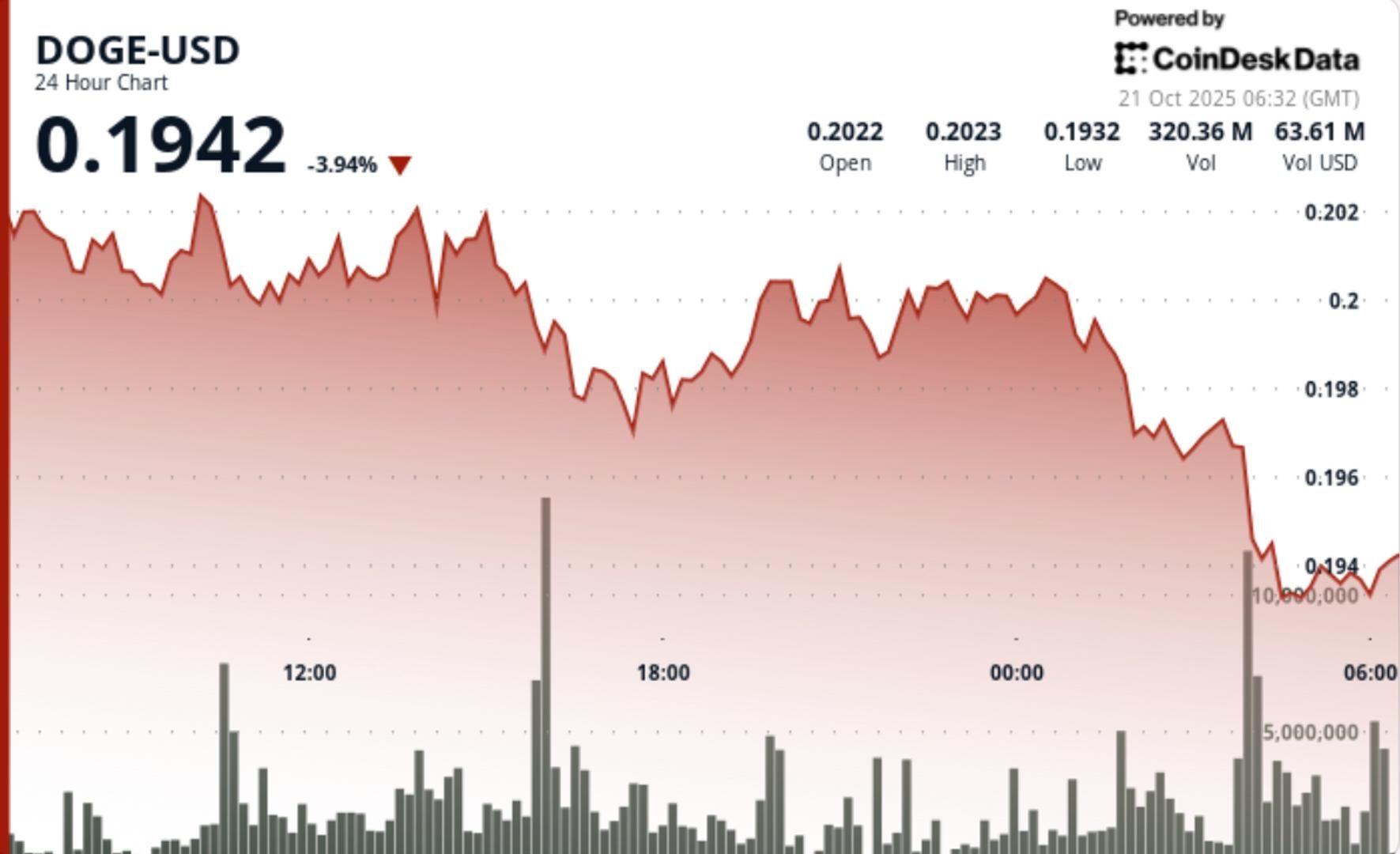

Selling builds near $0.20 resistance after multiple failed breakout attempts, while macro stress keeps traders defensive across alt markets.

Updated Oct 21, 2025, 7:24 a.m. Published Oct 21, 2025, 7:00 a.m.

- Dogecoin fell 3% as institutional investors reduced risk amid macroeconomic pressures.

- The cryptocurrency faced resistance at $0.20, with significant selling activity preventing breakouts.

- Traders are monitoring support levels around $0.195, with potential for a rebound if conditions improve.

Dogecoin traded heavy into the weekend, slipping 3% as institutional desks unwound risk across majors. Selling built near $0.20 resistance after multiple failed breakout attempts, while macro stress keeps traders defensive across alt markets.

DOGE’s retracement follows a week of volatile cross-asset flows sparked by fresh U.S.–China tariff headlines. Institutional sentiment turned risk-off as macro funds pared crypto exposure alongside broader deleveraging in altcoin futures. Regulatory overhang from pending U.S. Treasury rules adds pressure as corporate treasuries reduce crypto allocations.

STORY CONTINUES BELOW

DOGE traded between $0.204–$0.197 through Oct. 20–21, marking a 3% range with heavy afternoon volume. The 15:00 UTC block saw 818 million DOGE change hands — nearly three times the daily average — as large sellers capped rallies above $0.20. Price slipped toward $0.197 in late U.S. trade before finding limited support on thin volume.

The final hour (01:10–02:09 UTC) saw another 1% decline as algorithmic triggers fired below $0.20. Volume spiked to 40.5 million on the 01:56 print, confirming programmatic liquidation before markets stabilized near $0.197.

Structure remains short-term bearish while DOGE holds below the $0.20 handle. Repeated rejections at that level mark a clear resistance band, with next support around $0.194–$0.196. RSI and momentum indicators stay negative but nearing oversold; traders note potential squeeze risk on any reclaim above $0.201.

Desks are watching for signs of stabilization near $0.195 support. A clean reclaim of $0.201 on volume could spark short covering into $0.208–$0.21. Failure to defend $0.194 exposes $0.187 — last month’s structural base. Macro sentiment still rules direction; any softening in trade-war rhetoric could trigger a risk rebound led by DOGE and SHIB.

More For You

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

By Sam Reynolds

6 hours ago

Glassnode says last week’s selloff “cleared out excess without breaking structure,” while Enflux points to renewed institutional layering from Blockchain.com’s SPAC and Bitmine’s $800 million ETH buildout as signs of deeper market resilience.

What to know:

- Bitcoin stabilizes around $110,300 in Asia after a recent correction, with market analysts describing the move as a necessary reset.

- Institutional investments continue as Tom Lee’s Bitmine allocates $800 million to Ethereum, indicating ongoing interest despite retail speculation cooling.

- Gold hits a record high amid U.S.-China trade tensions, while Japan’s Nikkei 225 rises on Wall Street gains and political optimism.