-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

Technical desks noted Golden Cross signals across majors, reinforcing bullish momentum. Analysts flagged a decisive break above $0.255 as opening a path toward $0.32.

By Shaurya Malwa, CD Analytics

Updated Oct 2, 2025, 4:25 a.m. Published Oct 2, 2025, 4:25 a.m.

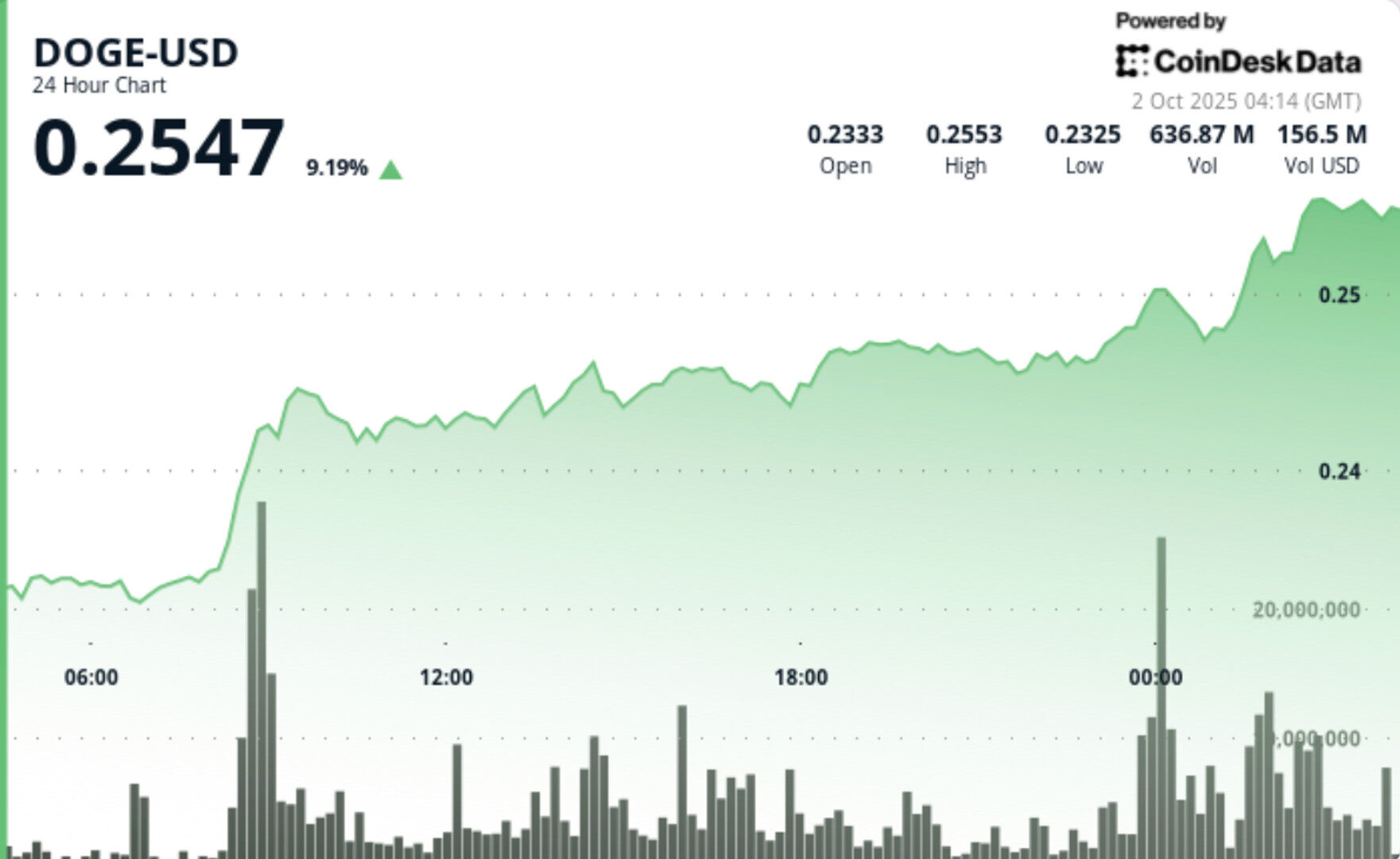

Dogecoin surged nearly 9% as traders speculated on U.S. ETF approvals and institutional interest.

SHIB’s 6% rally was supported by a significant drop in exchange reserves, highlighting reduced supply.

Technical analysis shows DOGE’s support at $0.242 and resistance at $0.254, with potential to reach $0.32.

Dogecoin ripped nearly 9% higher, breaking through resistance on more than a billion tokens traded. Support reset to $0.242 after an early breakout, while late-session flows pushed DOGE into the $0.254 zone before consolidation.

Traders pointed to SHIB’s parallel 6% rally — underpinned by record trillion-token turnover and exchange balances at two-year lows — as further evidence of institutional accumulation across meme-coins.

DOGE advanced 8.8% over the 24 hours from Oct. 1, 03:00 to Oct. 2, 02:00, climbing from $0.23 to $0.25. The move was fueled by speculation around U.S. ETF approvals and aggressive institutional positioning.

SHIB also surged 6.2% in the same window, with exchange reserves dropping to multi-year lows, underscoring a reduction in available supply as meme-coins gained broader bid interest.

STORY CONTINUES BELOW

- DOGE traded a $0.02 corridor, marking 9.3% volatility.

- Breakout at 08:00 drove price from $0.234 to $0.242 on 1.03B tokens — 4x the average.

- Intraday highs stretched to $0.249 and $0.253 before sellers capped at $0.254.

- Final hour saw DOGE climb from $0.248 to $0.254 on back-to-back 40M+ surges, settling near $0.252.

Support has shifted to $0.242 following the breakout, with resistance hardened at $0.254–$0.255. The session carved an ascending triangle, validated by higher lows and sustained turnover.

Technical desks noted Golden Cross signals across majors, reinforcing bullish momentum. Analysts flagged a decisive break above $0.255 as opening a path toward $0.32 — with ETF-driven flows providing the catalyst.

- Whether DOGE can flip $0.25 into firm support and push toward $0.32.

- If ETF speculation continues to underpin both DOGE and SHIB into October deadlines.

- SHIB’s exchange supply squeeze — at two-year lows — as a potential tailwind for meme-coin rotation.

- CD20 index reaction after both DOGE (+9%) and SHIB (+6%) posted outsized moves on heavy turnover.

More For You

Sep 9, 2025

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

By Shaurya Malwa, CD Analytics

24 minutes ago

Traders are closely monitoring the potential for a breakout above $3.00, with attention on the upcoming SEC decision on ETF applications.

What to know:

- XRP surged past key resistance levels following the launch of SBI’s institutional lending initiative.

- The token’s price action saw a 5.2% increase, with significant trading volumes exceeding 160 million tokens.

- Traders are closely monitoring the potential for a breakout above $3.00, with attention on the upcoming SEC decision on ETF applications.