This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

CoinDesk 20 Index: 1,891 −1.6%

Bitcoin (BTC): $59,574 −0.6%

Ether (ETH): $2,516 −1.5%

S&P 500: 5,591.96 −0.0%

Gold: $2,553 +1.1%

Nikkei 225: 38,647.75 +0.74%

Crypto prices were muted as the week drew to an end, with bitcoin 0.7% lower in the last 24 hours at $59,500. The broader digital asset market, as measured by the CoinDesk 20 Index, has dropped 1.5%. Bitcoin extended its week-long slide after last week’s rally, with major exchange-traded funds (ETFs) recording net outflows amid signs of waning demand. BTC is on track to end August at an 8% haircut (with one day to go), the steepest drop since April. Overall bitcoin demand growth remains low and has even turned negative in the last few weeks.

Dogecoin is one of the few tokens to buck the trend, rising nearly 0.7%. A Manhattan judge dismissed a lawsuit that alleged Elon Musk and Tesla manipulated the price of DOGE by exploiting Musk’s social media influence and public statements. Statements cited in the suit included his claims to “become Dogecoin’s CEO,” put a “literal Dogecoin in SpaceX and fly it to the moon,” and that “Dogecoin might become the standard for the global financial system.” Judge Alvin Hellerstein said the statements were “aspirational and puffery,” not factual claims, and thus, no reasonable investor would rely on them.

Crypto startup Bridge, which wants to build a global stablecoin-based payments network, recently raised $40 million in fresh funding, taking the total raised to $58 million. The startup, which was founded by Square and Coinbase alumni Zach Abrams and Sean Yu, aims to “enable companies to use a stablecoin rail without thinking about it,” Abrams said in an interview with Fortune. Bridge, whose customers include SpaceX and Coinbase, aspires to become a Web3 version of payments processor Stripe, operating as a global payments system into which other developers can integrate seamlessly. Earlier this year, Stripe itself said it planned to add crypto payments through Circle’s USDC stablecoin.

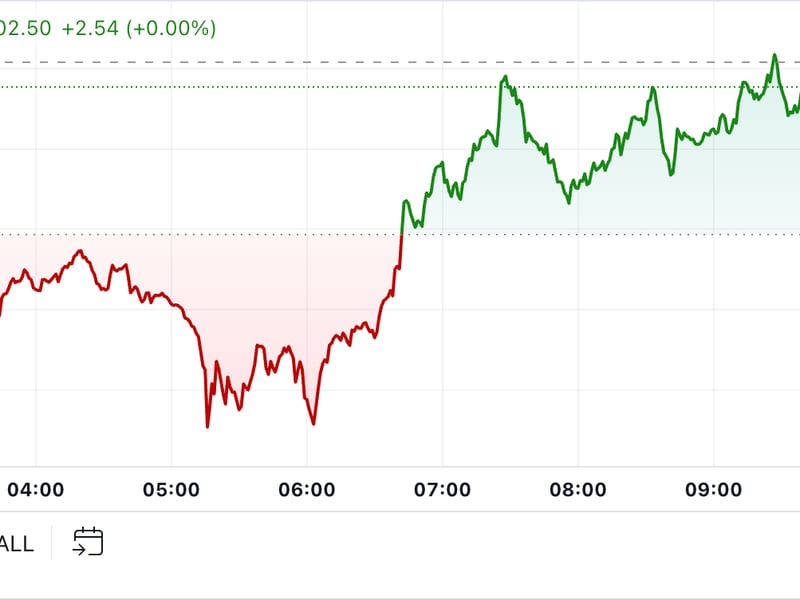

The chart shows that every single MSCI country stock index is currently above its 200-day moving average.

When this figure surpasses 90%, it can be a signal for exuberant bullishness and thereby potential correction risks.

Stock market movement can be seen as an indicator of cryptocurrency movement as the two are affected by many of the same factors.

Source: MacroMicro

– Jamie Crawley