-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Shaurya Malwa, CD Analytics

Updated Aug 14, 2025, 5:51 a.m. Published Aug 14, 2025, 5:50 a.m.

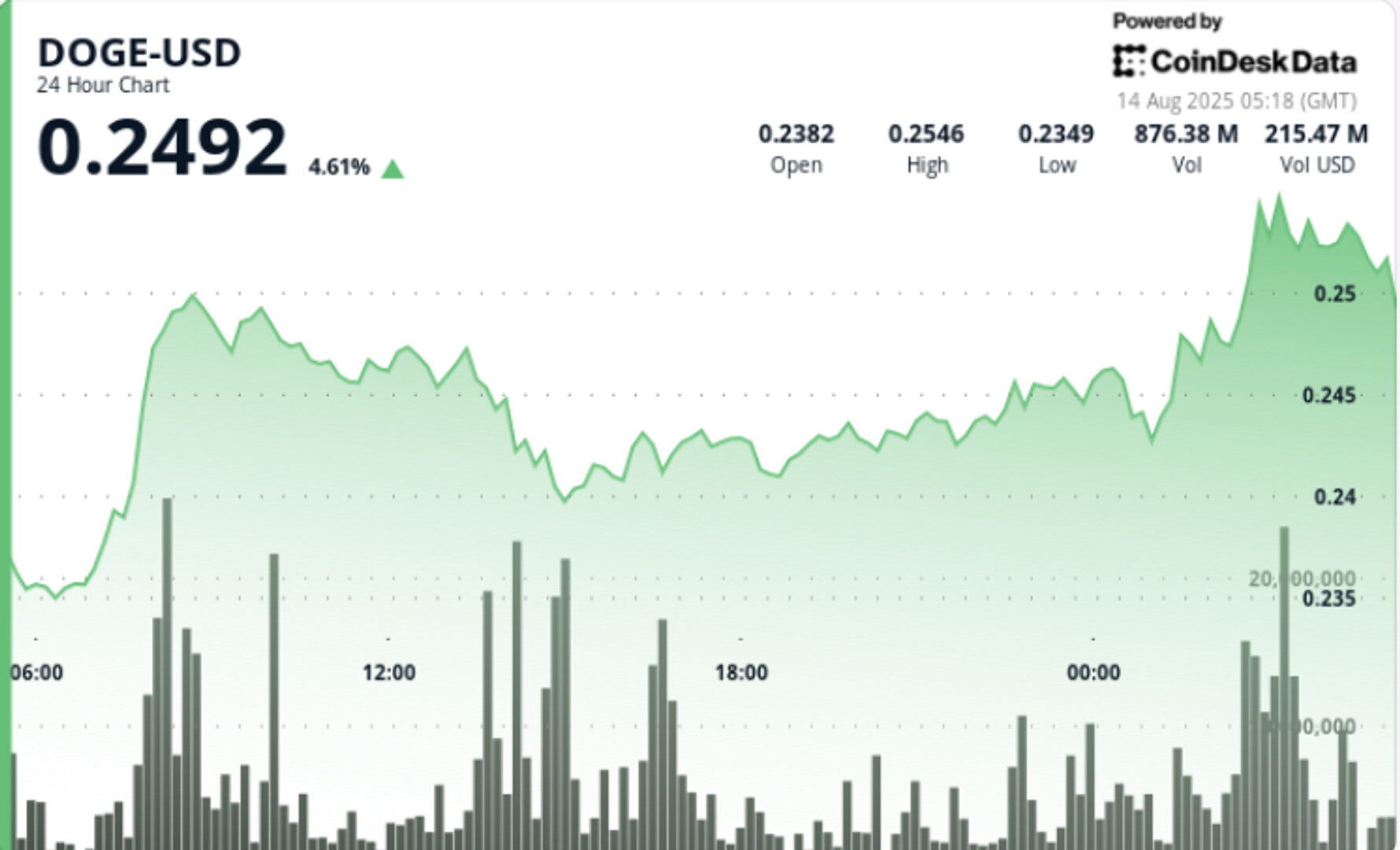

- Dogecoin surged over 7% in the past 24 hours, breaking through the $0.25 resistance level.

- Whale purchases exceeded $200 million, pushing futures open interest above $3 billion.

- Technical patterns suggest further upside toward $0.27, with $0.25 now acting as support.

Dogecoin surged over 7% in the past 24 hours, fueled by more than $200 million in whale purchases and a sharp uptick in derivatives positioning. The memecoin broke through the $0.25 resistance level, triggering a volume-led breakout and sending futures open interest above $3 billion. Large-holder ownership now sits just shy of 50%, underscoring growing institutional participation.

Technical patterns suggest further upside toward the $0.27 area, with bullish sentiment intact.

- Whale accumulation crossed 1 billion DOGE tokens (worth $200 million) in the past 24 hours.

- Large-holder ownership neared 50%, a threshold last approached during previous market tops.

- DOGE futures open interest surpassed $3 billion, indicating a sharp return of leveraged positioning.

- Broader crypto market strength supported the rally, with risk sentiment boosted by equity market gains.

- DOGE rallied from $0.24 to $0.25 in the 24-hour period from Aug. 13 05:00 to Aug. 14 04:00 (+7%).

- Trading range spanned $0.24–$0.26, reflecting 9% intraday volatility.

- Breakout above $0.25 occurred in evening hours following earlier consolidation.

- Volume during breakout phases significantly exceeded daily averages, peaking at 29.2 million in a single minute.

- Final hour showed stabilization at $0.25 after brief pullback.

- Breakout from bullish flag pattern projects short-term target near $0.27.

- $0.25 now acting as fresh support after multiple successful retests.

- Resistance stands at $0.26, with a clean move above opening path to $0.27.

- Volume profile indicates strong accumulation rather than speculative churn.

- Futures OI and funding rates suggest sustained long positioning in near term.

- Ability of $0.25 support to hold during any intraday pullbacks.

- Break above $0.26 to confirm continuation toward $0.27.

- Whale wallet flows for signs of ongoing accumulation.

- Funding rate spikes that could signal overcrowded longs.

- Correlation with broader risk-on moves in equities.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

More For You

By Omkar Godbole, AI Boost|Edited by Parikshit Mishra

55 minutes ago

BTC hit record highs above $124,000 early today, but the momentum has quickly faded consistent with the pattern seen since mid-July.

What to know:

- Long-term holders have accelerated their selling, impacting market momentum, according to observers.

- Blockchain data reveals a decline of over 300,000 BTC held by long-term wallets in the past four weeks, with dormant wallets becoming active.

- Institutional call overwriting has led to reduced volatility, while strong demand at $118,000 levels supports the market amid macroeconomic tailwinds.