This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

CoinDesk 20 Index: $1,773.25 −1.29%

Bitcoin (BTC): $56,000.24 −1.27%

Ether (ETH): $2,370.13 −0.8%

S&P 500: 5,503.41 −0.3%

Gold: $2,519.38 +0.09%

Nikkei 225: 36,391.47 −0.72%

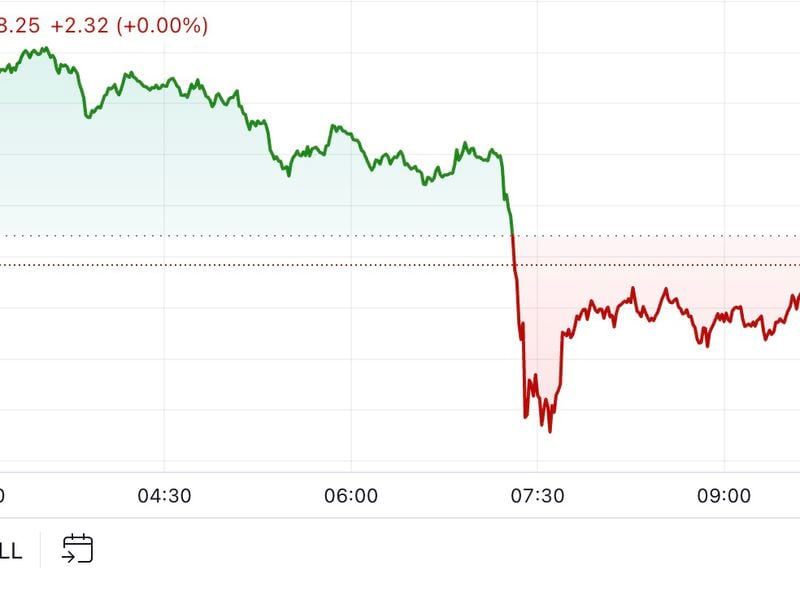

Bitcoin fell as low as $55,300 before recovering to trade around $56,100, down 1% in 24 hours and extending its seven-day loss to over 5%. The broader digital asset market as measured by the CoinDesk 20 Index (CD20) has dropped more than 1.3% over 24 hours. The U.S. government is set to release its nonfarm payrolls report for August later. If the reading is weak, as all the other economic data this week has been, it will strengthen the argument for an interest-rate cut of 50 basis points in September.

Bitcoin’s 200-day simple moving average is in danger of turning bearish as its upward momentum has slowed to a crawl for the first time since October. Since late August, the measure has averaged a daily increase of less than $50, a significant drop from the $200-plus moves seen earlier this year, according to data from charting platform TradingView. As of writing, the 200-day SMA was $63,840. The 100-day SMA recently moved below the 200-day SMA, confirming a bearish crossover. The averages signal a weakening bullish sentiment and growing caution consistent with the increasing macroeconomic uncertainty.

At the end of August, the crypto market had dropped 24% from its March peak to $2.02 trillion, JPMorgan said in a research report. The bank highlighted the lack of major catalysts to support crypto assets in the face of challenging macroeconomic factors. Spot ether and bitcoin ETF flows were “somewhat uninspiring,” JPMorgan said, adding that many viewed the launch of ETH ETFs as disappointing when compared with the bitcoin versions in January. Spot bitcoin ETF flows also disappointed, recording net outflows of $81 million in August. The bank said it awaits the next catalyst for development and “enhanced retail engagement.”

The chart shows the number of ether held in wallets associated with centralized exchanges.

The so-called exchange balance has increased by over 263,000 ETH ($624 million) since late August, a sign of investors looking to liquidate their holdings or use coins for derivatives trading.

Source: CryptoQuant

– Omkar Godbole