Roughly $12 billion in futures positions were wiped out on Friday, marking a major shift in market structure and potentially signaling a bottom.

By James Van Straten|Edited by Stephen Alpher

Updated Oct 15, 2025, 4:26 p.m. Published Oct 15, 2025, 3:36 p.m.

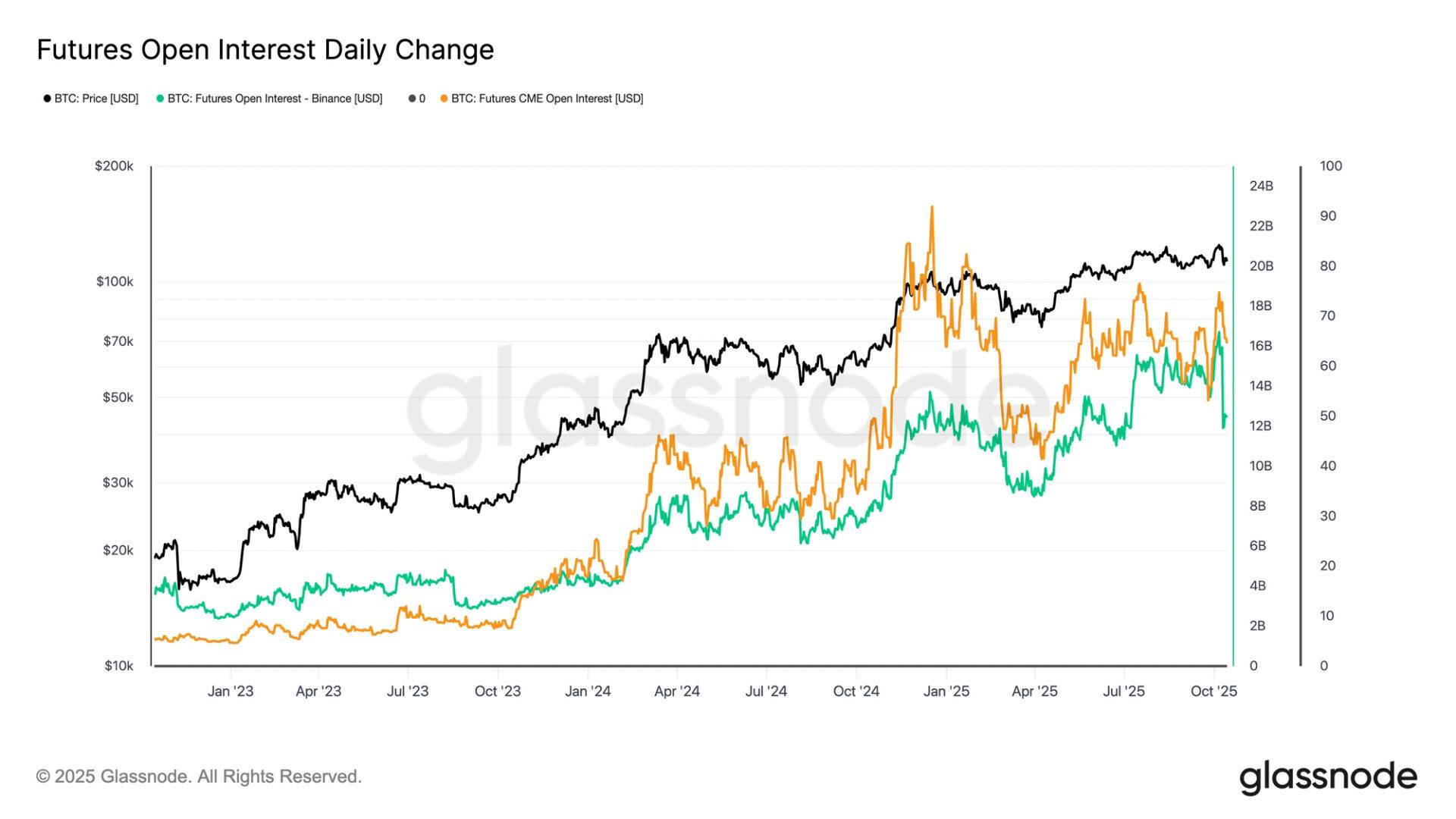

- Bitcoin open interest dropped from $70 billion (560,000 BTC) to $58 billion (481,000 BTC) in a single day, the largest ever USD decline.

