-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

Share this article

By Shaurya Malwa, CD Analytics

Updated Sep 4, 2025, 5:08 a.m. Published Sep 4, 2025, 5:08 a.m.

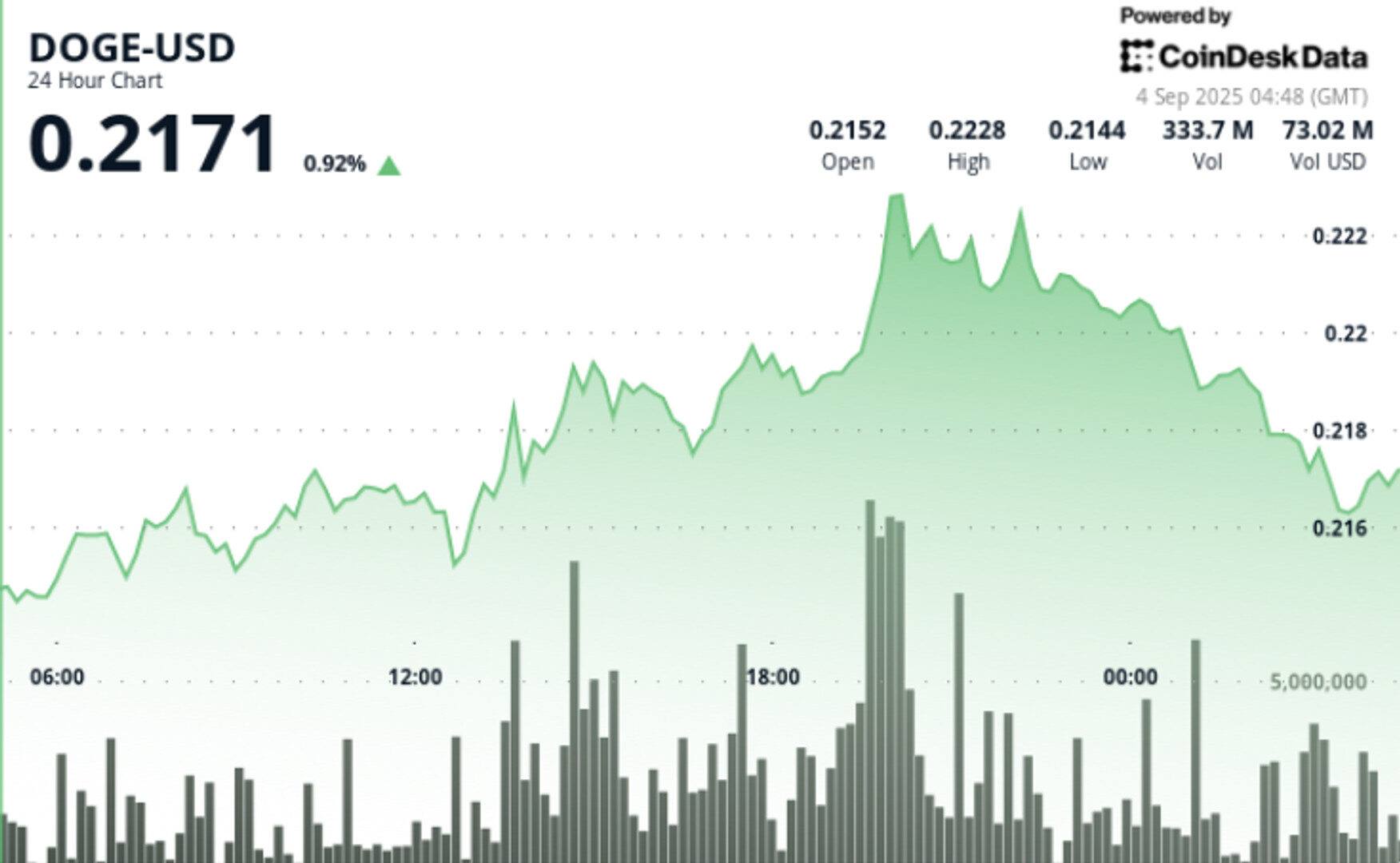

- DOGE advanced 4% over a 24-hour period, with trading volumes significantly exceeding the average.

- Analysts are divided on DOGE’s future, with some predicting a decline and others forecasting a potential rise.

- Key support and resistance levels are at $0.214 and $0.223, with institutional activity influencing price movements.

- DOGE advanced 4% during the 24h session from Sept. 3 at 03:00 to Sept. 4 at 02:00, climbing from $0.216 to $0.218.

- Trading volumes spiked to 416.41M tokens during resistance testing at $0.223, far above the 24h average of 244.87M.

- Prediction markets (Polymarket) show ETF approval odds rising from 51% to 71%, drawing institutional positioning.

- Analysts split: some warn of a triangle breakdown toward $0.17 Fibonacci support, while others forecast potential upside toward $1.00–$1.40 based on historical pattern repeats.

- DOGE traded within a $0.009 range (4.17% volatility) between $0.214 and $0.223.

- Midday rally (13:00–15:00) lifted price from $0.215 to $0.219 on volume spikes >400M.

- Evening session rejection at $0.223 triggered profit-taking and heavy volume flows.

- Final hour (01:31–02:30) saw DOGE fade 0.5% from $0.219 to $0.218, with volume accelerating to 16.1M in the last minute.

- Session low printed at $0.2178 as $0.218 support gave way under late selling pressure.

- Support: $0.214 confirmed by repeated institutional bids in overnight trading.

- Resistance: $0.223 established on high-volume rejection.

- Momentum: Lower highs forming; expanding volume on declines signals distribution.

- Patterns: Possible triangle setup under $0.22; breakdown would target $0.17 Fibonacci support.

- Volume: Institutional-level surges above 400M confirmed corporate desk participation.

- Whether $0.218 support holds or if breakdown opens path to $0.214 → $0.17.

- Institutional flows around ETF speculation — if regulatory odds firm up, could trigger breakout bids.

- Macro backdrop (Fed rate path + treasury adoption narratives) supporting risk-on appetite.

- Whale activity and treasury inflows as clues to whether accumulation outweighs distribution.

More For You

By Shaurya Malwa, CD Analytics

31 minutes ago

Token rebounds from session lows with whale accumulation offsetting institutional liquidations, but resistance levels cap momentum.

What to know:

- XRP traded in a narrow range from $2.81 to $2.87 over a 24-hour period, with large wallets accumulating 340 million XRP despite significant institutional liquidations.

- Total transaction volume on the XRP Ledger more than doubled on September 1, reaching 2.15 billion XRP.

- Analysts are divided on XRP’s future, with some predicting a rise to $7–$13 and others warning of resistance below key trendlines.