 29, 12:00 a.m.: Japan’s Cabinet Office releases January’s Consumer Confidence Survey.

- Consumer Confidence Index Est. 36.5 vs. Prev. 36.2.

- Jan. 29, 4:00 a.m.: The European Central Bank (ECB) releases December 2024’s Monetary Developments in the Euro Area report.

- M3 Money Supply YoY Est. 3.8% vs. Prev. 3.8%.

- Jan. 29, 8:45 a.m.: The Bank of Canada (BoC) releases the (quarterly) Monetary Policy Report.

- Jan. 29, 9:45 a.m.: The BoC announces its interest rate decision.

- Est. 3% vs. Prev. 3.25% followed by a press conference at 10:30 a.m.

- Jan. 29, 2:00 p.m.: The Federal Open Market Committee (FOMC) announces the U.S. central bank’s latest interest rate decision.

- Target Range for the Federal Funds Rate Est. 4.25% to 4.5% vs. Prev.: 4.25% to 4.5% followed by a press conference at 2:30 p.m. Livestream link.

- Jan. 27, 10:00 a.m.: The U.S. Census Bureau releases December 2024’s Monthly New Residential Sales report.

- Governance votes & calls

- Compound DAO is voting whether to implement interest-rate curve adjustments for Stablecoin Comets across multiple networks, including Ethereum and Base.

- Clover Finance DAO is voting whether to rebrand the CLV Network to Lucent Network to align with a pivot toward building a decentralized finance and artificial intelligence platform (DeFAI). The rebrand would include a migration from Polkadot to an SVM chain and a new token ticker, LUX.

- Arbitrum DAO is voting on a proposal to establish the Arbitrum Strategic Objective Setting (SOS), which would allow DAO members to propose and vote on short to mid-term objectives.

- Unlocks

- Jan. 31: Optimism (OP) to unlock 2.32% of circulating supply worth $52.9 million.

- Jan. 31: Jupiter (JUP) to unlock 41.5% of circulating supply worth $626 million.

- Feb. 1: Sui (SUI) to unlocked approximately 2.13% of its circulating supply worth $226 million.

- Token Listings

- Jan. 28: Pudgy Penguins (PENGU) and Magic Eden (ME) to be listed on Kraken.

- Jan. 29: Cronos (CRO), Movement (MOVE) and Usual (USUAL) to be listed on Kraken.

- Jan. 29-31: Crypto Peaks 2025 (Palisades, California)

- Jan. 30, 12:30 p.m. to 5:00 p.m.: International DeFi Day 2025 (online)

- Jan. 30-31: Ethereum Zurich 2025

- Jan. 30-31: Plan B Forum (San Salvador, El Salvador)

- Jan. 30 to Feb. 1: Crypto Gathering 2025 (Miami Beach, Florida)

- Jan. 30-Feb. 1: CryptoXR 2025 (Auxerre, France)

- Jan. 30-Feb. 2: Oasis Onchain 2025 (Nassau, Bahamas)

- Jan. 30-Feb. 4: The Satoshi Roundtable (Dubai)

- Feb. 1-28: Mammathon (online), a global hackathon for Celestia (TIA).

- Feb. 3: Digital Assets Forum (London)

- Feb. 5-6: The 14th Global Blockchain Congress (Dubai)

- Feb. 6: Ondo Summit 2025 (New York).

- Feb. 7: Solana APEX (Mexico City)

- Feb. 13-14: The 4th Edition of NFT Paris.

- Feb. 18-20: CoinDesk’s Consensus Hong Kong

- Feb. 19: Sui Connect: Hong Kong

- Feb. 23-March 2: ETHDenver 2025 (Denver, Colorado)

- Feb. 25: HederaCon 2025 (Denver)

By Shaurya Malwa

- AI-themed agents and memes took a thumping Monday, with stalwarts Virtuals Protocol (VIRTUALS), ai16z (AI16Z) and eliza (ELIZA) sliding as much as 30% as China’s DeepSeek led to a reiteration of U.S. AI startup valuations.

