-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Shaurya Malwa, CD Analytics

Updated Aug 25, 2025, 6:59 a.m. Published Aug 25, 2025, 6:58 a.m.

- Dogecoin’s price dropped sharply after reaching $0.25, driven by large whale transfers to Binance and fading momentum.

- Despite institutional accumulation, Dogecoin is testing critical support levels amid macroeconomic pressures.

- Traders are closely watching if $0.23 will hold as support, with potential downside if it fails.

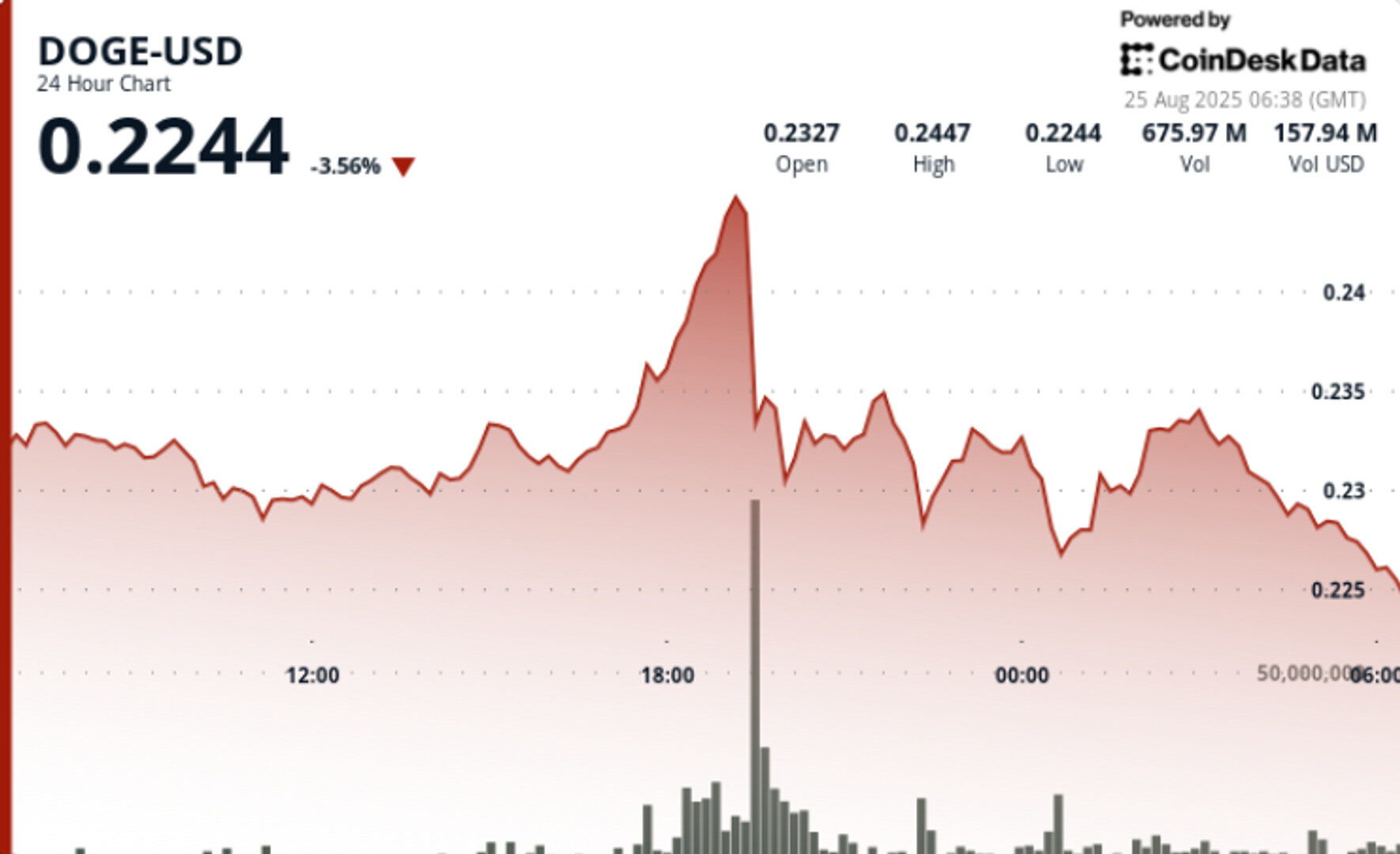

Dogecoin retreated sharply on August 24–25 after spiking to $0.25, as heavy whale transfers to Binance coincided with distribution pressure and fading momentum at key resistance. Despite institutional accumulation earlier in the month, the token is now testing critical support levels.

Market attention turned to DOGE after a 900 million token transfer (valued at over $200 million) was tracked moving to Binance wallets. The move raised concerns about short-term sell pressure just as the token’s rally toward $0.25 ran into resistance. Meanwhile, on-chain data showed whales accumulated over 680 million DOGE in August—suggesting deeper-pocketed investors remain positioned for long-term upside even as near-term technicals weaken.

STORY CONTINUES BELOW

Macroeconomic context also weighed on sentiment. Risk assets pulled back following fresh trade policy headlines and hawkish central bank commentary. Futures open interest in DOGE dipped 8%, reflecting lighter speculative positioning despite the month’s whale activity.

• DOGE traded in a wide $0.02 range (8%) between $0.23 lows and $0.25 highs in the 24-hour period from August 24 at 06:00 to August 25 at 05:00.

• The key breakout occurred at 19:00 UTC on August 24, when DOGE spiked to $0.25 on 2.29 billion volume—multiple times the daily average.

• The move quickly reversed, with prices sliding to $0.23 and settling at $0.23 by session close, down 3% from the open.

• In the final hour (04:44–05:43), DOGE fell another 0.4% as heavy volume broke through $0.229 intraday support, hitting lows near $0.228 before closing at $0.228.

• Resistance: Heavy rejection at $0.25 confirmed strong overhead supply, with 2.29 billion tokens traded at the peak.

• Support: Multiple retests anchored support near $0.23, though pressure persisted through late-session deterioration.

• Pattern: Range-bound consolidation ($0.228–$0.233) suggests buyers defending support but momentum favoring sellers.

• Volume: Spikes of 10–12 million per minute during the 05:07–05:08 window signal institutional distribution.

• Indicators: A golden cross remains intact on higher timeframes, but immediate momentum skews bearish without a reclaim of $0.24.

• Whether $0.23 holds as durable support—loss of this level could open downside toward $0.21 psychological zone.

• Follow-through on whale transfers: more Binance inflows could intensify sell pressure, while further accumulation would counterbalance.

• Futures positioning: OI contraction suggests sidelined leverage, but a rebound could fuel the next move.

• Macro backdrop: risk assets remain sensitive to central bank policy; dovish turns could provide relief rallies.

• Broader meme coin flows: correlation with SHIB and PEPE rallies remains a secondary driver of speculative flows into DOGE.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

More For You

By Omkar Godbole, AI Boost|Edited by Parikshit Mishra

42 minutes ago

Bitcoin has retraced to pre-Powell levels, maintaining bearish technical setup.

What to know:

- Bitcoin has retraced to pre-Powell levels, maintaining bearish technical setup.

- Key support for BTC lies at $110,756, with a significant support zone near the 200-day simple moving average at $100,887.

- Ether’s chart shows doji candle and bearish divergence on the RSI.