Trading volume surged to 721 million tokens, indicating active repositioning rather than thin price movement.

By Shaurya Malwa, CD Analytics

Updated Dec 23, 2025, 4:38 a.m. Published Dec 23, 2025, 4:38 a.m.

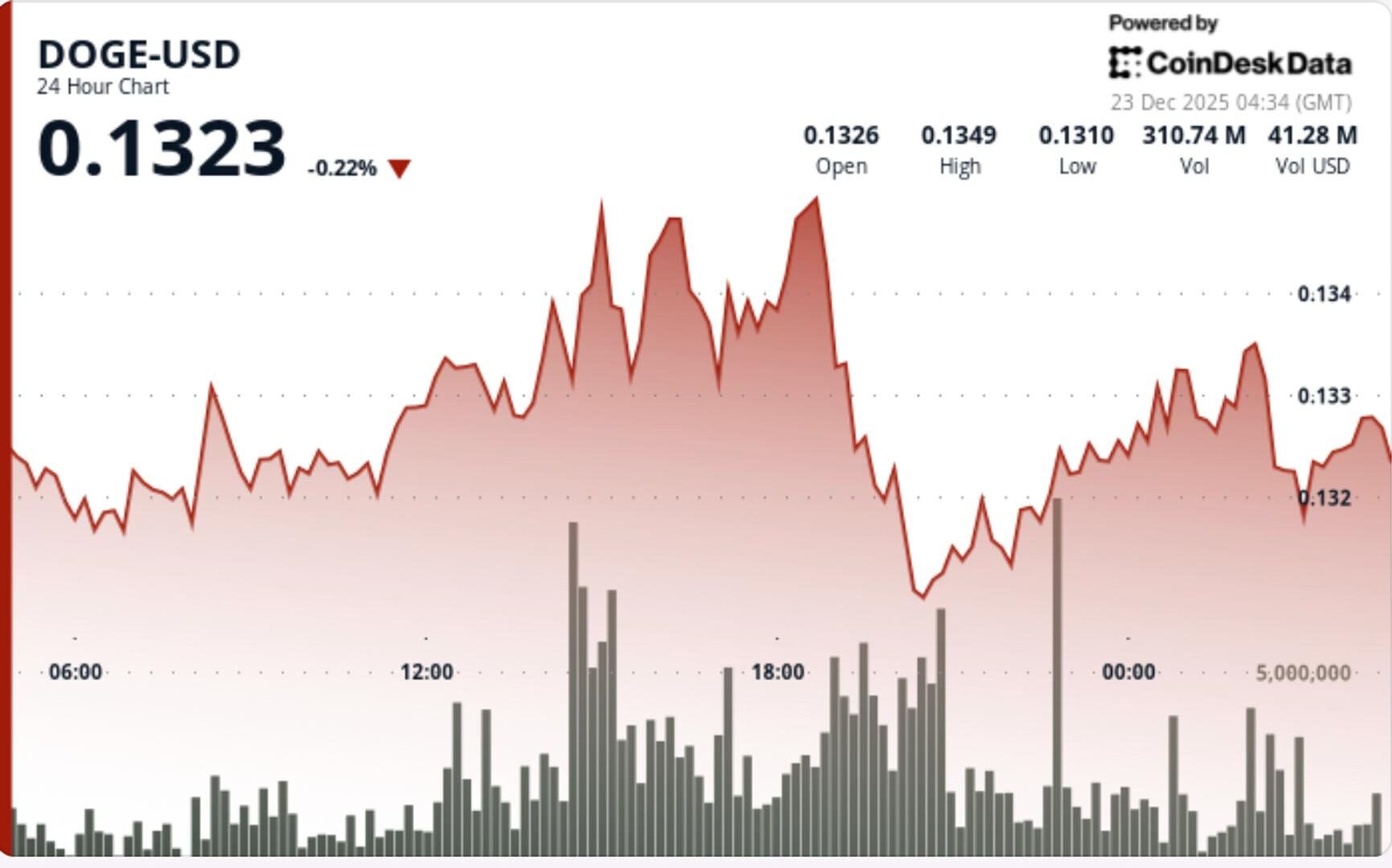

- Dogecoin fell 1.8% as sellers regained control, with price drifting toward the lower end of its recent range.

- Trading volume surged to 721 million tokens, indicating active repositioning rather than thin price movement.

- DOGE lost support near $0.1320, confirming a bearish short-term bias as it failed to sustain gains above $0.135.

Dogecoin edged lower during Sunday’s session after failing to hold short-term support, with elevated volume suggesting sellers are regaining control as price drifts toward the lower end of its recent range.

DOGE fell about 1.8% over the past 24 hours, sliding from an intraday high near $0.1341 to trade around $0.1323. The move followed a failed recovery attempt above $0.135, where selling pressure re-emerged and capped upside momentum.

STORY CONTINUES BELOW

Trading activity picked up notably during the decline. Volume rose to roughly 721 million tokens around the session peak, about 150% above the 24-hour average, indicating active repositioning rather than thin, low-liquidity price movement.

The key technical development was DOGE’s loss of support near $0.1320, a level that had held during several prior pullbacks. Once that area gave way, price drifted toward session lows with limited follow-through buying.

On intraday charts, DOGE also slipped below the lower boundary of a short-term ascending channel, confirming a shift away from the modest recovery structure that had formed late last week. The rejection near $0.1352 established a lower high, reinforcing the bearish short-term bias.

- DOGE failed to sustain gains above $0.135, meeting selling interest at resistance

- Volume expanded sharply during the rejection, pointing to distribution

- Price slipped below $0.1320, a level that had acted as near-term support

- Late-session trade stabilized near $0.1323, but without a strong rebound

Overall, price action reflected controlled selling rather than panic, though momentum remains tilted lower.

With $0.1320 now acting as overhead resistance, attention shifts to whether DOGE can stabilize above the next demand area near $0.1280–$0.1290. That zone aligns with prior consolidation and could attract dip-buying interest if selling pressure eases.

On the upside, DOGE would need to reclaim $0.1320 and then $0.1350 to neutralize the current bearish structure. Until then, rallies are likely to face supply from traders looking to exit positions on strength.

For now, DOGE remains in a fragile technical position, with price action suggesting a consolidation-to-lower pattern rather than a confirmed reversal.

More For You

Dec 19, 2025

L1 tokens broadly underperformed in 2025 despite a backdrop of regulatory and institutional wins. Explore the key trends defining ten major blockchains below.

What to know:

2025 was defined by a stark divergence: structural progress collided with stagnant price action. Institutional milestones were reached and TVL increased across most major ecosystems, yet the majority of large-cap Layer-1 tokens finished the year with negative or flat returns.

This report analyzes the structural decoupling between network usage and token performance. We examine 10 major blockchain ecosystems, exploring protocol versus application revenues, key ecosystem narratives, mechanics driving institutional adoption, and the trends to watch as we head into 2026.

More For You

46 minutes ago

Data from CoinGlass shows bitcoin is down more than 22% so far in the fourth quarter, making 2025 one of the weakest year-end periods outside of major bear markets.

What to know:

- Bitcoin’s price is nearing $90,000, offering a short-term boost to the crypto market, but analysts remain cautious about a significant recovery.

- The total crypto market capitalization has surpassed $3 trillion, yet analysts warn that the rebound may be driven by exhaustion rather than renewed confidence.

- Bitcoin remains about 30% below its 2025 peak, with the market still vulnerable to sharp reversals, particularly during U.S. trading hours.