- The downturn dented massive Sunday rallies on Jupiter’s JUP and Base memecoin toshi (TOSHI).

- JUP spiked 40% as founder ‘Meow’ announced at an annual conference that the platform would burn over $3 billion JUP tokens and begin using 50% of its fees to buy back the tokens from the market.

- TOSHI more than doubled as Coinbase listed perpetual futures for the token, making it the only Base memecoin with both a spot and futures listing on the influential exchange.

- The subsequent spike in demand sent the token to a peak market capitalization of $820 million.

- BTC perpetual funding rates flipped negative during European hours, showing a net bias for shorts. Historically, such a positioning has tended to mark local price bottoms.

- BNB, DOGE, TRX and AVAX also saw negative funding rates.

- BTC, ETH short-dated options now show a bias for put options, offering downside protection. Expiries after February continue to show a bias for calls.

- Key block trades for the day include a short volatility play, involving short positions in BTC $05K call and $98K put, both expiring on Jan. 10. In ETH’s case, shorts in out-of-the-money calls and a long position in the $3K put has been noted.

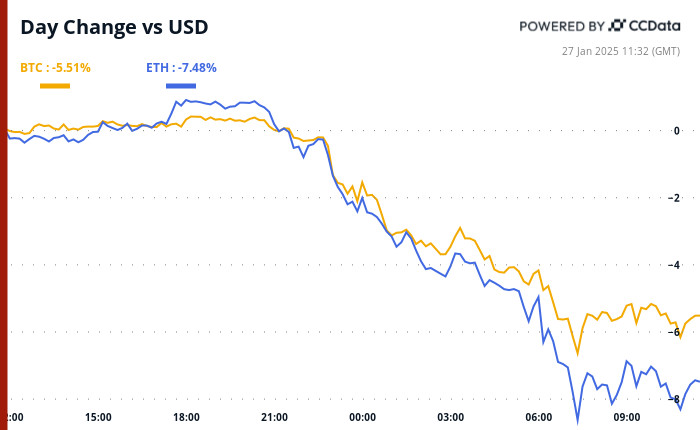

- BTC is down 5.95% from 4 p.m. ET Friday to $98,784.45 (24hrs: -5.84%)

- ETH is down 6.12% at $3,050.20 (24hrs: -7.88%)

- CoinDesk 20 is down 9.07% to 3,536.28 (24hrs: -9.66%)

- CESR Composite Staking Rate is down 2bps to 3.1%

- BTC funding rate is at 0.0006% (0.7% annualized) on Binance

- DXY is down 0.26% at 107.17

- Gold is down 0.21% at $2,767.13/oz

- Silver is down 0.55% to $30.48/oz

- Nikkei 225 closed -0.92% at 39,565.80

- Hang Seng closed +0.66% to 20,197.77

- FTSE is down 0.21% at 8,483.97

- Euro Stoxx 50 is down 1.51% at 5,140.89

- DJIA closed on Friday -0.32% to 44,424.25

- S&P 500 closed -0.29% at 6,118.71

- Nasdaq closed -0.5% at 19,954.30

- S&P/TSX Composite Index closed +0.14% at 25,468.49

- S&P 40 Latin America closed +0.53% at 2,322.63

- U.S. 10-year Treasury was down 13 bps at 4.5%

- E-mini S&P 500 futures are down 2.37% at 5,988.00

- E-mini Nasdaq-100 futures are down 4.27% at 20,974.75

- E-mini Dow Jones Industrial Average Index futures are unchanged at 44,216.00

- BTC Dominance: 59.45 (0.60%)

- Ethereum to bitcoin ratio: 0.0392 (-1.7%)

- Hashrate (seven-day moving average): 766 EH/s

- Hashprice (spot): $60.2

- Total Fees: 4.19 BTC/ $439,954

- CME Futures Open Interest: 187,465 BTC

- BTC priced in gold: 35.8 oz

- BTC vs gold market cap: 10.17%

- The RSI on the hourly chart dropped to 20 during the Asian hours, the lowest since late August.

