BTC

$82,018.05

–

0.01%

ETH

$1,559.10

–

2.76%

USDT

$0.9994

–

0.03%

XRP

$2.0195

+

0.18%

BNB

$581.08

+

0.34%

SOL

$117.69

+

2.22%

USDC

$0.9999

+

0.01%

DOGE

$0.1580

+

0.68%

ADA

$0.6297

+

0.37%

TRX

$0.2376

–

1.32%

LEO

$9.4353

+

0.39%

LINK

$12.45

+

0.15%

AVAX

$18.65

+

2.91%

HBAR

$0.1734

+

1.61%

XLM

$0.2370

+

0.51%

TON

$2.9316

–

2.24%

SUI

$2.1929

+

1.76%

SHIB

$0.0₄1201

–

0.73%

OM

$6.4629

–

3.73%

BCH

$301.51

+

1.63%

By James Van Straten, Omkar Godbole|Edited by Parikshit Mishra

Apr 11, 2025, 9:27 a.m.

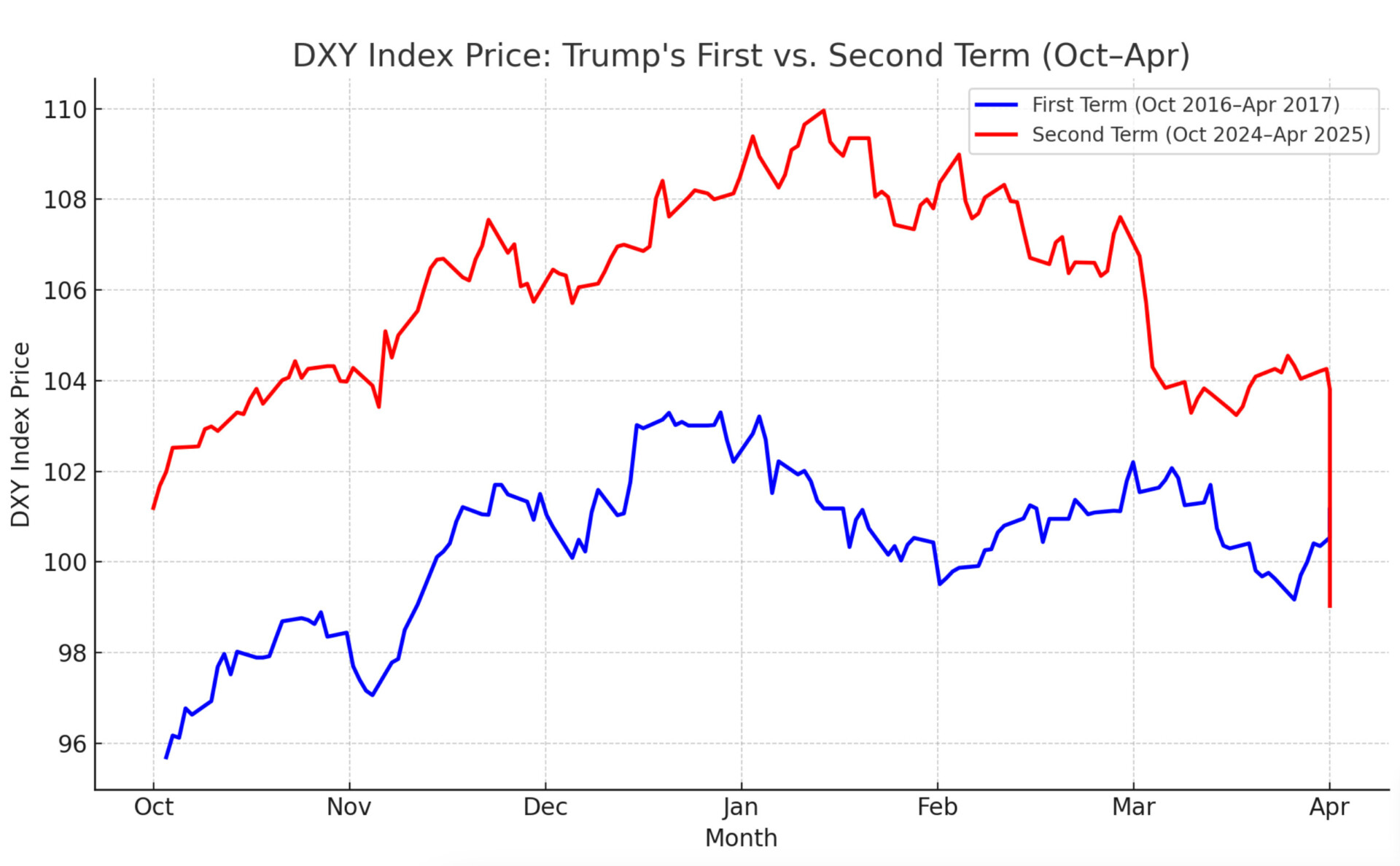

- The DXY Index has dropped below levels seen at the same point during Trump’s first term.

- Market participants continue to move away from U.S. assets, causing the U.S. dollar to weaken amid escalating trade tensions with China.

- China has increased tariffs on U.S. goods to a cumulative 125%, intensifying the trade war.

The Dollar index (DXY), which measures the strength of the U.S. dollar against a basket of other currencies, has dropped below the 100 mark for the first time since April 2022.

In January, research from CoinDesk noted that the DXY index was mirroring the pattern seen during President Trump’s first term — and it now appears to have done just that. The index has fallen over 10% from its recent high of 110 and is now at its lowest level in three years.

STORY CONTINUES BELOW

Investor sentiment continues to shift away from U.S. assets, putting further downward pressure on the dollar, as trade tensions between the U.S. and China intensify.

Just before press time, China announced an increase in tariffs on U.S. goods, raising the total levy to 125% from 84%, signaling a firm stance in the ongoing trade dispute.

Meanwhile, bitcoin (BTC), which has recently behaved as a low-beta asset compared to equities, remains resilient and continues to trade above $81,000.

James Van Straten is a Senior Analyst at CoinDesk, specializing in Bitcoin and its interplay with the macroeconomic environment. Previously, James worked as a Research Analyst at Saidler & Co., a Swiss hedge fund, where he developed expertise in on-chain analytics. His work focuses on monitoring flows to analyze Bitcoin’s role within the broader financial system.

In addition to his professional endeavors, James serves as an advisor to Coinsilium, a UK publicly traded company, where he provides guidance on their Bitcoin treasury strategy. He also holds investments in Bitcoin, MicroStrategy (MSTR), and Semler Scientific (SMLR).

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team based in Mumbai, holds a masters degree in Finance and a Chartered Market Technician (CMT) member. Omkar previously worked at FXStreet, writing research on currency markets and as fundamental analyst at currency and commodities desk at Mumbai-based brokerage houses. Omkar holds small amounts of bitcoin, ether, BitTorrent, tron and dot.