This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

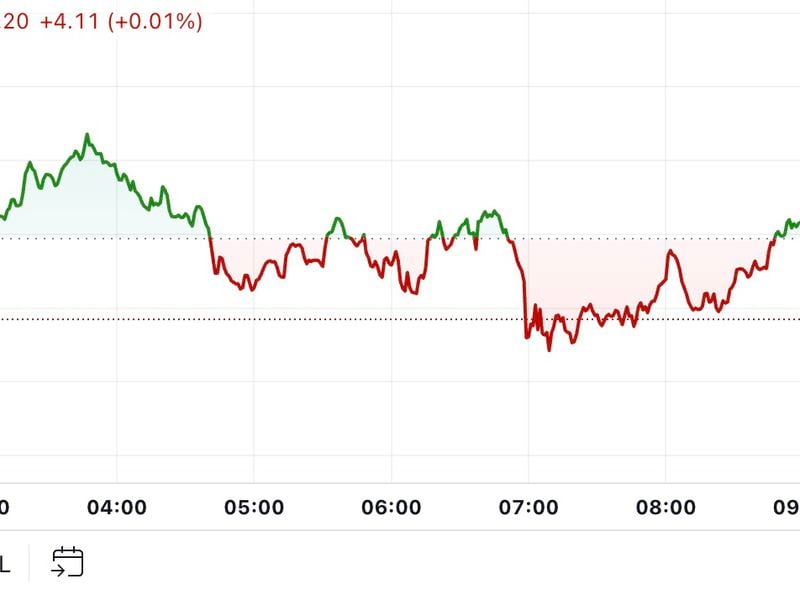

CoinDesk 20 Index: 2,039.00 -1.08%

Bitcoin (BTC): $67,083.27 -0.76%

Ether (ETH): $2,609.37 -0.27%

S&P 500: 5,842.47 +0.47%

Gold: $2,688.52 +0.54%

Nikkei 225: 38,911.19 -0.69%

Bitcoin pulled back to $67,000 throughout the Asian and European mornings, showing signs of a consolidation following Wednesday’s jump above $68,000. BTC was about 0.7% lower in the last 24 hours as of the late European morning, trading just above $67,000. Other major tokens showed similar minor retracements, with the broader digital asset market dipping 1%, as measured by the CoinDesk 20 Index. For the time being, bitcoin appears to have avoided an outright rejection following its move above $68,000 on Wednesday and is instead taking a breather, as traders wait for the next catalyst.

Donald Trump’s lead over Kamala Harris in the prediction markets has spread beyond Polymarket to Kalshi, which is now also showing strong momentum for the Republican candidate. Trump is currently leading against Harris 56-44 on Kalshi, with a surge occurring in early October. The rise in Trump’s odds on Kalshi isn’t an entirely unexpected event, Jack Such, a market research analyst at Kalshi, wrote in a note Wednesday. “Harris is falling in key demographics and has lost ground in every “Blue Wall” state over the past three weeks,” Such wrote. Trump’s lead on Polymarket has spread to 20 points, with traders seeing a 60% chance of him returning to the White House in 2025.

A growing number of Asia-based private wealth managers are entering the crypto market, with some forecasting bitcoin will hit $100,000 by year’s end, according to a report by digital asset technology platform Aspen Digital. Digital assets have emerged as an alternative investment class for private wealth in Asia, with 76% of family offices and high-net-worth individuals investing in cryptocurrencies and 16% planning to do so in the future. That’s a notable improvement from the previous study in 2022, when 58% had exposure to digital assets and 34% planned to invest. Most respondents cited higher returns as a primary driver, with an increasing number of respondents citing diversification and inflation hedge appeal as key motivations to invest in digital assets, the report shared with CoinDesk said.

The chart shows top blockchains by the total dollar value of cryptocurrencies bridged in the past four weeks.

Ethereum leads the way, followed by Coinbase’s layer 2 Base, which has seen significantly higher activity than its rival Arbitrum.

Source: Artemis

– Omkar Godbole