- Open interest at the CME remained stable while Binance saw significant unwinding, indicating the event was driven by crypto-native liquidity rather than institutional flows.

Friday was the largest liquidation event on a nominal basis in crypto history. The scale of deleveraging is best understood by looking at open interest (OI) — the total value of outstanding futures and perpetual contracts that have not yet been settled.

Glassnode’s data shows before Friday’s sell-off, bitcoin open interest stood at around $70 billion, an all-time high. This equated to roughly 560,000 BTC worth of futures positions. Following the deleveraging, OI fell to about $58 billion, or approximately 481,000 BTC.

STORY CONTINUES BELOW

Because USD-denominated OI is influenced by bitcoin’s price which dropped from $122,000 to $107,000 during the event looking at OI in BTC terms provides a more accurate picture of the scale of the deleveraging.

Data from Glassnode shows that Friday marked the largest single-day deleveraging event for bitcoin in USD terms, with more than $10 billion wiped from OI in a single day. In BTC terms, it was the second-largest deleveraging event on record, trailing only the COVID crash in March 2020. However, it’s important to note that bitcoin was trading near $5,000 back then, compared to $122,000 which significantly impacts the comparison in nominal terms.

Breaking the data down by exchange shows where the deleveraging came from. The Chicago Mercantile Exchange (CME) the largest venue for bitcoin futures typically used by institutional investors saw little change, with OI holding steady at around 145,000 BTC.

In contrast, Binance, the second-largest futures exchange, experienced a significant reduction, with OI plunging from $16 billion (130,000 BTC) to $12 billion (105,000 BTC). This suggests that the deleveraging was concentrated primarily within the crypto-native trading ecosystem, rather than being driven by traditional finance participants.

Historically, large single-day or short-term drops in open interest of this magnitude have often coincided with market bottoms. Previous examples include the March 2020 COVID crash, the summer 2021 sell-off during China’s mining ban, and the collapse of FTX in November 2022.

More For You

Oct 10, 2025

Combined spot and derivatives volumes fell 17.5% in September, continuing a four-year seasonal trend

What to know:

- Trading activity falls 17.5% in September slowdown: Combined spot and derivatives volumes dropped to $8.12 trillion, marking the first decline after three months of growth. September has now seen reduced trading volume for the fourth consecutive year.

- Open interest reaches record high despite derivatives market share decline: Total open interest surged 3.2% to $204 billion and peaked at an all-time high of $230 billion during the month.

- Altcoins on CME outperform as Bitcoin and Ether futures decline: While CME’s total derivatives volume stayed flat at $287 billion (-0.08%), SOL futures jumped 57.1% to $13.5 billion and XRP futures rose 7.19% to $7.84 billion. BTC and ETH futures fell 4.05% and 17.9% respectively.

More For You

By Siamak Masnavi, AI Boost|Edited by Aoyon Ashraf

59 minutes ago

Coinbase launched The Blue Carpet, then added BNB to its roadmap — an intent signal, not a guarantee — pending market-making support and technical readiness.

What to know:

- Coinbase introduced “The Blue Carpet,” a consolidated listings experience with direct access to its listings team, asset-page customization, referral discounts and select Coinbase One seats.

- Thirty-three minutes later, Coinbase added BNB to its listing roadmap; roadmap inclusion is not a guarantee and trading will start only after liquidity and technical criteria are met, with a separate launch notice.

- The signal is notable because bnb anchors the BNB Chain tied to Binance, Coinbase’s fiercest rival; listing remains free and does not require issuers to buy ancillary services.