-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Shaurya Malwa, CD Analytics

Updated Aug 22, 2025, 5:17 a.m. Published Aug 22, 2025, 5:17 a.m.

- Dogecoin surged after a $50 million acquisition by a Trump-linked entity and Wyoming’s launch of a state-backed stablecoin.

- Federal Reserve officials signaled a softer stance on digital assets, boosting institutional interest in cryptocurrencies.

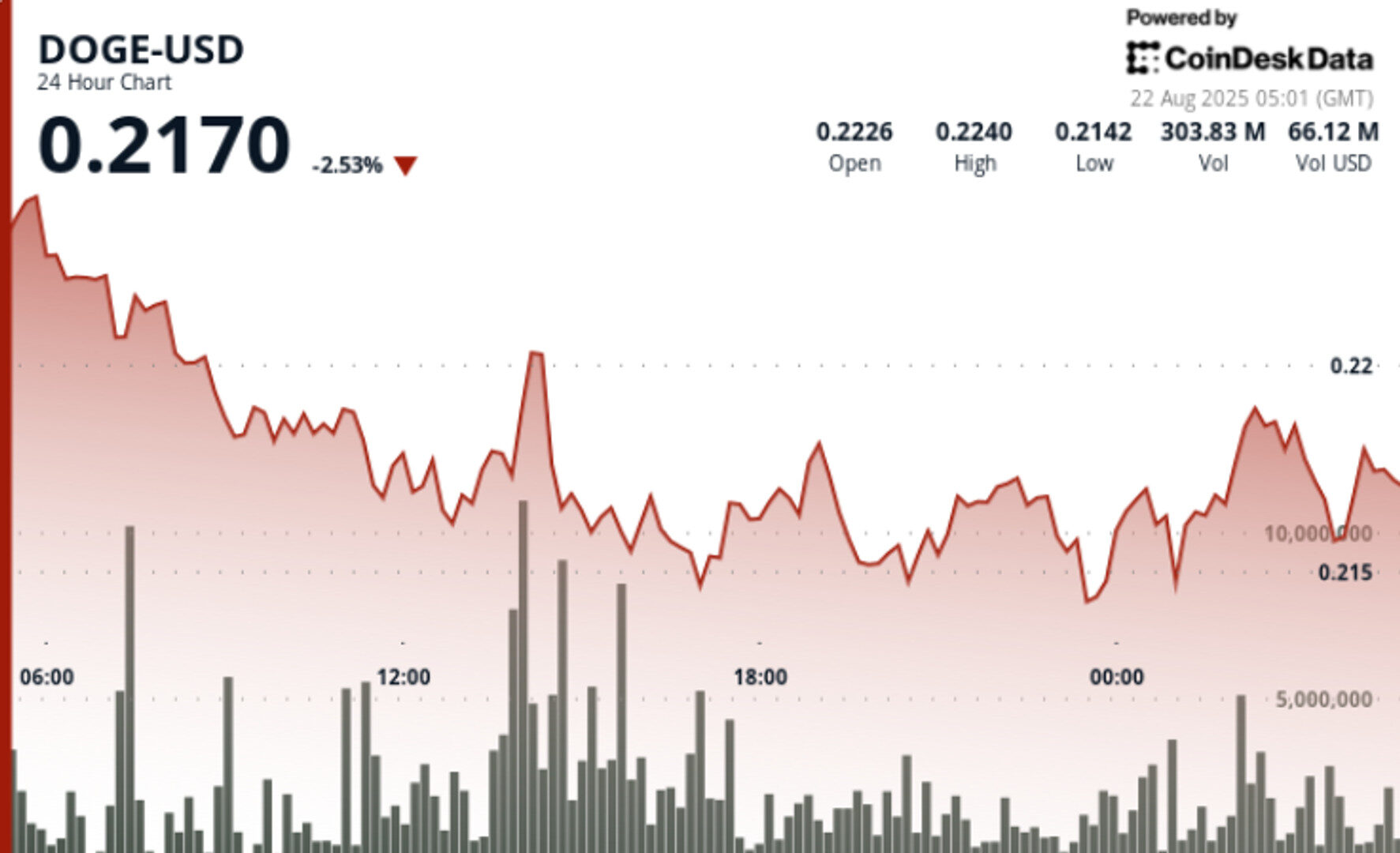

- DOGE’s price fluctuated between $0.21 and $0.22, with significant trading volumes indicating strong institutional activity.

Dogecoin rallied on Tuesday after a string of regulatory and corporate catalysts shifted sentiment across the crypto sector. A $50 million Trump-linked acquisition of a DOGE mining firm, Wyoming’s launch of a state-backed stablecoin, and comments from Federal Reserve officials signaling a softer stance on digital assets all converged to trigger fresh institutional flows.

• Thumzup, a Trump-affiliated entity, acquired Dogehash for $50 million, creating what executives described as the largest DOGE mining operation. The deal signals deep-pocketed confidence in Dogecoin infrastructure.

• Wyoming unveiled the Frontier Stable Token, the first government-backed state stablecoin, reinforcing the U.S. regulatory pivot toward digital assets.

• Fed Vice Chair Michelle Bowman warned banks about competitive risks from delaying digital asset adoption, signaling a more crypto-accommodative posture.

• SoFi Technologies integrated Bitcoin’s Lightning Network, targeting the $740 billion remittance market — another signal of traditional finance edging deeper into crypto rails.

STORY CONTINUES BELOW

• DOGE traded in a $0.01 band from $0.21 to $0.22 between Aug. 20 15:00 and Aug. 21 14:00, marking ~4–5% intraday volatility.

• The token rallied 5% from $0.21 to $0.22 during the Aug. 20 evening session, establishing $0.22 as near-term resistance.

• A late-session 60-minute window (Aug. 21 13:22–14:21) saw DOGE surge 1% from $0.22 to $0.22 with volume spikes above 61.8 million, confirming institutional activity.

• Support consistently held in the $0.21–$0.22 zone with bounces on 320–380 million volume across key testing points.

• Support: $0.21–$0.22 established as reliable floor with repeated high-volume retests.

• Resistance: $0.22 key pivot cleared, but bulls need follow-through toward $0.225 to confirm breakout.

• Volume: Peak surges of 61.8 million and 378.6 million confirm institutional buying interest.

• Pattern: Classic consolidation followed by impulsive breakout; upward trajectory if support base holds.

• Futures OI: Stable around $3 billion, reflecting sustained leveraged interest despite macro volatility.

• Whether DOGE can sustain above the $0.22 pivot and push toward $0.225–$0.23 resistance.

• The market’s reaction to Fed policy shifts and Wyoming’s stablecoin launch — potential sector-wide tailwind.

• Whale accumulation patterns, already totaling 2 billion DOGE ($500M) this week.

• Mining sector expansion via Thumzup’s acquisition and its impact on DOGE’s hashpower distribution.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

More For You

1 hour ago

SBI VC Trade, a licensed Electronic Payment Instruments Exchange Service Provider, said it expects RLUSD to go live in Japan during the first quarter of 2026.

What to know:

- Ripple and SBI Holdings plan to introduce Ripple USD (RLUSD) in Japan to capitalize on the country’s evolving stablecoin market.

- RLUSD, fully backed by U.S. dollar deposits and other assets, aims for a 2026 launch with monthly third-party attestations.

- The partnership is seen as a significant step in enhancing Japan’s digital finance infrastructure and stablecoin reliability.