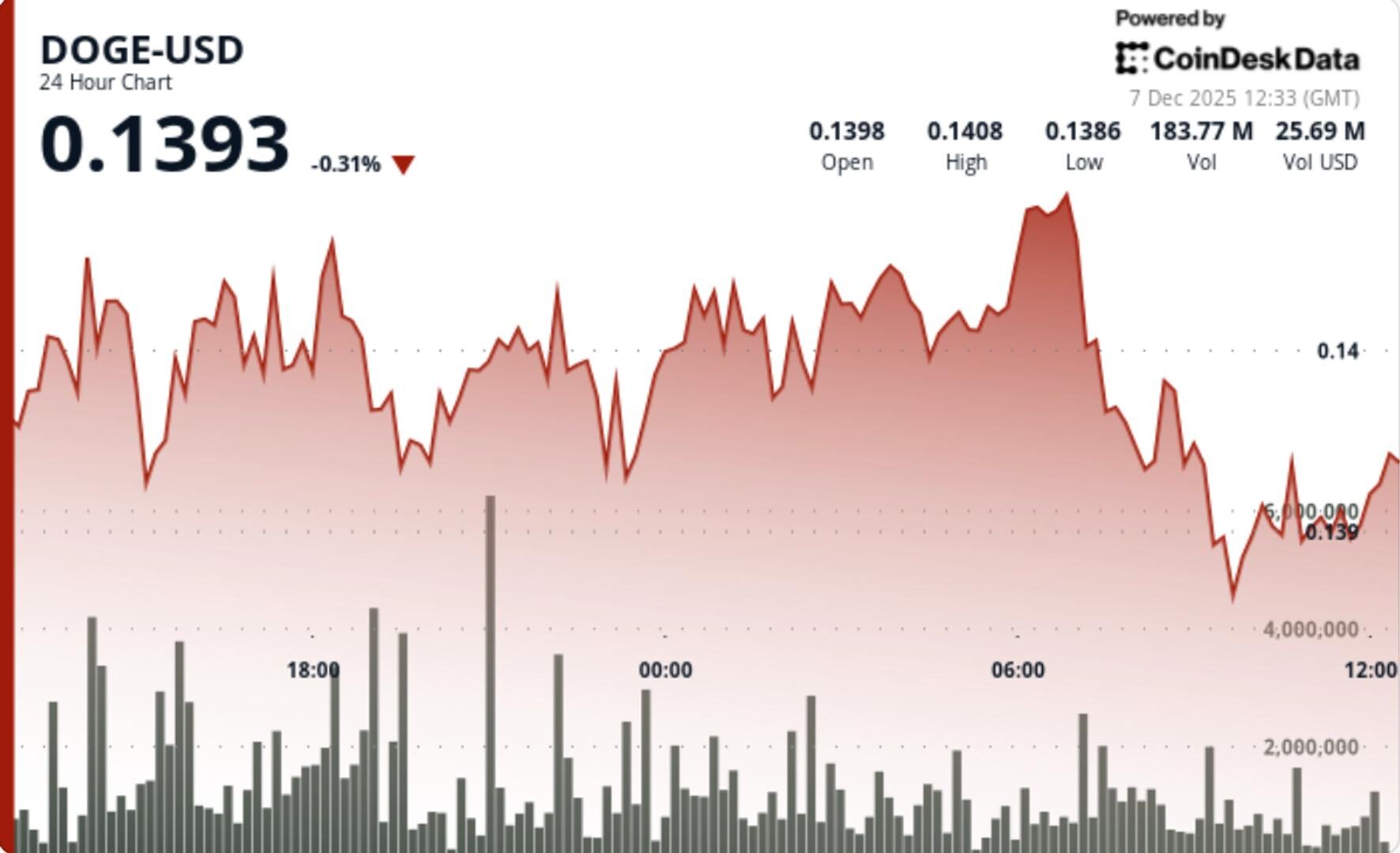

Dogecoin Price News: Activity Hits 3-Month High but DOGE Price Action Remains Range-Bound

DOGE network engagement surged to 71,589 active addresses — its highest reading since September — signaling improving chain activity despite muted price performance.

Updated Dec 7, 2025, 12:59 p.m. Published Dec 7, 2025, 12:58 p.m.

- Dogecoin struggles to break the $0.1409 resistance despite significant whale accumulation and increased network activity.

- Whale purchases have increased large-holder balances by 480 million DOGE, but price remains constrained by strong sell pressure.

- The divergence between bullish fundamentals and weak technicals suggests consolidation until a catalyst emerges.

Memecoin faces rejection at $0.1409 resistance while institutional flows surge to 480M tokens, creating divergence between technical weakness and fundamental strength.

- Dogecoin continues to struggle beneath the $0.14 threshold despite strong accumulation trends and a spike in network activity. On-chain data shows whales purchased 480 million DOGE between December 2–4, lifting total large-holder balances from 28.0B to 28.48B.

- At the same time, DOGE network engagement surged to 71,589 active addresses — its highest reading since September — signaling improving chain activity despite muted price performance.

- Whale buying and rising activity contrast sharply with price behavior, which remains pinned beneath a dense resistance zone as breakeven sellers and technical overhead cap momentum.

- DOGE’s attempt to reclaim the $0.1409 resistance failed decisively when a 333M volume spike — 79% above average — triggered immediate rejection from the level. This confirms strong distribution pressure at the psychological barrier.

- The structure remains range-bound with tight consolidation between $0.1393 and $0.1400. Volume contraction following the breakout failure underscores market indecision and a lack of conviction among buyers.

- Intraday charts reveal a minor breakdown below $0.140 support, pushing DOGE to $0.1392 on heightened activity above 15M — a move that widens the consolidation range and establishes fresh resistance at $0.1400.

- Despite accumulation from whales, the technical picture remains weak: the market sits beneath resistance, momentum wanes, and lower timeframes show no confirmed trend reversal.

- DOGE fell 1.2% from $0.1522 highs to $0.1395, with multiple failed pushes toward $0.1409.

- The most significant action occurred at 07:00 UTC when volume exploded to 333M, coinciding with a sharp rejection from resistance.

- Subsequent weakness carried DOGE to $0.1392, forming a new intraday support at $0.1393 while consolidating around the $0.1395 midpoint.

- DOGE faces a critical standoff between strong underlying accumulation and weak near-term technicals.

- Whale buying is rising, but overhead supply remains heavy at $0.1400–$0.1409, where repeated sell pressure signals active distribution.

- A break above $0.1409 could open a path toward $0.142, but failure to hold $0.1393 risks a retest of $0.1380.

- The divergence between bullish fundamentals and range-bound technicals suggests consolidation is likely until volume re-expands or a catalyst emerges.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By James Van Straten, AI Boost|Edited by Stephen Alpher

23 minutes ago

Rising bitcoin supply in loss, weakening spot demand and cautious derivatives positioning were among the issues raised by the data provider in its weekly newsletter.

What to know:

- Glassnode’s weekly newsletter shows multiple onchain metrics now resemble conditions seen at the start of the 2022 bear market, including elevated top buyer stress and a sharp rise in supply held at a loss.

- Off chain indicators show softening demand and fading risk appetite, with declining ETF flows and weakening spot volumes.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language