The total amount of capital locked on decentralized finance (DeFi) protocols hit $170 billion on Thursday, a landmark figure as now all of the the losses from the 2022 Terra/LUNA ecosystem collapse and subsequent bear market have been erased.

While Ethereum still commands the lion’s share of capital at 59%, newcomers including Coinbase-backed layer 2 network Base, HyperLiquid’s layer 1 blockchain and Sui have begun to chip away at Ethereum’s dominance, collectively amassing more than $10 billion worth of total value locked (TVL), representing around 6%.

STORY CONTINUES BELOW

Investor trends have shifted in this recent cycle; institutional adoption of ether has led to outflows from traditional liquid staking products like Lido into institutional staking products like Figment, while there has also been growth in Solana and BNB Chain due to a seismic rise in memecoin activity.

Solana is now the second largest blockchain in terms of DeFi with $14.4 billion in TVL with BNB chain behind that with $8.2 billion.

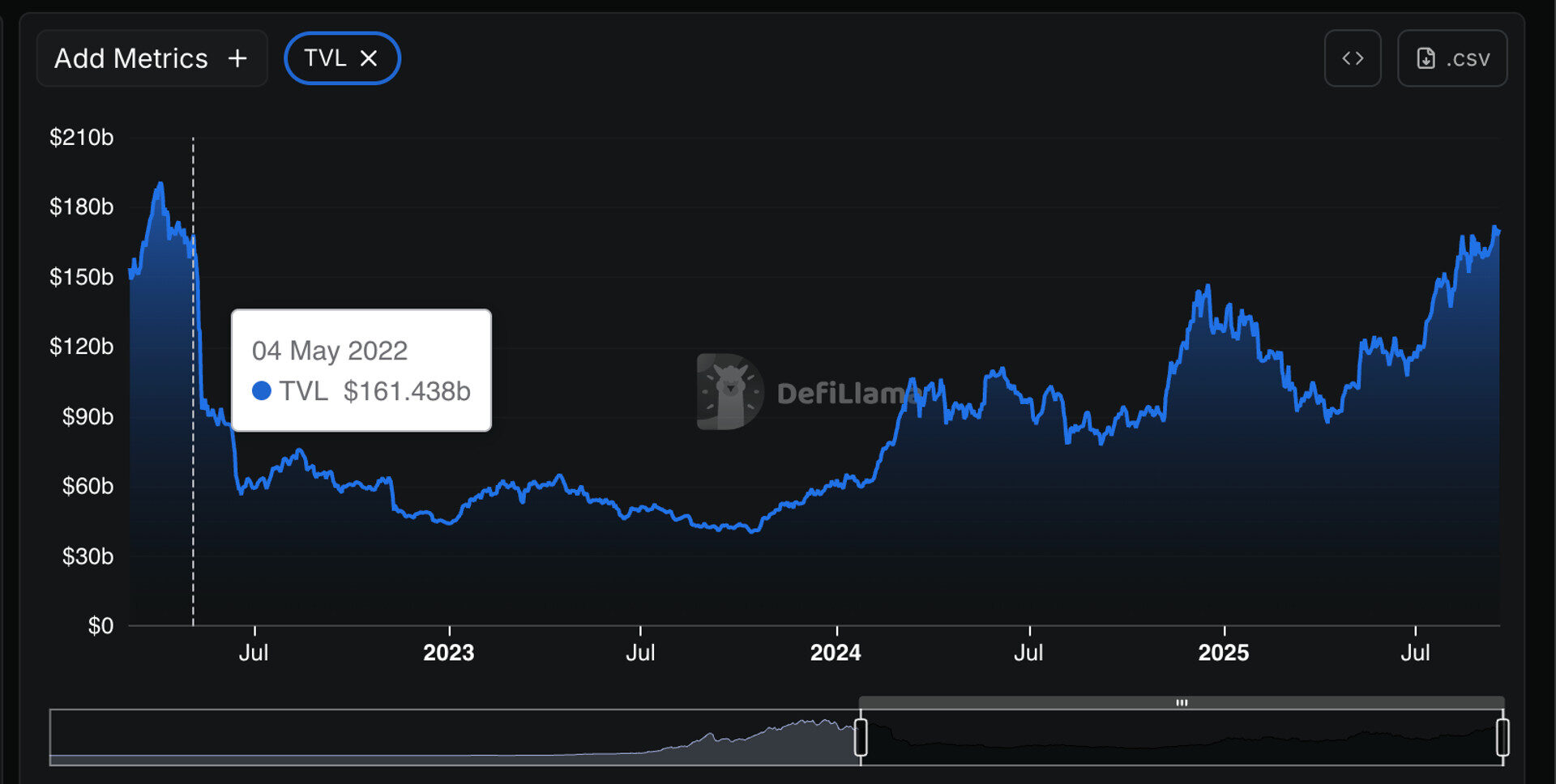

The previous bull market between January 2021 and April 2022 saw rapid growth across the DeFi ecosystem, with TVL jumping from $16 billion to $202 billion. This cycle has been more measured with a slow but steady gain from $42 billion in October 2022 to $170 billion in September 2025.

The rise suggests crypto investors might be learning from their mistakes of 2022 and have created a more mature ecosytem to lend, borrow and generate yield.

The Terra implosion saw $100 billion worth of TVL wiped off almost overnight as investors, including bankrupt crypto hedge fund Three Arrows Capital, took a gung ho approach on an algorithmic stablecoin that ultimately failed — leading to contagion and bad debt spreading across the entire industry.

Terra was the crypto-form of a classic “dividend trap,” a product that offered yields that were too good to be true but ultimately turned out to be unsustainable.

Now, yields have receded with lending protocol Aave offering a 5.2% yield on stablecoins while restaking protocol Ether.fi is offering 11.1%, far less than the 20% Terra was offering on its stablecoin.

With the DeFi sector now being back where it was before the Terra debacle, albeit with more sustainable yields, critics will ask how can the market continue to grow to topple 2021’s record high in terms of TVL.

The answer to that is nuanced. While it’s true that institutional adoption and inflows to assets like ether and solana will continue to drive a bullish narrative, the industry is still battling with rampant hacks, scams and rug pulls connected to memecoins.

Crypto investors lost $2.5 billion to hacks and scams in the first half of 2025 and in order for the industry to truly become a viable alternative to traditional finance, investors need to be protected.

Unlike traditional finance where deposits are often insured and protected, the very essence of cryptocurrencies means that you are on your own; if you lose your keys, get phished or hacked, there is no helpline to call.

The next iteration of DeFi, whether that is in this cycle or the next, will need to focus on security and hack prevention — because the industry is still one major implosion away from another crypto winter.