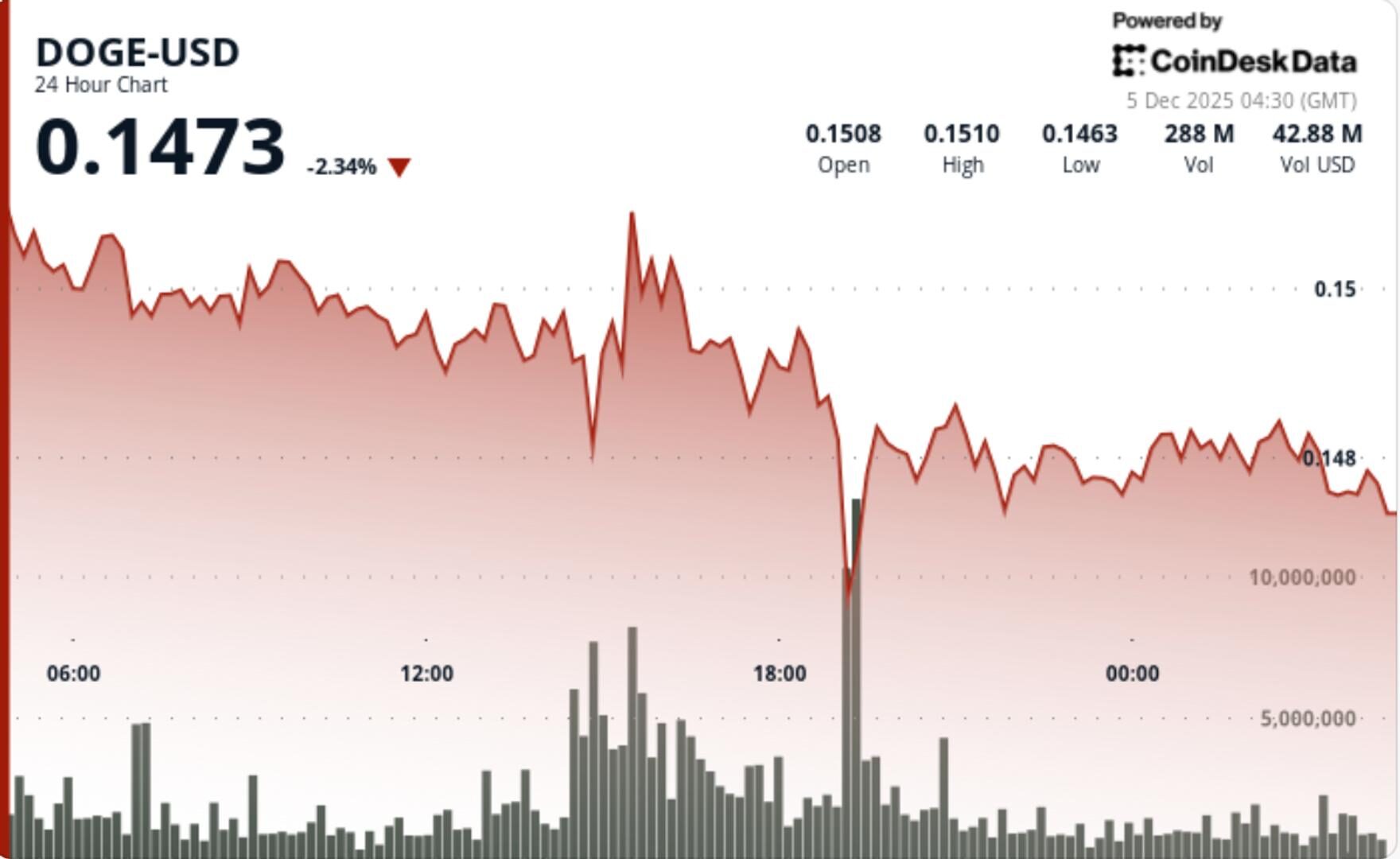

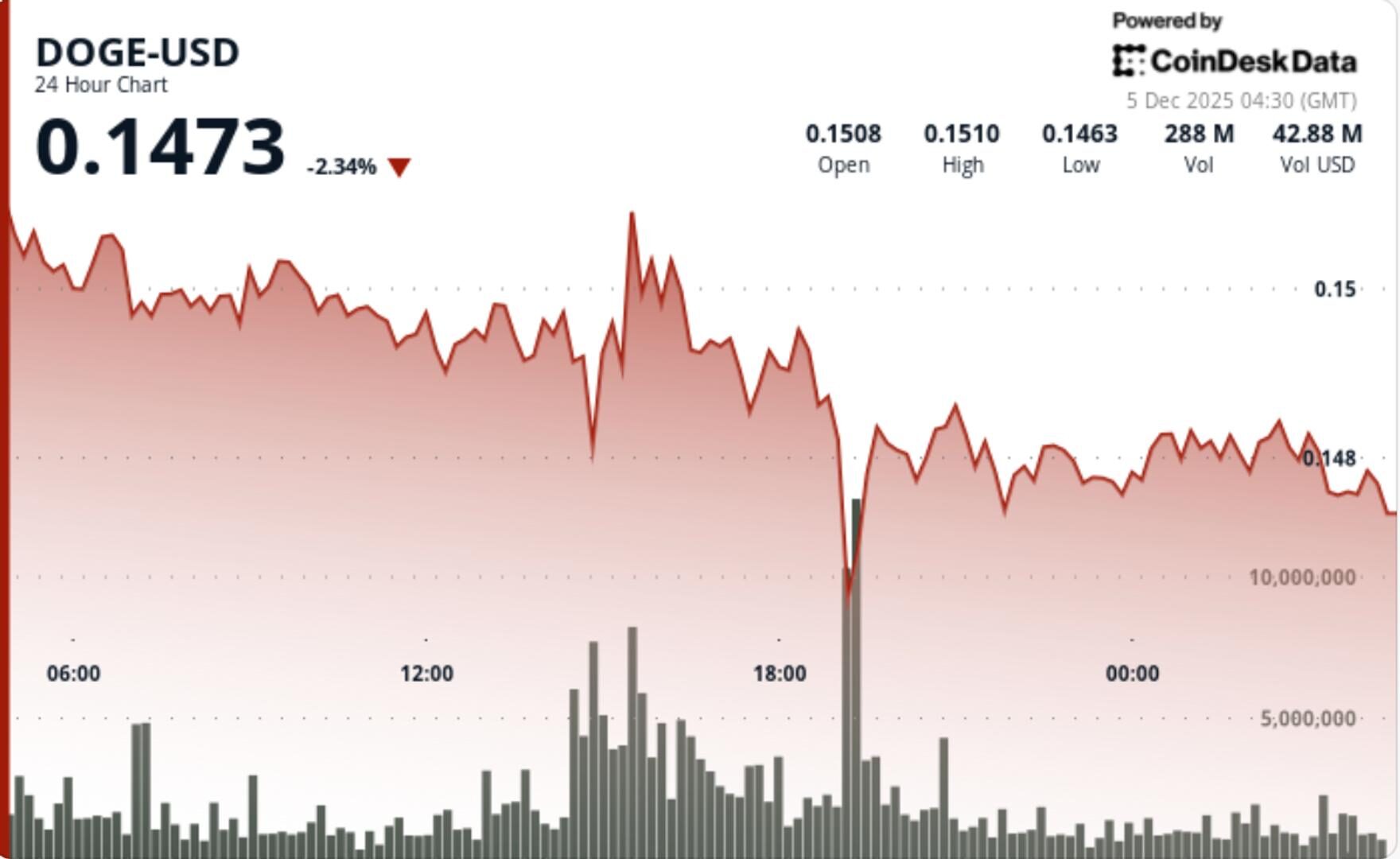

Technical analysis shows DOGE failed to hold key support levels, suggesting continued downside unless buyers reclaim critical price points.

DOGE ETF Buzz Meets Bearish Reality as Dogecoin Prints Fresh Lower Lows

Technical analysis shows DOGE failed to hold key support levels, suggesting continued downside unless buyers reclaim critical price points.