Gold and silver outrun bitcoin (BTC) price as 2025’s go-to protectors of fiat money

By James Van Straten, Omkar Godbole|Edited by Sheldon Reback

Dec 30, 2025, 11:17 a.m.

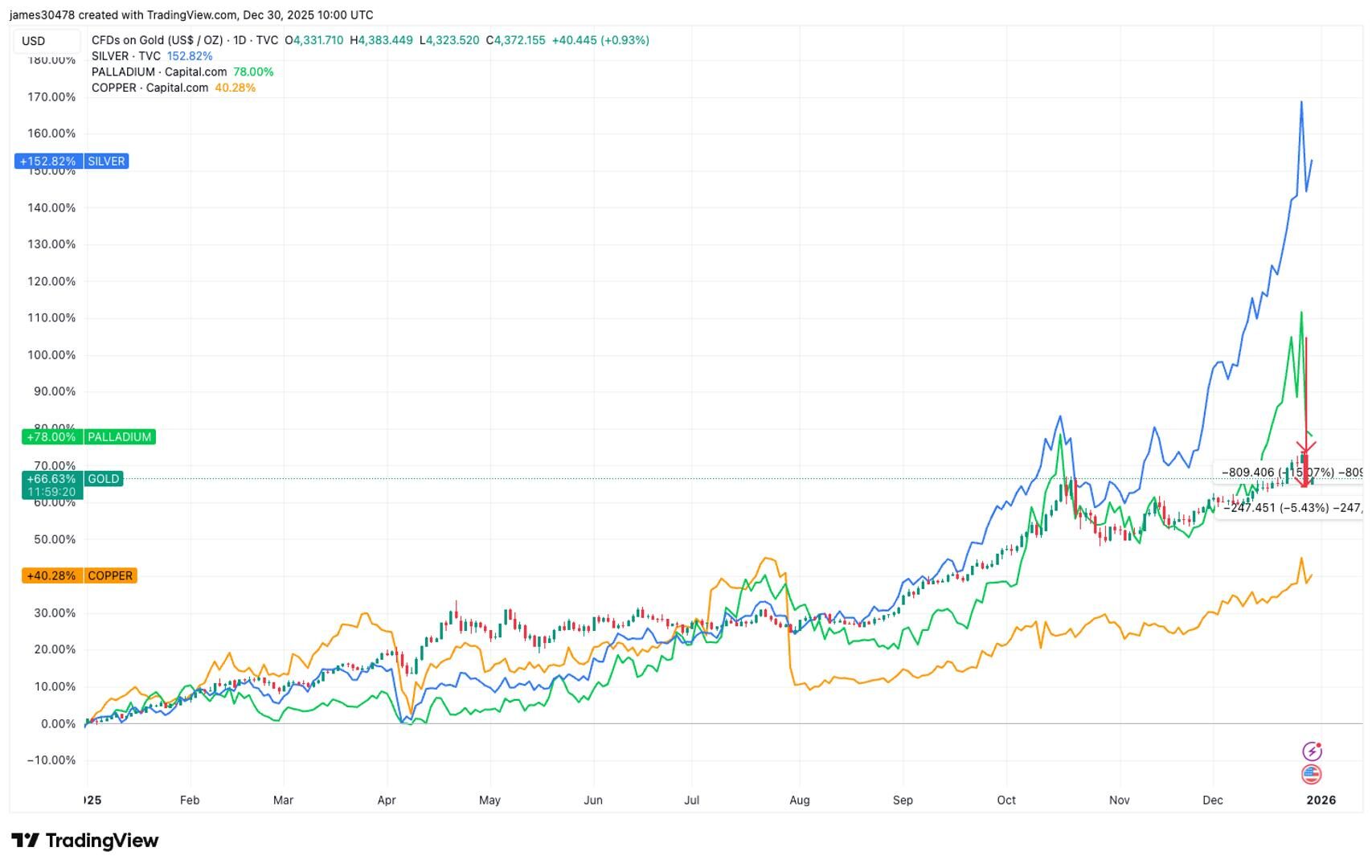

- Metals have emerged as the clear winners of the debasement trade in 2025, with gold and silver posting outsized gains while bitcoin has lagged.

- Gold’s advance has been underpinned by exceptional strength on price charts, staying above its 200-day moving average for roughly 550 trading days, the second-longest streak on record.

This year, investors decisively chose precious metals such as gold to hedge against the potential erosion of paper money value, sidelining bitcoin BTC$87,909.00.

Gold has risen almost 70% since Jan. 1 and silver about 150%, far outpacing the largest cryptocurrency, which has fallen about 6%.

STORY CONTINUES BELOW

Analysts attributed the rally to the so-called “debasement trade.” That’s an investment strategy that involves buying perceived store-of-value assets and waiting for the fiat currency to devalue, or debase. The depreciation, the result of ultra-easy monetary policies and fiscal deficit, leads to a loss of purchasing power and drives up the price of the asset.

Early this year, BTC bulls made bold predictions, citing the debasement trade as a key catalyst driving their year-end forecasts. Bitcoin’s rally, however, abruptly ran out of steam above $126,000 in early October. Since then, it has pulled back to below $90,000.

Gold’s rally has been particularly notable from the perspective of technical analysis, according to The Kobeissi Letter.

The metal has remained above its 200-day simple moving average, a widely followed long-term trend indicator that smooths price action over roughly nine months, for around 550 consecutive trading days. This marks the second-longest streak on record, trailing only the approximately 750-session stretch that followed the 2008 financial crisis.

Still, the bitcoin bulls aren’t phased. Crypto analysts expect the cryptocurrency to catch up with gold next year, living up to its tendency to rally with a lag.

“Gold has been leading BTC by roughly 26 weeks, and its consolidation last summer matches Bitcoin’s pause today,” Lewis Harland, a portfolio manager at Re7 Capital, told CoinDesk. “The metal’s renewed strength reflects a market increasingly pricing in further currency debasement and fiscal strain into 2026, a backdrop that has consistently supported both assets, with Bitcoin historically responding with greater torque.”

The predictions market seems aligned with that view. As of writing, traders on Polymarket assigned a 40% probability of BTC being the best-performing asset next year, with gold at 33% and equities at 25%.

More For You

Dec 19, 2025

L1 tokens broadly underperformed in 2025 despite a backdrop of regulatory and institutional wins. Explore the key trends defining ten major blockchains below.

What to know:

2025 was defined by a stark divergence: structural progress collided with stagnant price action. Institutional milestones were reached and TVL increased across most major ecosystems, yet the majority of large-cap Layer-1 tokens finished the year with negative or flat returns.

This report analyzes the structural decoupling between network usage and token performance. We examine 10 major blockchain ecosystems, exploring protocol versus application revenues, key ecosystem narratives, mechanics driving institutional adoption, and the trends to watch as we head into 2026.

More For You

By James Van Straten|Edited by Jamie Crawley

13 minutes ago

During this current correction, long term holders have sold over 1 million BTC, the largest sell pressure event from this cohort since 2019.

What to know:

- Long-term holders have recorded a positive 30-day net position change, accumulating around 33,000 BTC as recent buyers mature into holders.

- During this current correction, long term holders have sold over 1 million BTC, the largest sell pressure event from this cohort since 2019.

- This marked the third major wave of long term holder selling this cycle, following distribution in March and November 2024.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language