Strong ETF flows and surging prices highlight investor demand for assets immune to government debasement.

By James Van Straten|Edited by Stephen Alpher

Oct 3, 2025, 11:50 a.m.

- BlackRock’s spot bitcoin ETF and the SPDR Gold ETF both ranked among the top 10 most traded ETFs yesterday, a rare occurrence according to Bloomberg’s Eric Balchunas.

- The action occurred as bitcoin surged above $120,000 and within reach of its $124,000 record, while gold took aim at $4,000 per ounce after a 50% year-to-date gain.

The debasement trade, also known as the sound money or hard asset trade, is well and truly alive. Bitcoin (BTC), at more than $120,000, sits just a stone’s throw from its all-time high of $124,000. Meanwhile, gold has almost gained 50% year-to-date, setting fresh record highs almost daily and now trading just below $3,900.

Exchange-traded fund flows highlight the enthusiasm behind this trade. Both BlackRock’s iShares Trust (IBIT) and the SPDR Gold ETF (GLD) ranked among the top 10 most traded ETFs on Thursday, a rare occurrence according to Bloomberg Senior ETF analyst Eric Balchunas.

STORY CONTINUES BELOW

The GLD saw $4.88 billion in volume, making it the fourth most traded ETF, while IBIT came in seventh with $3.21 billion. The top traded ETF was the SPDR S&P 500 ETF (SPY) with more than $26 billion in volume.

“Everyone wants in on the the debaser trade I guess,” said Balchunas.

Comedian and sound money advocate Dominic Frisby told CoinDesk exclusively that both bitcoin and gold share a unique property: they cannot be printed by governments.

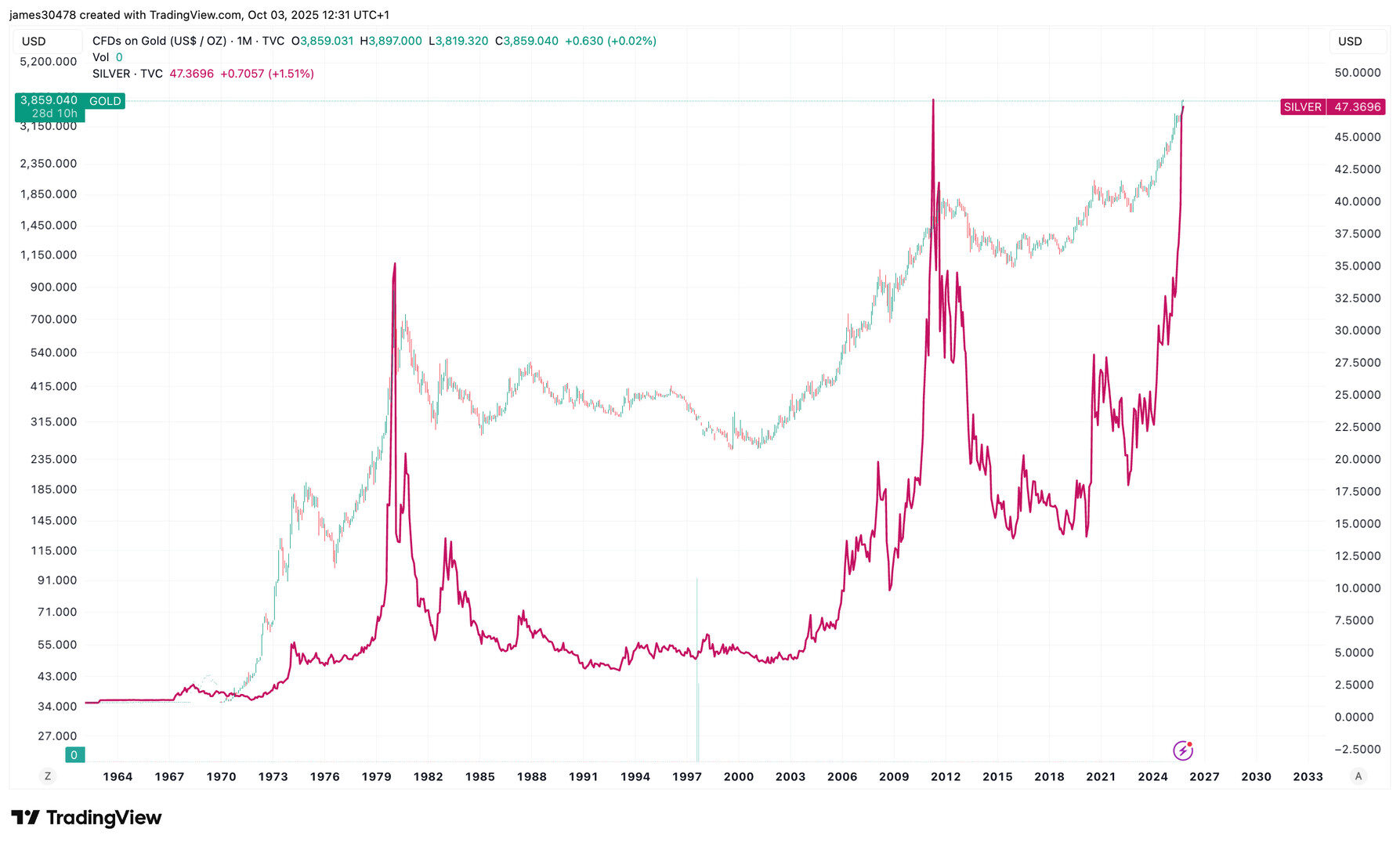

Frisby: “Bitcoin’s within a couple of percent of all-time highs. Gold’s at all-time highs. Silver’s closing in on all-time highs. It’s almost as though people are losing faith in fiat. Nothing lasts forever, of course. But those major monies which are immune to government debasement are having their day in the sun. Again.”

Silver has surged alongside gold, currently trading just below $48, its third-highest level behind peaks in 2011 and 1980. Interestingly, in both of those years, silver’s top coincided with gold’s. If history rhymes, this could suggest that when silver ends its parabolic run, gold may top as well. That scenario just might create the path to even more upside potential for bitcoin.

More For You

Sep 9, 2025

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

By Oliver Knight, Jacob Joseph|Edited by Sheldon Reback

23 minutes ago

Bitcoin’s battle with $120,000 could set the stage for fresh record highs, as derivatives data shows signs of both bullish conviction and concentrated risk, while altcoins outperform.

What to know:

- Futures open interest remains above $32 billion, with basis rates near 8%, but funding divergences across exchanges suggest pockets of aggressive long exposure.

- Put-call volumes and delta skews signal a moderation of bullish sentiment, pointing to a more balanced and cautious positioning among options traders.

- With BTC holding its ground, tokens like ETH, SOL, and smaller caps such as ETHFI and CAKE rallied strongly, though select names like MYX took steep losses.