BTC

$103,715.58

–

0.26%

ETH

$2,483.91

–

0.09%

USDT

$1.0001

–

0.03%

XRP

$2.1264

–

1.40%

BNB

$644.12

+

0.85%

SOL

$142.48

–

0.45%

USDC

$0.9998

–

0.02%

TRX

$0.2731

–

0.10%

DOGE

$0.1634

–

2.85%

ADA

$0.5779

–

1.93%

HYPE

$34.23

–

4.89%

WBT

$49.00

–

0.33%

BCH

$486.62

+

0.87%

SUI

$2.7298

–

2.36%

LINK

$12.76

–

1.11%

LEO

$8.8950

–

0.48%

XLM

$0.2446

–

1.02%

AVAX

$17.49

–

0.75%

TON

$2.9760

+

1.86%

SHIB

$0.0₄1145

+

0.07%

By Shaurya Malwa, CD Analytics

Updated Jun 20, 2025, 4:28 p.m. Published Jun 20, 2025, 4:28 p.m.

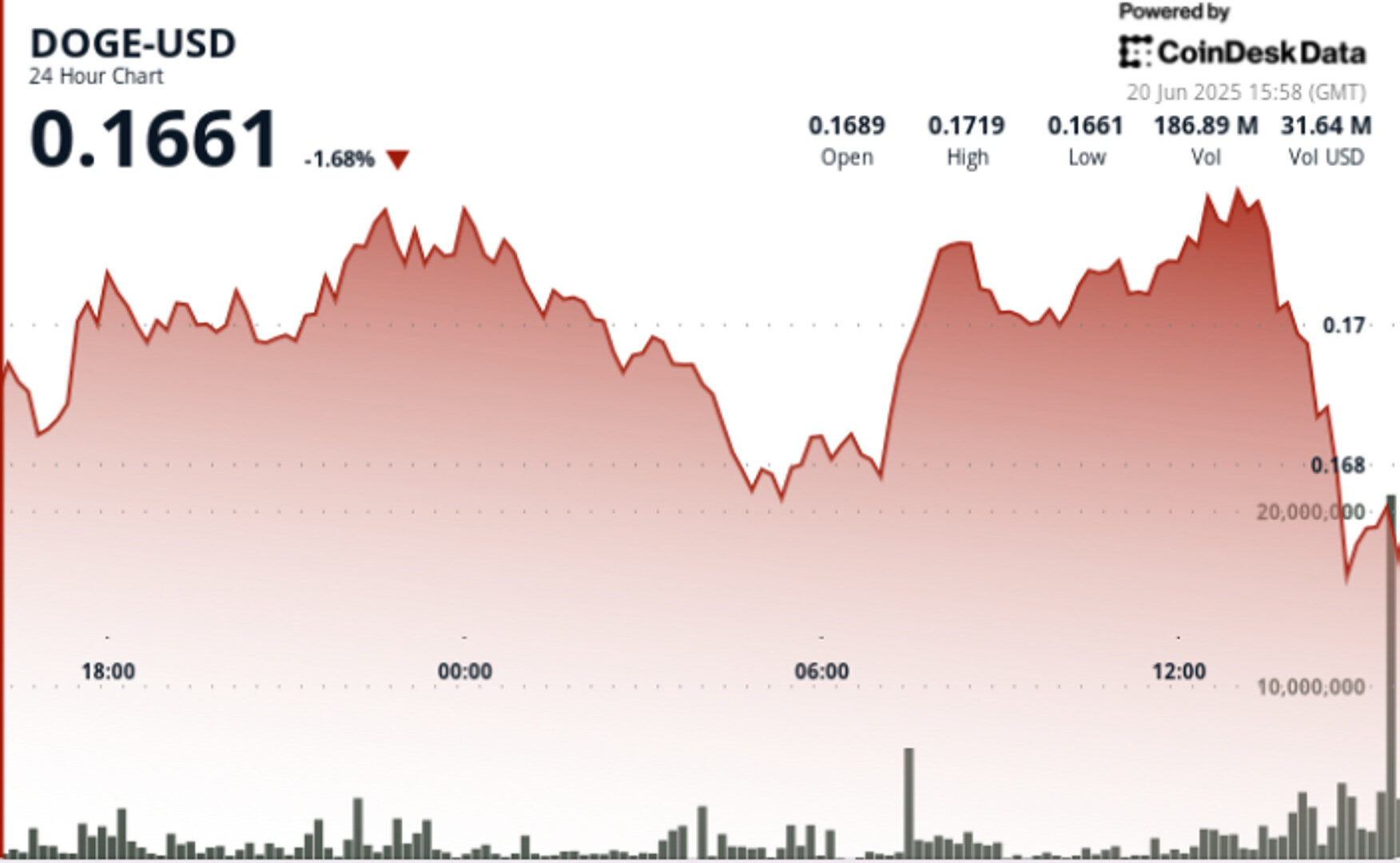

- Dogecoin is stabilizing near $0.170 after a sharp reversal from session lows, indicating signs of accumulation amid macroeconomic tensions.

- The cryptocurrency is forming a symmetrical triangle pattern, which analysts suggest could lead to a significant price move.

- Despite attempts to break above $0.172, Dogecoin faced resistance, but strong support has been established at $0.168.

Dogecoin is stabilizing near $0.170 after a sharp reversal from session lows, showing signs of accumulation as macroeconomic tensions rattle global markets.

The meme cryptocurrency found strong support at $0.16, and is now coiling within a symmetrical triangle — a technical pattern known to precede major directional moves.

Story continues

- Analysts are increasingly focused on DOGE’s tightening technical structure. The current symmetrical triangle setup, combined with compressing volume and narrowing volatility, suggests a breakout could be imminent.

- Historical precedence for this pattern points to a potential 60% price move — though the direction remains unclear.

- As the Federal Reserve prepares to issue its next policy guidance and risk assets remain under pressure, DOGE’s positioning near a breakout point could present opportunity — or risk — for traders betting on a resolution.

DOGE traded within a 2.7% range between $0.167 and $0.172 over the 24-hour period. A sharp 1.8% drop at 04:00 was followed by a strong recovery during the 07:00 hour, where volume spiked to 248 million units — the day’s highest. That rebound solidified $0.168 as a key support level.

Price action then entered a consolidation phase between $0.170 and $0.172. Attempts to break above resistance at $0.172 were rejected during the 13:00 hour, with 193 million in selling volume. Downward pressure re-emerged around 13:45–13:51, when volume spiked again to 18.7 million, but DOGE held its ground at $0.170.

- DOGE posted a 2.7% 24-hour range, trading from $0.167 to $0.172.

- Sharp 1.8% decline early in session was reversed with 248M volume at $0.168 — now confirmed as support.

- Consolidation range established between $0.170–$0.172.

- Resistance tested and rejected at $0.172 during high-volume 13:00 hour (193M).

- Late-session dip saw volume surge to 18.7M; price defended $0.170 floor.

- Symmetrical triangle pattern tightening, with analysts calling for potential 60% move on breakout.

- RSI hovering near 50; MACD flattened — momentum indicators reflect compression phase.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.