Filecoin (FIL) falls on above-average volume, drops below $1.30 support amid wider slide

By Will Canny, CD Analytics|Edited by Sheldon Reback

Dec 16, 2025, 12:56 p.m.

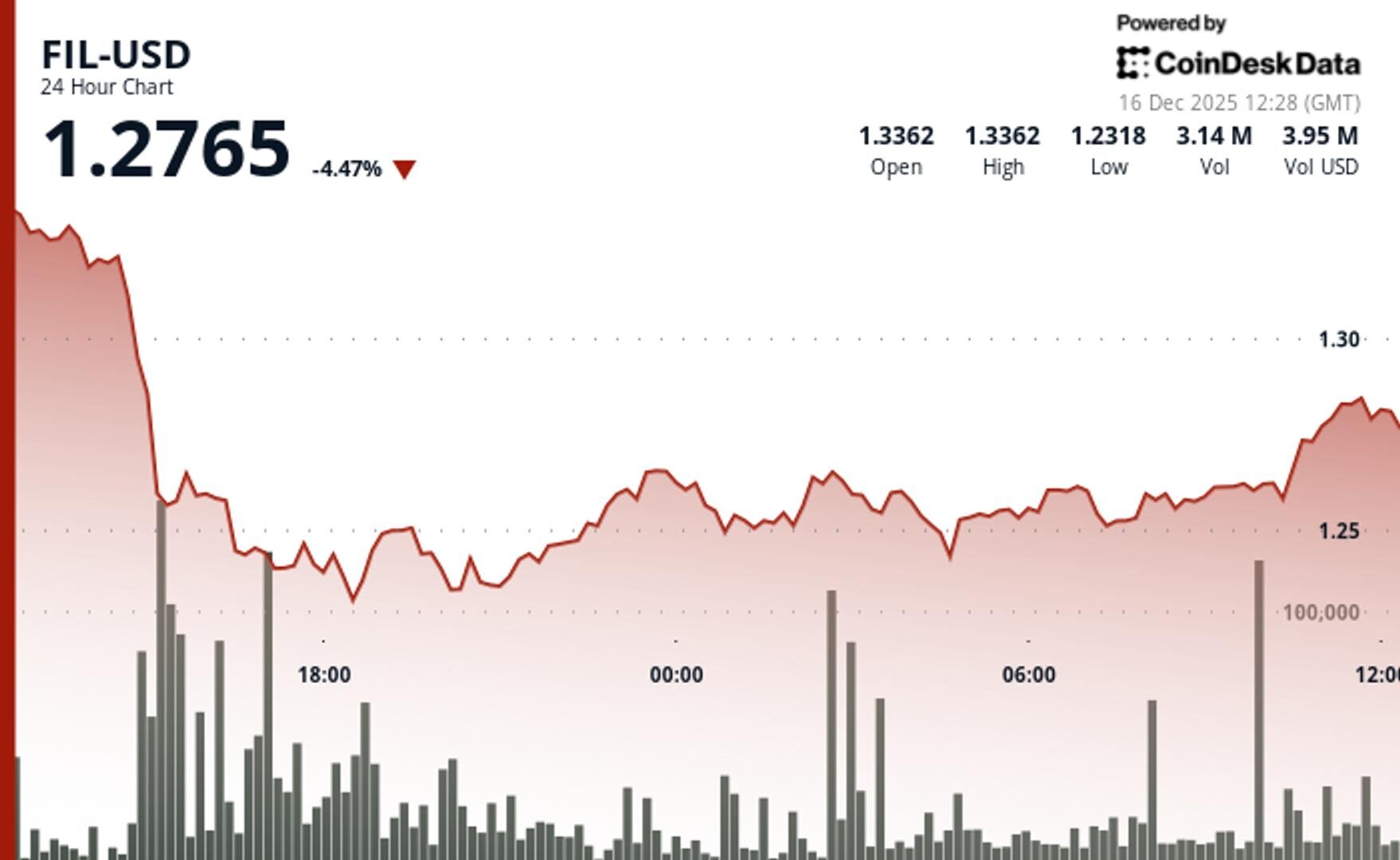

- FIL slid 4% to as low as $1.23 over 24 hours before staging a recovery.

- Volume surged 185% above average during the key breakdown below $1.30 support.

Filecoin FIL$1.2690 fell 4.2% to $1.28 on Tuesday amid significant volatility as traders drove sharp reversals during a broader market decline, according to CoinDesk Research’s technical analysis model.

The model showed that the decentralized storage token established a bearish price trend with $0.08 range representing 6.3% volatility.

STORY CONTINUES BELOW

Volume was 12.75% above the seven-day average, according to the model. The peak of 11.7 million tokens was 85% above the 24-hour average of 2.81 million.

The spike confirmed the token’s breakdown below the psychological $1.30 support price, the model said.

Wider crypto markets also fell. The CoinDesk 20 index was 3.7% lower at publication time.

Technical Analysis:

- Primary support sits at $1.278 with resistance capping advances near $1.285, creating a tight $0.007 trading range

- The 185% volume surge during $1.30 breakdown confirmed institutional participation while normalized late-session activity suggests a consolidation phase, according to the model.

- Classic support-resistance dynamics emerged with swift capitulation followed by an immediate recovery bounce indicating buyer interest at lower levels

- Near-term range bound between $1.278-$1.285 with broader 24-hour bearish trend intact until reclaim of $1.30 psychological level

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By James Van Straten|Edited by Sheldon Reback

1 hour ago

Monday once again emerges as a pressure point for bitcoin, aligning ETF outflows with recurring bitcoin lows.

What to know:

- U.S. spot bitcoin and ether ETFs recorded the largest net outflows since Nov. 20.

- Monday has been a consistent pressure point for bitcoin this year, with several major local lows occurring on that day, and Velo data showing Monday as the third-worst performing day over the past 12 months.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language