-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Omkar Godbole, AI Boost|Edited by Sheldon Reback

Aug 21, 2025, 8:21 a.m.

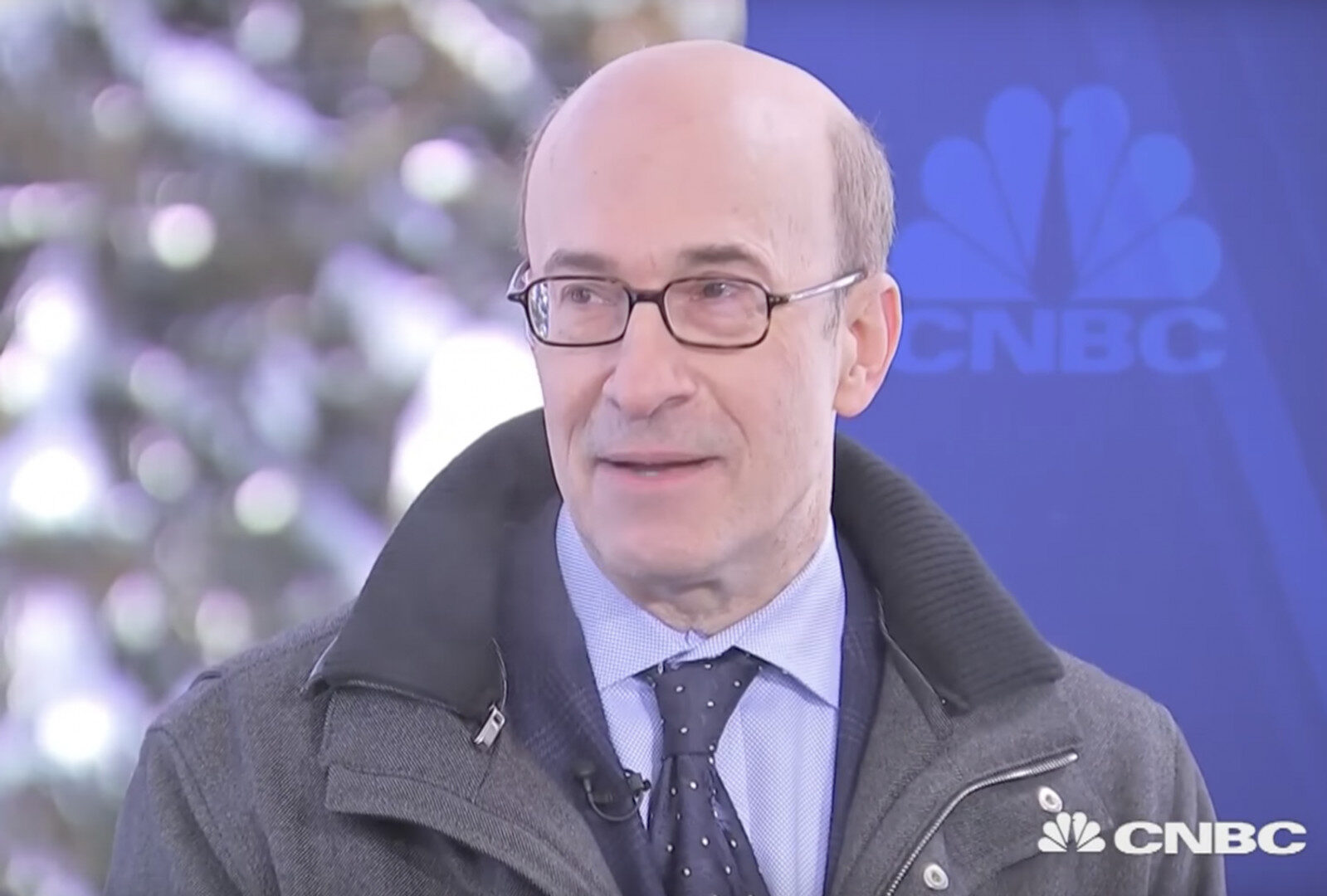

- Kenneth Rogoff, an economics professor at Harvard, predicted in 2018 that bitcoin would be worth $100 rather than $100,000 in a decade.

- Bitcoin’s price has surpassed $100,000, contrary to Rogoff’s initial prediction.

- Rogoff says he underestimated BTC’s role in the underground economy and overestimated regulators’ ability to restrain its use.

In 2018, Kenneth S Rogoff, professor of economics at Harvard University and a former chief economist at the International Monetary Fund, predicted bitcoin

was more likely to be worth $100 than $100,000 in a decade.

In reality, bitcoin’s price rose above $100,000 this year, a 10-fold increase from March 2018’s sub-$10,000 level when Rogoff predicted the crash.

STORY CONTINUES BELOW

On Tuesday, with bitcoin hovering around $113,000, Rogoff reflected on how he had missed the mark, saying he had been “far too optimistic about the U.S. coming to its senses regarding sensible cryptocurrency regulation.”

In a post on X, Harvard economist Ken Rogoff expressed said he’d expected policymakers to adopt a firm stance to curb the use of cryptocurrencies in tax evasion and illegal activities. He was, indirectly, criticizing the regulatory environment as being less than prudent and allowing cryptocurrencies like BTC to flourish in ways he did not anticipate.

Rogoff underestimated how bitcoin would compete with fiat currencies to serve as the transaction medium of choice in the 20 trillion-dollar global underground economy.

“This demand puts a floor on its price, as I discuss at length in my new book Our Dollar, Your Problem,” Rogoff said.

He also flagged a “blatant conflict of interest,” with regulators “holding hundreds of millions (if not billions) of dollars in cryptocurrencies seemingly without consequence.”

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Omkar Godbole is a Co-Managing Editor and analyst on CoinDesk’s Markets team. He has been covering crypto options and futures, as well as macro and cross-asset activity, since 2019, leveraging his prior experience in directional and non-directional derivative strategies at brokerage firms. His extensive background also encompasses the FX markets, having served as a fundamental analyst at currency and commodities desks for Mumbai-based brokerages and FXStreet. Omkar holds small amounts of bitcoin, ether, BitTorrent, tron and dot.

Omkar holds a Master’s degree in Finance and a Chartered Market Technician (CMT) designation.

“AI Boost” indicates a generative text tool, typically an AI chatbot, contributed to the article. In each and every case, the article was edited, fact-checked and published by a human. Read more about CoinDesk’s AI Policy.

More For You

By Shaurya Malwa|Edited by Parikshit Mishra

1 hour ago

LayerZero’s $110 million token-swap offer faces competition as Wormhole pushes for a delay in Stargate’s governance vote to submit a higher bid.

What to know:

- Wormhole has entered the bidding for Stargate, proposing a bid higher than LayerZero’s $110 million offer.

- The proposal suggests delaying the vote to allow the community to consider Wormhole’s offer.

- A merger between Wormhole and Stargate could create a major cross-chain hub, enhancing liquidity and network integration.