BTC

$109,721.06

+

0.71%

ETH

$2,863.86

+

4.98%

USDT

$0.9999

–

0.02%

XRP

$2.3260

+

2.04%

BNB

$669.43

+

1.27%

SOL

$167.19

+

5.73%

USDC

$0.9996

–

0.01%

DOGE

$0.2032

+

6.27%

TRX

$0.2894

–

0.84%

ADA

$0.7254

+

4.32%

HYPE

$43.54

+

8.54%

SUI

$3.5117

+

1.86%

LINK

$15.61

+

3.46%

AVAX

$22.57

+

3.01%

BCH

$444.35

+

3.55%

XLM

$0.2825

+

2.40%

LEO

$9.0230

+

1.57%

TON

$3.2933

–

0.91%

SHIB

$0.0₄1358

+

4.49%

HBAR

$0.1795

+

0.04%

By CD Analytics, Will Canny|Edited by Sheldon Reback

Jun 11, 2025, 3:33 p.m.

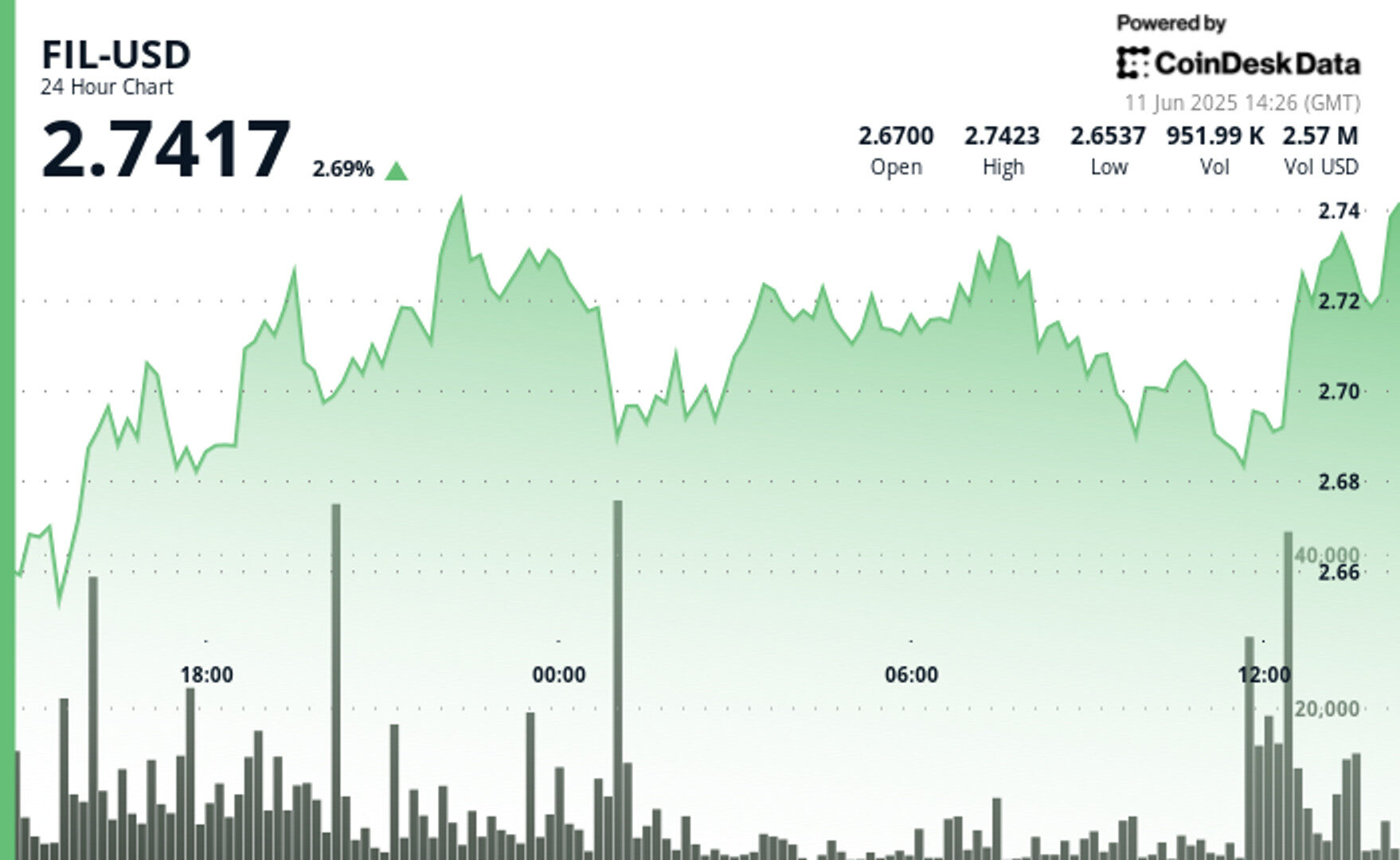

- Filecoin rallied after establishing a support zone at $2.68-$2.69.

- The token is 3.6% higher, trading around $2.755.

Filecoin

has established a higher trading range amid significant market volatility, with multiple price bounces confirming support levels around $2.68-$2.69, according to CoinDesk Research’s technical analysis model.

The token is currently 3.6% higher over 24 hours, trading around $2.755.

STORY CONTINUES BELOW

The price action comes as ether

whales return to the market, potentially signaling the start of renewed interest in alternative cryptocurrencies.

The broader market gauge, the CoinDesk 20, was 0.8% higher at publication time.

Technical Analysis:

- FIL-USD demonstrated resilient price action over the 24-hour period, establishing a trading range of 2.642-2.735 (3.52% range).

- Notable support at 2.680-2.690 confirmed by multiple bounces.

- The 12:00 hour marked a pivotal moment with exceptional volume (4.12M), more than double the period average.

- Bullish momentum maintained through subsequent hours, with price consolidating above 2.710.

- In the last hour, FIL-USD exhibited notable volatility with a significant price swing, reaching a peak of 2.735 at 13:28 before dropping to 2.713 by 13:32.

- The slip coincided with the highest volume spike of the period (104,483 units), suggesting strong selling pressure at resistance levels.

- Asset has since established a consolidation pattern between 2.718-2.722, with multiple tests of support around 2.718 showing buyer interest.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

Will Canny is an experienced market reporter with a demonstrated history of working in the financial services industry. He’s now covering the crypto beat as a finance reporter at CoinDesk. He owns more than $1,000 of SOL.