By CD Analytics, Will Canny|Edited by Nikhilesh De

Oct 7, 2025, 3:27 p.m.

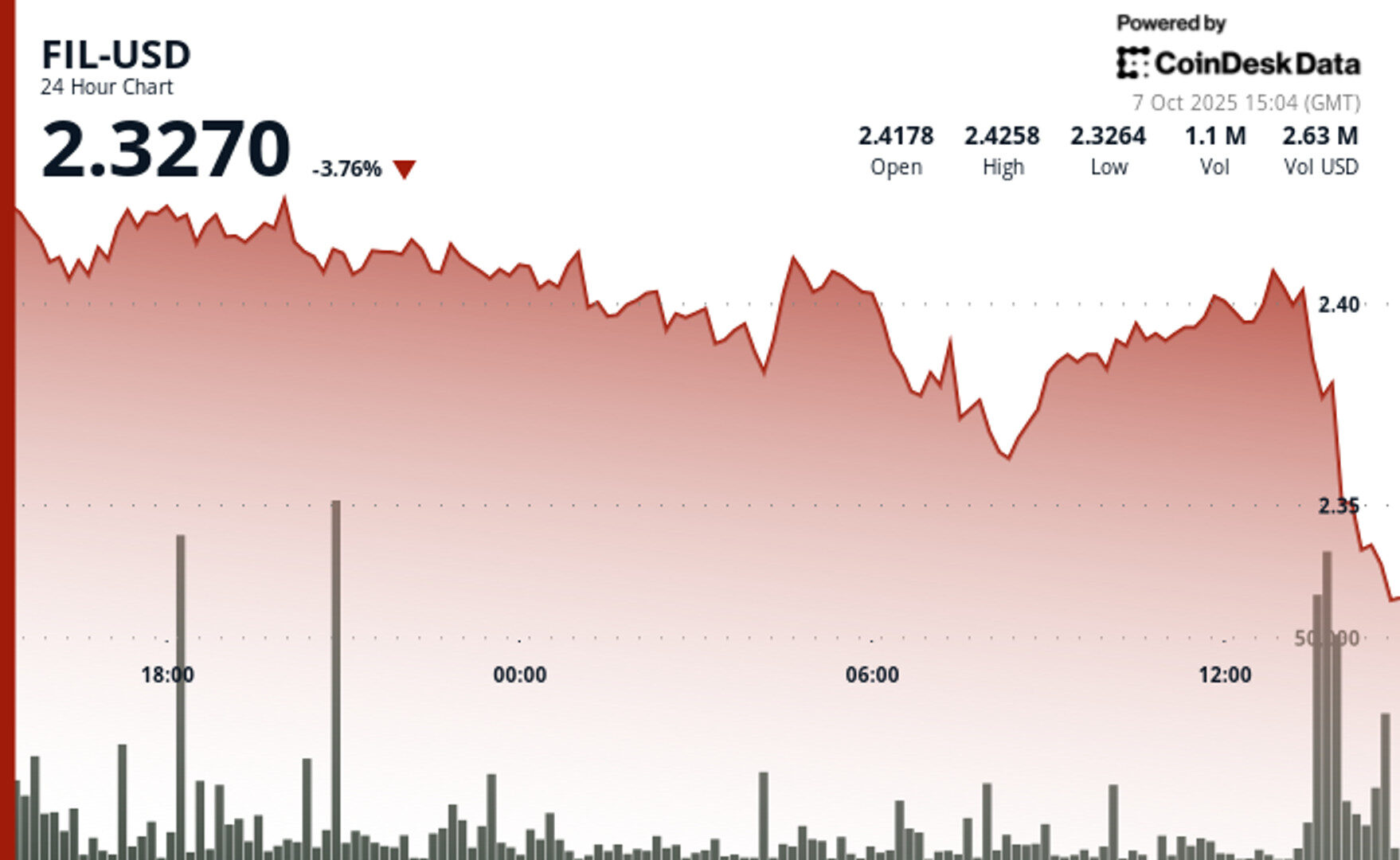

- FIL slipped 4% amid a broader decline in crypto markets.

- The token broke through many support levels as selling pressure intensified.

FIL$2.3400 confronted intense selling pressure as the token penetrated multiple support thresholds at $2.39, $2.37, and $2.36 amid exceptionally robust trading volumes on Tuesday morning during the U.S. trading session, according to CoinDesk Research’s technical analysis model.

The model showed the decentralized storage network’s native cryptocurrency experienced its most severe contraction during the last trading hour, with panic selling evident as volume reached 530,000 within a singular minute.

STORY CONTINUES BELOW

The token breached key support levels amid institutional liquidation and elevated-volume selloff, according to the model.

The last week saw core protocol updates, new AI initiatives and ongoing preparations for FIL Dev Summit 7, the network said in a post on X.

In recent trading, Filecoin was 4.4% lower, around $2.31.

The wider crypto market also declined, with the broad market gauge, the CoinDesk 20, down 3.4%

- Resistance levels at $2.41-$2.42 maintained firmness during early trading sessions before subsequent breakdown.

- Multiple support thresholds breached at $2.39, $2.37, and $2.36 indicating technical vulnerability.

- Volume surge to 5.67 million during selloff confirms institutional liquidation patterns.

- Single-minute volume peak of 530,000 suggests panic selling and capitulation.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Sep 9, 2025

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

By Krisztian Sandor, Helene Braun|Edited by Stephen Alpher

4 minutes ago

What to know:

- Bitcoin pulled back to $122,000, reversing 3% from record highs, while major altcoins XRP, DOGE, ADA plunged 4%-5%.

- Analysts warned that several metrics point to the crypto rally getting overheated in the short-term.

- Past week’s BTC inflows and derivatives activity was the year’s highest, laying the ground for a potential shakeout, a K33 analyst said.