Filecoin Trades Little Changed, Underperforms Wider Crypto Markets

By Will Canny, CD Analytics|Edited by Cheyenne Ligon

Dec 12, 2025, 2:20 p.m.

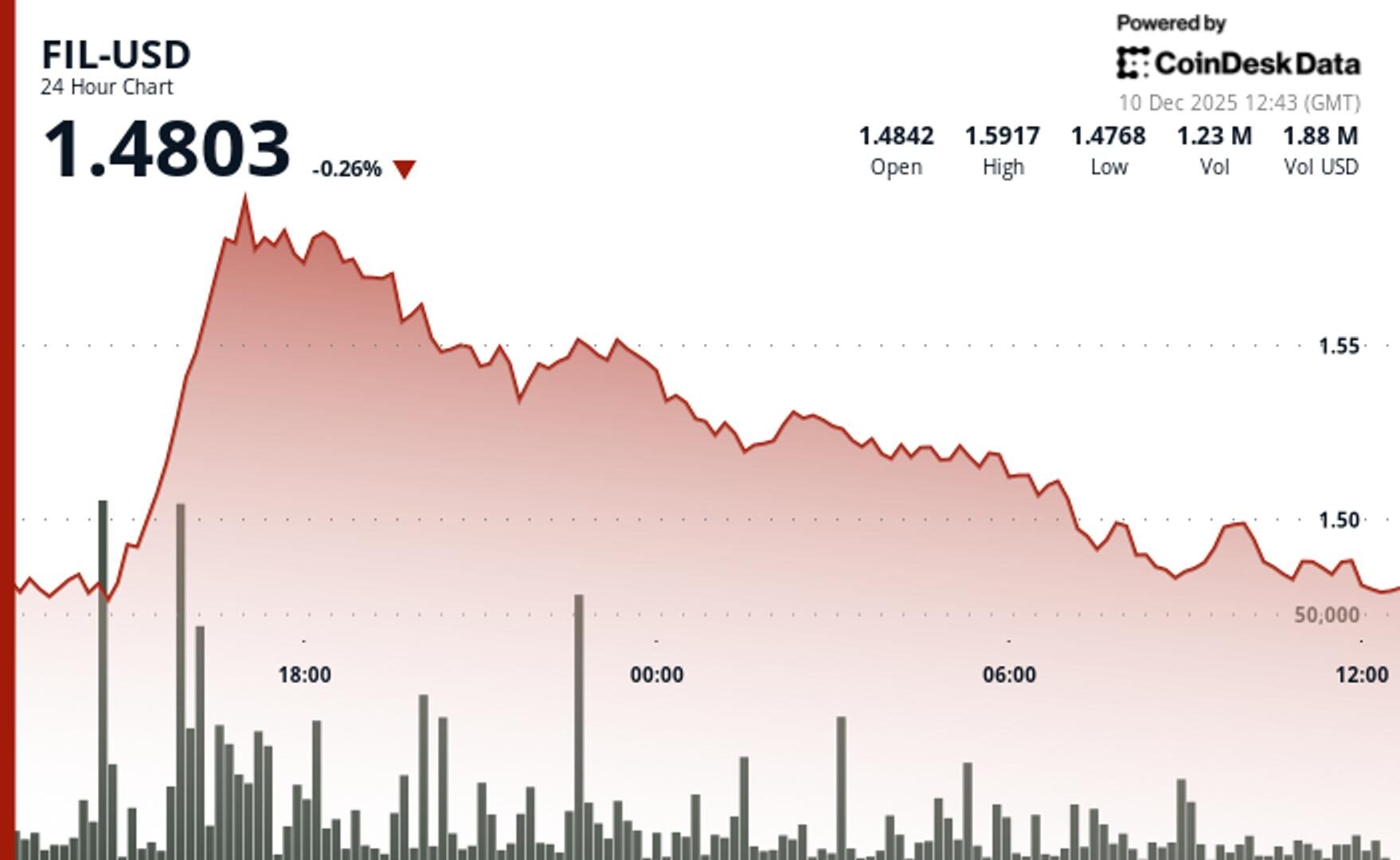

- Filecoin slipped 0.2% to $1.37 over the last 24 hours.

- Trading volume was 29% above weekly averages as institutional flows accelerated.

Filecoin dropped 0.2% to $1.37 over the last 24 hours as the token underperformed the wider crypto markets.

The broader market gauge, the CoinDesk 20 index, was 3% higher at publication time.

STORY CONTINUES BELOW

FIL trading activity jumped 29% above the seven-day average, signaling heightened institutional interest, according to CoinDesk Research’s technical analysis model.

The elevated volumes suggested smart money repositioning, with buyers stepping in at key technical levels, the model showed.

Filecoin traded to a session high of $1.397 before distribution pressure mounted during the last hour, according to the model.

The move established new short-term resistance near $1.40 and support at $1.36.

- Resistance formed at $1.40 session high

- Trading activity peaked at 5.9 million tokens during the 21:00 hour on Dec. 11, 68% above 24-hour averages.

- Final hour distribution pressure generated 642,087 tokens in volume during the breakdown sequence.

- Higher lows at $1.3577 and $1.3661 suggested underlying accumulation despite sector headwinds.

- Immediate upside targets at $1.3975 resistance and $1.40 psychological level.

- Downside risk extended to $1.39 session open, with major support zone beginning near $1.36 from the previous consolidation low.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By Will Canny, AI Boost|Edited by Cheyenne Ligon

10 minutes ago

German payments processor DECTA expects euro-pegged stablecoins to gain traction in payments and tokenized finance as MiCA takes full effect across the EU.

What to know:

- Euro stablecoins should benefit from MiCA’s full enforcement in 2026, creating a unified regime for reserves, supervision and operations, according to DECTA.

- Growth will hinge on MiCA-authorized issuers scaling banking rails, institutional settlement use and consumer-facing payment channels.

- The payments company expects non-compliant and synthetic euro tokens to give way to regulated stablecoins, though adoption will vary across EU member states.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language