- In other words, bearish momentum was the strongest in nearly five months.

- RSI readings below 30 are taken to represent oversold conditions and a sign of an impending bear breather.

- MicroStrategy (MSTR): closed on Friday at $353.67 (-5.11%), down 4.9% at $336.35 in pre-market.

- Coinbase Global (COIN): closed at $298.00 (+0.67%), down 4.9% at $283.39 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$32.52 (-4.18%)

- MARA Holdings (MARA): closed at $19.99 (+0.2%), down 6.1% at $18.77 in pre-market.

- Riot Platforms (RIOT): closed at $13.54 (+4.23%), down 6.94% at $12.60 in pre-market.

- Core Scientific (CORZ): closed at $15.98 (-2.2%), down 15.33% at $13.53 in pre-market.

- CleanSpark (CLSK): closed at $11.53 (+1.05%), down 6.76% at $10.75 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $26.22 (+2.22%), down 8.28% at $25.05 in pre-market.

- Semler Scientific (SMLR): closed at $55.46 (-9.3%), down 9.48% at $50.20 in pre-market.

- Exodus Movement (EXOD): closed at $61.25 (+39.2%), down 2.04% at $60 in pre-market.

Spot BTC ETFs:

- Daily net flow: $517.7 million

- Cumulative net flows: $39.94 billion

- Total BTC holdings ~ 1.173 million.

Spot ETH ETFs

- Daily net flow: $9.18 million

- Cumulative net flows: $2.8 billion

- Total ETH holdings ~ 3.67 million.

Source: Farside Investors

- As BTC and Nasdaq, gold has held relatively steady, possibly on the back of haven demand.

- Haven appeal seems to have driven the yield on the 10-year Treasury note lower by nine basis points to 4.504%. Bond prices and yields move in the opposite directions.

- Bitcoin Dives to Under $99K as DeepSeek, FOMC Steal Trump Effect (CoinDesk): Bitcoin fell below $99,000 as traders braced for this week’s FOMC meeting, and Chinese startup DeepSeek’s advanced AI model pressured U.S. tech valuations, weighing on market sentiment and crypto prices.

- Solana, Dogecoin, XRP Plunge 10% as Bloody Start to Week Sees $770M Long Liquidations (CoinDesk): SOL and DOGE led declines as crypto markets saw $770 million in bullish liquidations and overall market capitalization dropped 8.5%.

- Bitcoin May Be ‘Double Topping’ for a Price Slide to $75K (CoinDesk): Bitcoin’s inability to sustain gains above $100,000 signals weakening momentum. If the price drops below $91,300 it could potentially reaching as low as $75,000, analysts said.

- China’s Economy Stumbles in Sign Rebound Hinges on More Stimulus (Bloomberg): China’s January PMI data showed manufacturing contracting and services slowing, a signaling faltering recovery amid weak demand and trade pressures. Analysts warned of further slowdown without stronger fiscal stimulus.

- Fixed Income Investors Seek Ways to Navigate a Trump Presidency (Financial Times): Sticky consumer inflation, a strong U.S. jobs market and uncertainty over Trump’s policies have fueled a sell-off in Treasuries, though some investors see current prices as attractive for long-term gains.

- Emerging Market Investors Eye Frontier Assets Shielded From Trump’s Tariff Threats (Reuters): Amid Trump’s tariff threats and global tensions, some investors are turning to frontier markets like Serbia, Ghana and Sri Lanka for growth potential and insulation from U.S. trade risks.

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team based in Mumbai, holds a masters degree in Finance and a Chartered Market Technician (CMT) member. Omkar previously worked at FXStreet, writing research on currency markets and as fundamental analyst at currency and commodities desk at Mumbai-based brokerage houses. Omkar holds small amounts of bitcoin, ether, BitTorrent, tron and dot.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM,

BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.