-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

Updated Aug 19, 2025, 5:51 a.m. Published Aug 19, 2025, 5:51 a.m.

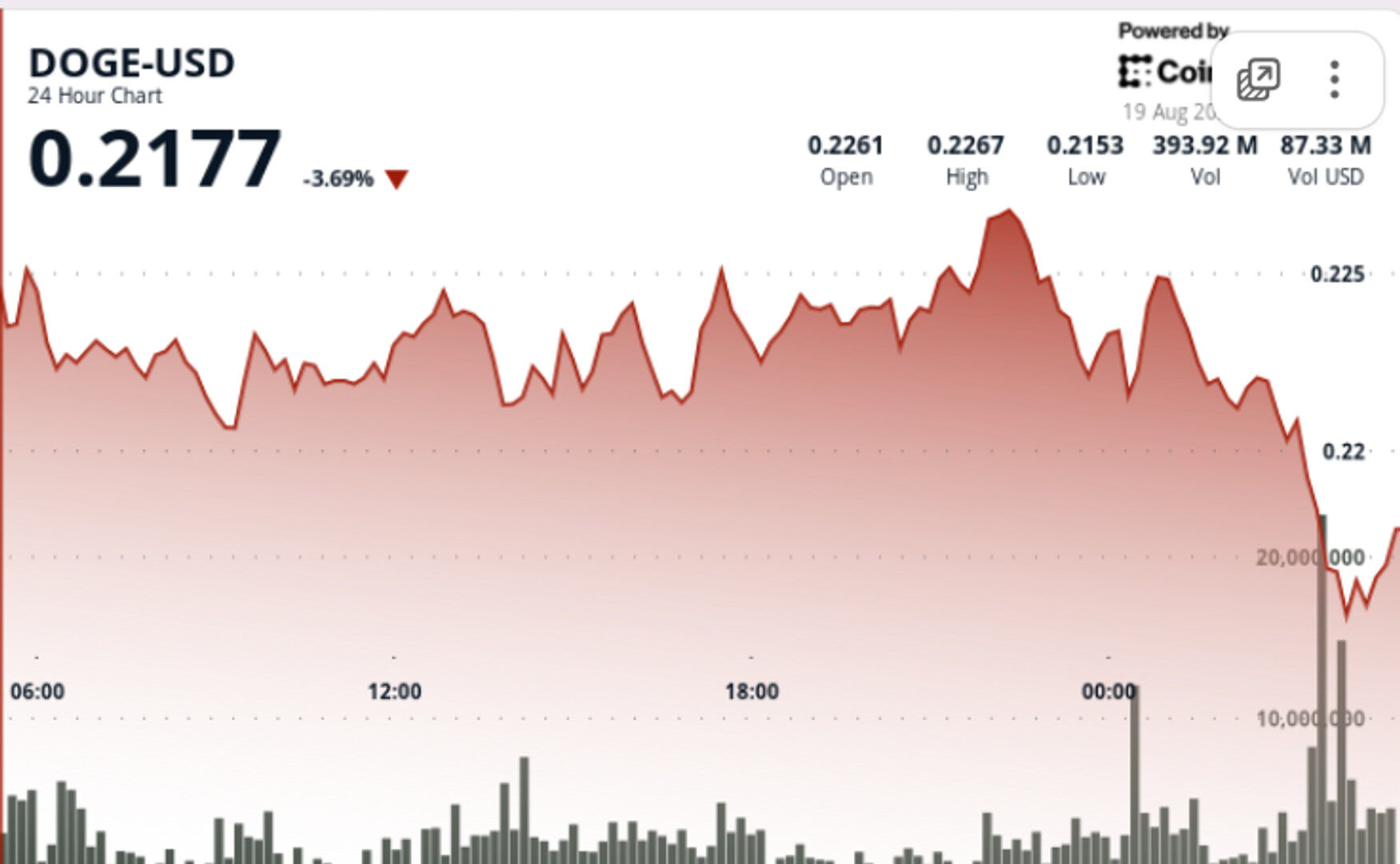

- Dogecoin fell 4% overnight, dropping from $0.23 to $0.22 amid heavy trading volume.

- The decline was part of a broader crypto liquidation trend, influenced by U.S. inflation data.

- Institutional investors accumulated 2 billion DOGE this week, despite the price drop.

Dogecoin slid overnight, erasing gains despite heavy institutional accumulation, as $782 million in trading volume overwhelmed support levels and sent the token into correction mode.

The move came alongside broad crypto liquidations, reflecting heightened macro pressure.

• Dogecoin dropped from $0.23 to $0.22 in a 24-hour window ending August 19 at 04:00, marking a 4% decline.

• A sharp liquidation wave hit between 03:00-04:00, where volumes spiked to 782 million DOGE — nearly double the daily average.

• The decline occurred as industry-wide liquidations topped $1 billion, triggered by U.S. inflation prints beating expectations and denting Fed rate-cut hopes.

• Despite the drop, institutional buyers have accumulated 2 billion DOGE worth about $500 million this week, bringing total reported holdings to 27.6 billion.

STORY CONTINUES BELOW

• DOGE traded within a $0.01 band, reflecting 5% intraday volatility.

• Overnight crash drove the token to test $0.22 support, now viewed as the key level to defend.

• A late-session rebound attempt lifted prices modestly back toward $0.22, signaling demand at the lows.

• Resistance is building near $0.23, where profit-taking and heavy sell orders reappear.

• Breakdown from $0.23 invalidates prior bullish structure, with $0.22 emerging as new short-term floor.

• Volume surge of 782 million DOGE validates capitulation selling — a potential precursor to bottom formation.

• Support: $0.22 (critical), followed by $0.21 if pressure persists.

• Resistance: $0.23 (immediate), $0.25 (major breakout threshold).

• Indicators suggest mixed signals: RSI approaching oversold, but momentum remains negative.

• Whether institutional accumulation continues if $0.22 cracks — signaling smart money conviction or retreat.

• Broader market risk sentiment: equity weakness and macro headwinds remain the dominant driver.

• $1 billion+ in crypto liquidations highlight fragility; another macro shock could deepen downside.

• A reclaim of $0.23 would be seen as a short-term reversal trigger, otherwise $0.21 support test is likely.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

More For You

By Sam Reynolds|Edited by Parikshit Mishra

3 minutes ago

Regulators froze new lending products after forced liquidations and market distortions, but some analysts say improvements, not shutdowns, are the smarter path forward.

What to know:

- South Korea’s Financial Services Commission has suspended new crypto lending products to mitigate risks to users and market stability.

- The decision follows concerns about increasing leverage in crypto markets and a recent $1 billion liquidation event.

- Critics argue for improved safeguards and transparency rather than a complete shutdown of lending services.