By Shaurya Malwa, CD Analytics

Updated Nov 11, 2025, 4:53 a.m. Published Nov 11, 2025, 4:53 a.m.

- Dogecoin surged above key resistance levels before a late-session reversal erased most gains.

- Trading volume spiked 96% above average, driven by speculative interest and whale accumulation.

- The market’s inability to maintain breakout levels suggests short-term liquidity rather than sustained growth.

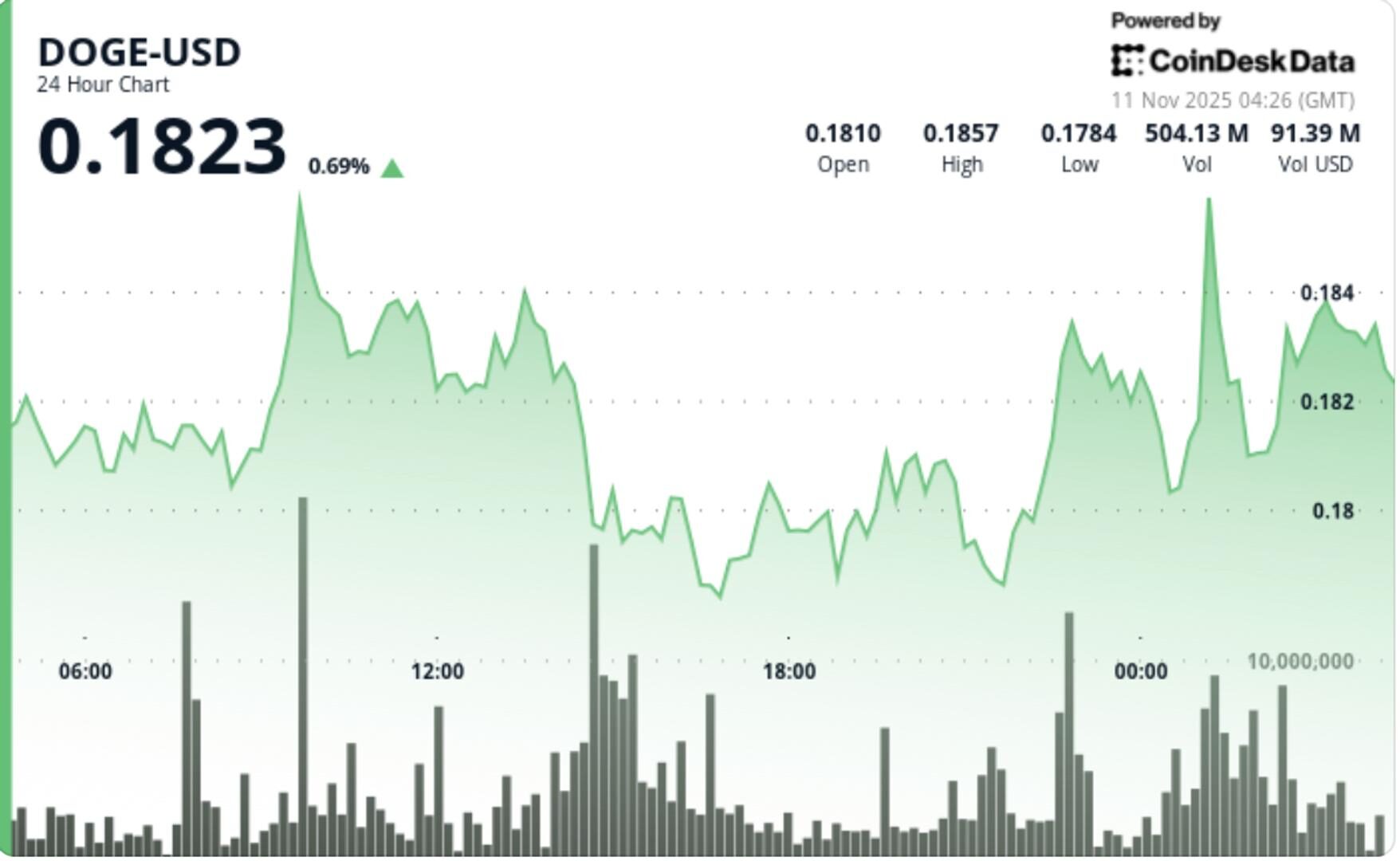

DOGE broke above key $0.1815 resistance during Tuesday’s session as volume surged 96% above average before a late-session reversal erased most intraday gains. The move created a lower high formation that signals a potential short-term shift in momentum.

