Share this article

Traders identify continued divergence between rising volume and flat price as a key accumulation signal — often a precursor to volatility expansion within 24–48 hours.

By Shaurya Malwa, CD Analytics

Updated Oct 23, 2025, 5:01 a.m. Published Oct 23, 2025, 5:01 a.m.

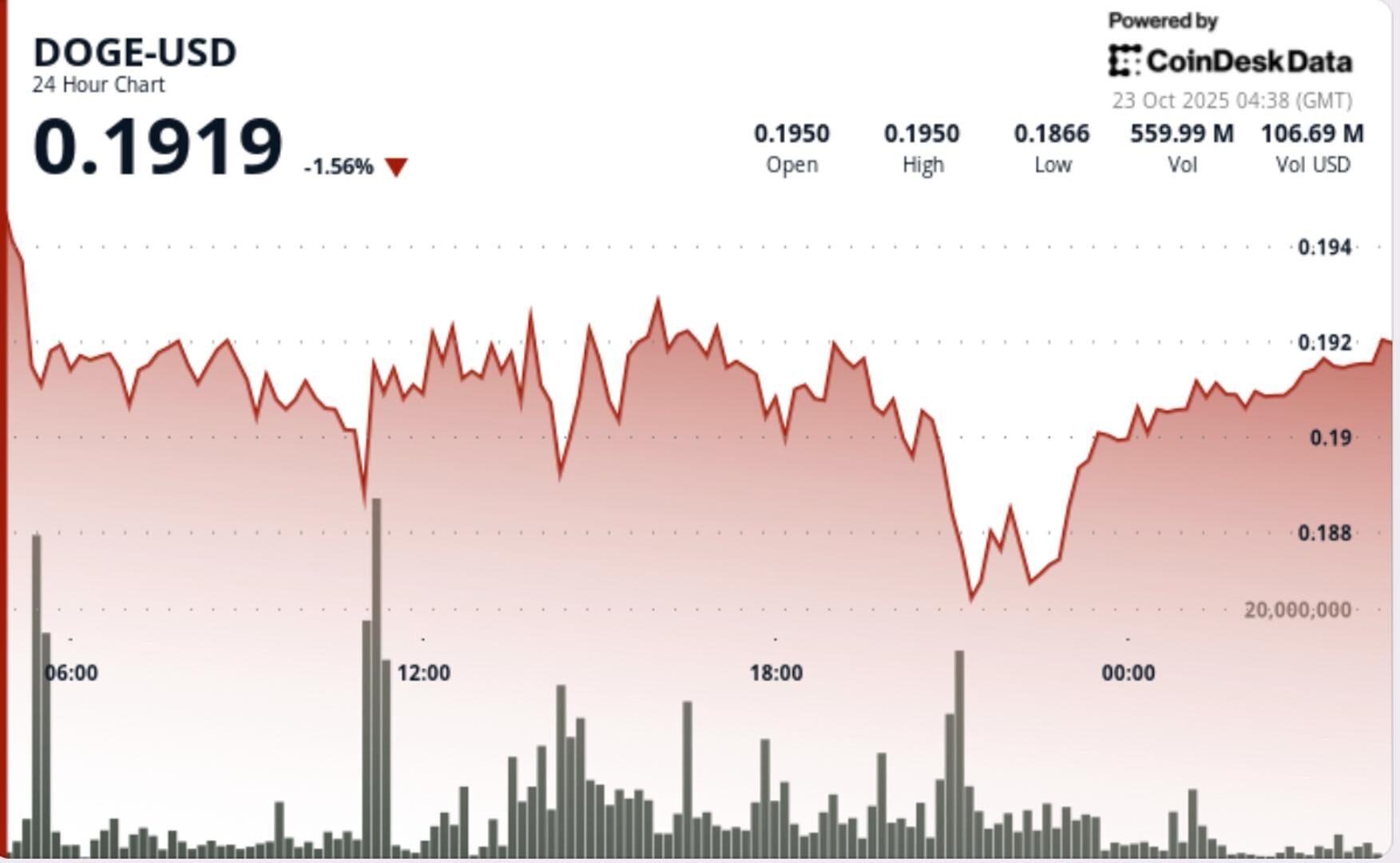

- Dogecoin fell 0.61% to $0.192, with trading activity climbing 20.26% above the weekly average, suggesting institutional accumulation.

- The token traded within a tight range, holding near the $0.19 psychological threshold, with support at $0.1860 and resistance at $0.1925.

- Traders are watching for a breakout above $0.1925, which could target $0.20–$0.21, while failure to hold support at $0.1860 may lead to a decline toward $0.18.

Meme coin consolidates near psychological support while institutional flows and elevated trading activity hint at position-building ahead of potential breakout.

- Dogecoin fell 0.61% to $0.192 during Tuesday’s session, retreating from intraday highs of $0.195 as sellers capped gains at resistance.

- The move follows Monday’s brief push toward $0.20, with traders citing steady institutional profit-taking at upper resistance levels.

- Despite muted price action, trading activity climbed 20.26% above the weekly average, with total turnover reaching 942.7 million tokens — roughly double the 24-hour mean.

- The elevated volume, paired with limited price movement, signals institutional accumulation rather than broad retail participation, suggesting positioning ahead of a potential breakout event.

- DOGE traded within a tight $0.0132 range between $0.1860 and $0.1953 across the 24-hour period, holding near the $0.19 psychological threshold.

- The session’s volume peak at 942.7 million occurred as the token tested resistance at $0.1925 before reversing lower, confirming short-term rejection.

- Support developed firmly around $0.1860, with repeated defenses across the mid-session window. The final trading hour showed DOGE stabilizing near $0.1916 on fading turnover, reflecting balanced order flow after earlier volatility spikes.

- DOGE’s short-term structure shows constructive accumulation forming beneath resistance. Hourly data reveals higher lows at $0.1914, $0.1916, and $0.1920 — confirming an ascending channel pattern supported by institutional volumes exceeding 10 million per candle during recovery sequences.

- Immediate resistance sits at $0.1925, while broader trend ceilings remain at $0.2060 and the monthly Fibonacci level near $0.2663.

- The sustained compression between $0.1860 support and $0.1925 resistance highlights a tightening volatility band typically preceding larger directional moves.

- Market participants are monitoring whether institutional flows maintain momentum above current volume thresholds.

- A clean break above $0.1925 could expose short-term targets near $0.20–$0.21, while failure to hold $0.1860 support risks renewed downside pressure toward the $0.18 zone.

- Traders identify continued divergence between rising volume and flat price as a key accumulation signal — often a precursor to volatility expansion within 24–48 hours.

More For You

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

By Shaurya Malwa|Edited by Omkar Godbole

3 hours ago

October is on track to deliver the least gains for investors since 2015, despite being a seasonally bullish month.

What to know:

- Bitcoin remained stable around $109,000, continuing a pattern of low volatility after significant liquidations last weekend.

- Ether and other major cryptocurrencies like solana, XRP, cardano showed little movement, reflecting a broader market pause.

- Traders are cautious amid uncertain macroeconomic cues and the upcoming Federal Reserve meeting, with many waiting for a significant market shift.