-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Shaurya Malwa, CD Analytics

Updated Aug 26, 2025, 3:44 p.m. Published Aug 26, 2025, 3:44 p.m.

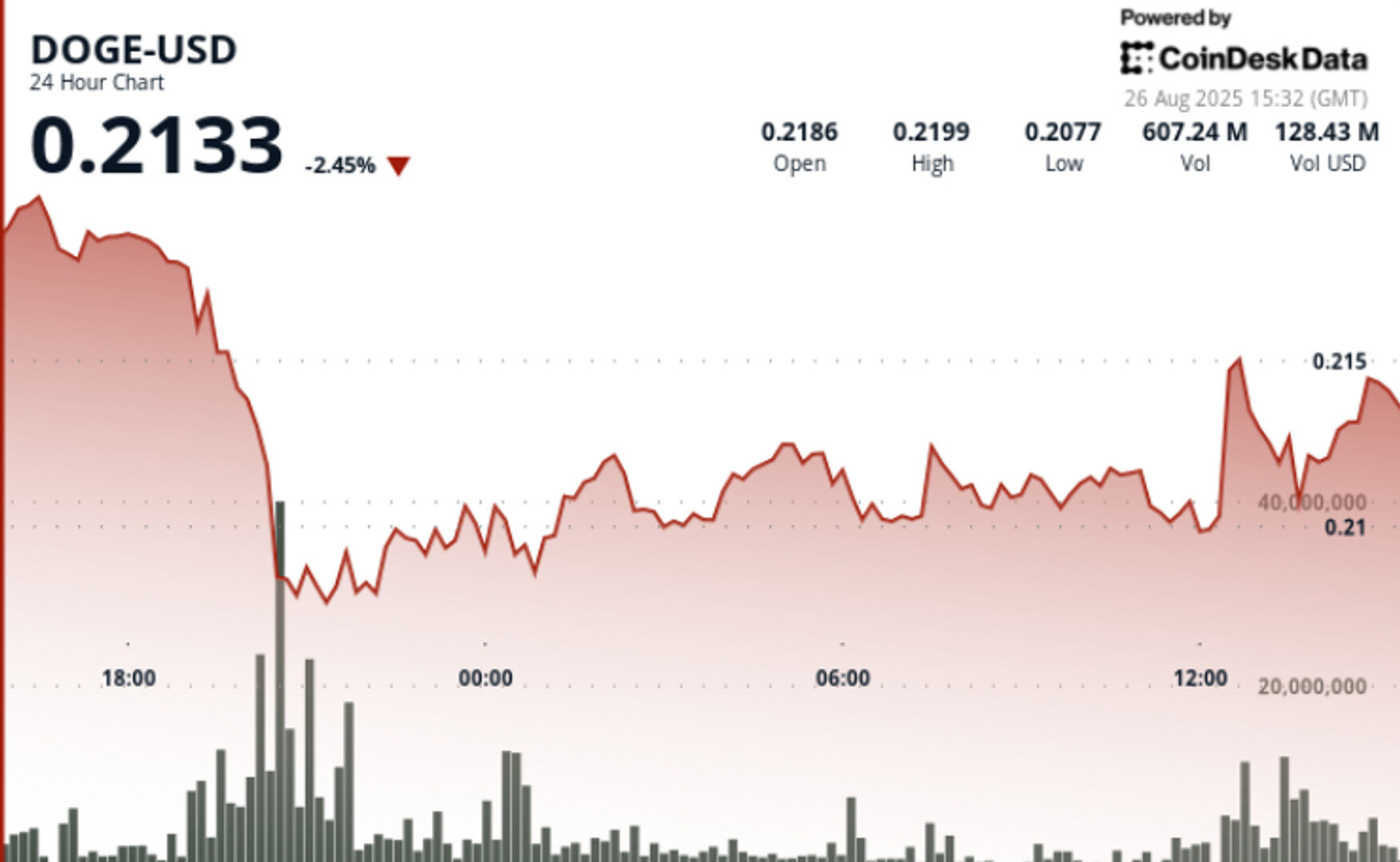

- Dogecoin experienced significant volatility between August 24–26, with prices swinging within a $0.013 range before stabilizing near $0.21.

- A massive transfer of 900 million DOGE to Binance contributed to market uncertainty, despite ongoing accumulation by large holders.

- Technical indicators suggest potential for a bullish reversal, though market sentiment remains divided between risks of a breakdown and optimism for a rebound.

Dogecoin traded through heavy volatility over the August 24–26 window, swinging within a $0.013 range before consolidating near $0.21. A sharp drop from $0.218 to $0.208 on August 25 came amid massive 1.57 billion volume, while broader pressure was tied to a 900 million DOGE transfer to Binance that unsettled traders.

Despite near-term caution, whales continue accumulating, leaving sentiment split between breakdown risks and dip-buying optimism.

- Whale transfers added fuel to volatility: between August 24–25, a single 900 million DOGE ($200+ million) was moved to Binance from a long-term holding wallet.

- Market sentiment soured on fears of a sell-off, with open interest in DOGE futures dropping 8% as speculative traders pared exposure.

- Despite the inflow, on-chain data shows whales accumulated over 680 million DOGE in August, countering retail distribution.

- Fed Chair Powell’s Jackson Hole comments sparked a 12% meme coin sector rally, aligning DOGE with broader risk-on momentum.

- DOGE posted a 6.06% spread in the 23-hour session ending August 26 at 12:00, trading between $0.221 and $0.208.

- The sharpest move came during 19:00–20:00 GMT on August 25, when DOGE fell from $0.218 to $0.208 on 1.57 billion volume.

- Price also whipsawed after the whale transfer, swinging from a $0.25 high to test $0.23 support before stabilizing.

- A rebound lifted DOGE from $0.210 session lows to $0.211–$0.212 in the 11:27–12:26 GMT window on August 26, aided by a 17.85 million volume spike at 11:58.

- Support established at $0.208 following the high-volume drop.

- Resistance holds at $0.218–$0.221, capping rallies.

- Current consolidation between $0.210–$0.212 suggests accumulation.

- RSI recovered from oversold levels near 42 to mid-50s, showing stabilizing momentum.

- MACD histogram narrowing toward bullish crossover, signaling potential upside reversal.

- Open interest decline of 8% points to reduced speculative leverage, limiting volatility but also dampening near-term upside.

- Sustained trading above $0.21 with elevated volumes (+16% vs. 30-day averages) strengthens bullish case.

- Bulls target a breakout toward $0.23–$0.24 if consolidation resolves upward and whale buying persists.

- Bears highlight $0.208 as the key downside trigger, with a break opening risk toward $0.200.

- The tug-of-war between exchange inflows (distribution risk) and whale accumulation (supportive demand) remains the decisive factor for the next leg.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

More For You

1 hour ago

Derivative milestone comes as spot XRP weathers sharp $2.96–$2.84 swing on 217 million volume and institutional flows step back in.

What to know:

- CME Group’s crypto futures suite has surpassed $30 billion in notional open interest, with SOL and XRP futures each crossing $1 billion.

- XRP became the fastest contract to reach $1 billion in notional open interest, achieving this milestone in just over three months.

- Despite regulatory pressures in the U.S., corporate adoption and pilot remittance programs keep XRP in focus, with institutional flows supporting its price action.