- Dogecoin advanced 3.1% to $0.1824 in Tuesday’s trading, extending a multi-session recovery before encountering selling pressure near the $0.184 zone.

- The meme coin traded between $0.1769 and $0.1838, carving a 3.9% range as traders tested upper channel boundaries.

- The Bitwise spot DOGE ETF could launch within 20 days through an automatic approval process, making it a catalyst for dogecoin price predictions.

- Bitwise’s approach places the memecoin ETF on a 20-day countdown to automatic approval under Section 8(a) of the Securities Act, barring SEC intervention.

- DOGE consolidated between $0.1810 and $0.1835 during mid-session trade, with buyers defending $0.1800 support.

- However, the late-session reversal indicated exhaustion among short-term traders after repeated tests of intraday highs.

- DOGE’s rally stalled abruptly at 14:00 GMT as profit-taking triggered a 1.1% pullback from $0.1842 to $0.1821. The correction unfolded on elevated volume of 7.8 million tokens, puncturing interim support near $0.1830 and disrupting the earlier ascending channel structure.

- The shift established a lower high formation at $0.1842/$0.1821, a common early signal of weakening bullish momentum.

- Despite overall intraday gains, the market’s inability to hold above breakout levels suggests the move may have been fueled by short-term liquidity rather than sustained accumulation.

- Dogecoin’s short-term structure remains constructive above $0.1800 but vulnerable to renewed selling below $0.1820. The ascending channel visible on 4-hour charts was compromised by the late-session breakdown, introducing a neutral-to-bearish bias heading into midweek trading.

- Momentum indicators show waning strength: RSI eased from 64 to 52, while MACD narrowed toward convergence. The elevated turnover during the reversal phase points to active distribution, though support zones near $0.1800 continue to attract buying interest.

- DOGE’s near-term path hinges on its ability to defend $0.1800 support and reclaim resistance around $0.1835–$0.1840.

- A close above this band could restore momentum toward $0.1860–$0.1880, while failure to hold support risks retesting the $0.1760 base.

- Analysts note that ETF speculation remains a background catalyst but short-term price behavior appears driven primarily by technical positioning and profit-taking flows from recent whale accumulation.

More For You

Nov 3, 2025

A deep dive into Zcash’s zero-knowledge architecture, shielded transaction growth, and its path to becoming encrypted Bitcoin at scale.

What to know:

In 2025, Zcash evolved from niche privacy tech into a functioning encrypted-money network:

- Shielded adoption surged, with 20–25% of circulating ZEC now held in encrypted addresses and 30% of transactions involving the shielded pool.

- The Zashi wallet made shielded transfers the default, pushing privacy from optional to standard practice.

- Project Tachyon, led by Sean Bowe, aims to boost throughput to thousands of private transactions per second.

- Zcash surpassed Monero in market share, becoming the largest privacy-focused cryptocurrency by capitalization.

More For You

By Shaurya Malwa, CD Analytics

1 hour ago

The breakout attempt at $2.57 met resistance as profit-taking emerged, though buyers held firm above the $2.52-$2.53 zone to confirm short-term support.

What to know:

- XRP outperformed the broader crypto market, rising 1.55% amid increased institutional flows and regulatory optimism.

- Trading volume surged 20.71% above the seven-day average, indicating strong institutional participation.

- XRP’s ability to maintain support above $2.50-$2.52 is crucial for sustaining its bullish momentum.