This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

CoinDesk 20 Index: $1,774.87 +1%

Bitcoin (BTC): $55,372.84 +1.4%

Ether (ETH): $2,319.53 +0.63%

S&P 500: 5,408.42 −1.73%

Gold: $2,494.24 −0.11%

Nikkei 225: 36,215.75 −0.48%

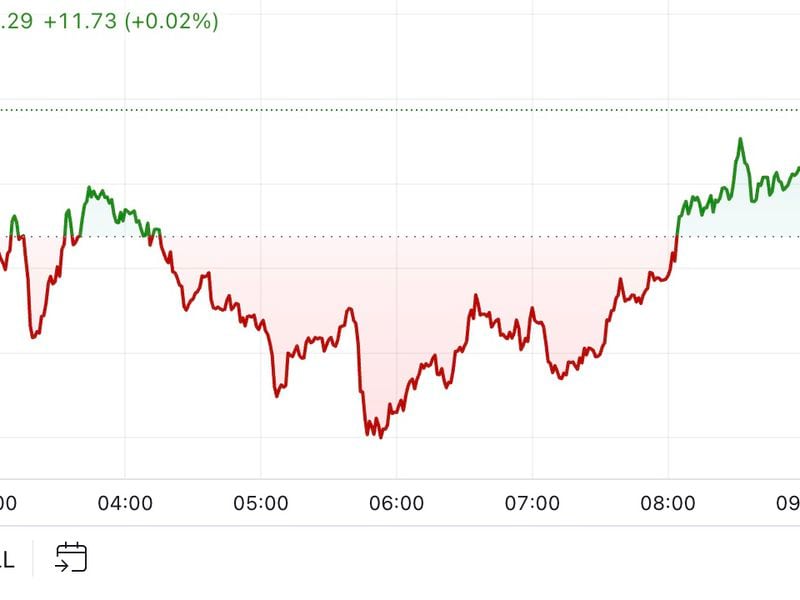

Bitcoin nudged above $55,000 during the European morning after holding between $54,000 and $55,000 over the weekend. It has added 1.45% in the last 24 hours while the broader crypto market has risen 1.15%, as measured by the CoinDesk 20 Index. This week, traders will be eyeing the U.S. release of August’s CPI and PPI data on Wednesday and Thursday respectively. Before then, on Tuesday, Donald Trump goes head to head with Kamala Harris in the first debate between the presidential candidates ahead of November’s election. Trump has said he aims to make the U.S. the “crypto capital” of the world, and Harris aides are also reportedly considering policies to bolster the industry.

A Trump victory in November could see bitcoin surge to an all-time high of $90,000, broker Bernstein said in a research report. A Harris victory, on the other hand, could see it test the $30,000-$40,000 range. Bernstein noted Trump’s vocal support for BTC, wishing to make the U.S. the “bitcoin and crypto capital of the world,” and having mentioned cryptocurrency in every policy speech he has made. “After the last three years of regulatory purge, a positive crypto regulatory policy can spur innovation again and bring the users back to financial products on the blockchain,” analysts led by Gautam Chhugani wrote. “Elections remain hard to call, but if you are long crypto here, you are likely taking a Trump trade,” the report added.

BTC is “grossly undervalued,” due to the market overlooking Bitcoin’s network security, according to trading firm Presto Research. Bitcoin’s hashrate, a measure of the computational power that secures the network, has hit an all-time high of 679 EH/s, the firm said in a note. “If you believe that trend will continue (in fact, the availability of spot ETF means we are in a much better setup than ever before), BTC seems grossly undervalued at the moment,” analysts Peter Chung and Min Jung said. Bitcoin miners are expanding their capacity again since August amid all-time highs in hashrate, which has typically marked price bottoms for the asset. Elsewhere, some traders said lower-than-expected U.S. payroll figures indicated a weaker labor market, while the lower unemployment figure has lessened the concerns of an imminent recession.

The FedWatch tool uses prices for the fed funds futures to predict the size of Fed interest-rate cuts on Sept. 18.

Traders currently assign less than a 30% probability to the Fed cutting rates by 50 basis points next week.

Source: CME’s FedWatch

– Omkar Godbole