BTC

$108,375.98

–

0.63%

ETH

$2,551.19

–

1.05%

USDT

$1.0000

–

0.01%

XRP

$2.2593

–

0.49%

BNB

$660.09

–

0.39%

SOL

$149.06

–

2.17%

USDC

$0.9999

+

0.00%

TRX

$0.2870

–

0.10%

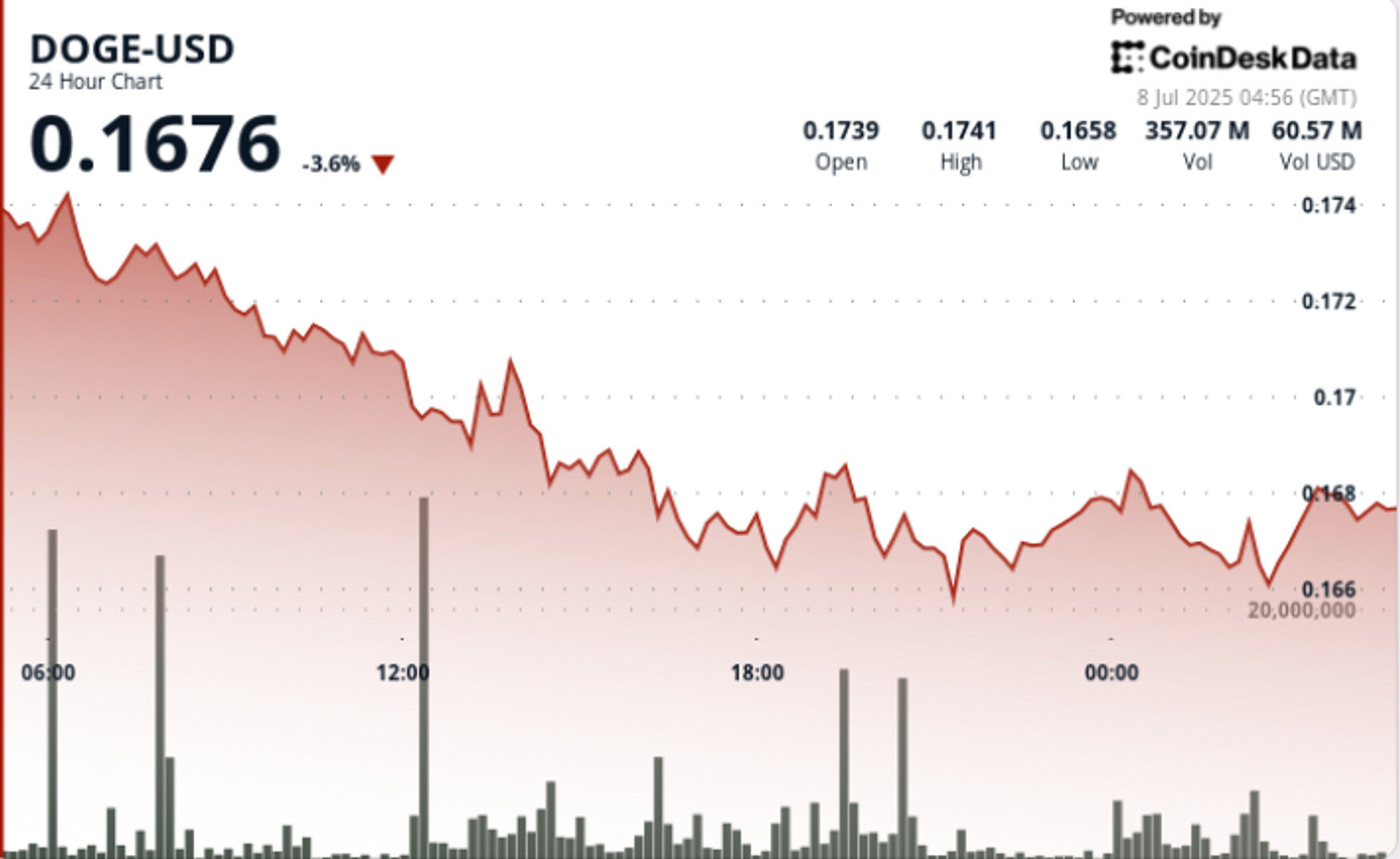

DOGE

$0.1676

–

3.14%

ADA

$0.5753

–

2.46%

HYPE

$37.79

–

5.38%

SUI

$2.8649

–

1.93%

BCH

$497.44

+

0.43%

WBT

$44.90

+

0.60%

LINK

$13.31

–

2.31%

LEO

$9.0455

+

0.05%

XLM

$0.2488

–

0.47%

AVAX

$17.81

–

2.63%

SHIB

$0.0₄1175

–

0.40%

TON

$2.7567

–

2.12%

Updated Jul 8, 2025, 6:48 a.m. Published Jul 8, 2025, 6:48 a.m.

- Dogecoin has stabilized near $0.17 after a 4.6% decline, with strong support forming at the $0.166–$0.167 zone.

- Despite recent weakness, large wallet accumulation and easing macro headwinds suggest potential bullish continuation if resistance at $0.18, $0.21, and $0.36 is broken.

- Elon Musk’s announcement of The American Party has reignited interest in Dogecoin, particularly among large holders, as whale accumulation is up 112% over the past week.

Dogecoin has stabilized near $0.17 after a 4.6% decline, with strong support forming at the $0.166–$0.167 zone.

Despite recent weakness, the surge in large wallet accumulation and easing macro headwinds point to potential bullish continuation if price can break through technical resistance zones at $0.18, $0.21, and $0.36.

- The cryptocurrency market is navigating a tense macro backdrop as escalating trade disputes and shifting central bank policies weigh on risk assets.

- The temporary extension of the U.S. “Liberation Day” tariff pause to August 1 has offered some relief, while major banks now anticipate Federal Reserve rate cuts between 0.25% and 1% starting as early as July.

- Meanwhile, Elon Musk’s surprise announcement of The American Party —a political platform rumored to incorporate blockchain-powered finance —has reignited interest in Dogecoin, particularly among large holders.

- Whale accumulation of DOGE is up 112% over the past week, even as retail interest declines.

- Analysts believe the asset is coiling within a multi-year cup-and-handle pattern that, if confirmed, could target levels as high as $0.75.

- For now, DOGE remains pinned beneath resistance but is showing early signs of bullish reaccumulation at key support.

- From 7 July 05:00 to 8 July 04:00, DOGE fell from $0.174 to a low of $0.166, marking a 4.6% decline over the 24-hour period.

- Strong volume-supported support emerged between $0.166–$0.167 during the 13:00 and 16:00 hours on 7 July.

- Price stabilized and modestly recovered to $0.168 in the final hours, with decreasing volatility signaling potential trend exhaustion.

- Between 8 July 03:38 and 04:37, DOGE exhibited a strong hourly recovery from $0.1672 to $0.1680, with a key breakout at 04:29–04:31 supported by 4.1M volume.

- A higher low formed at $0.1679, suggesting a potential shift in momentum and a foundation for short-term bullish continuation.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

“AI Boost” indicates a generative text tool, typically an AI chatbot, contributed to the article. In each and every case, the article was edited, fact-checked and published by a human. Read more about CoinDesk’s AI Policy.