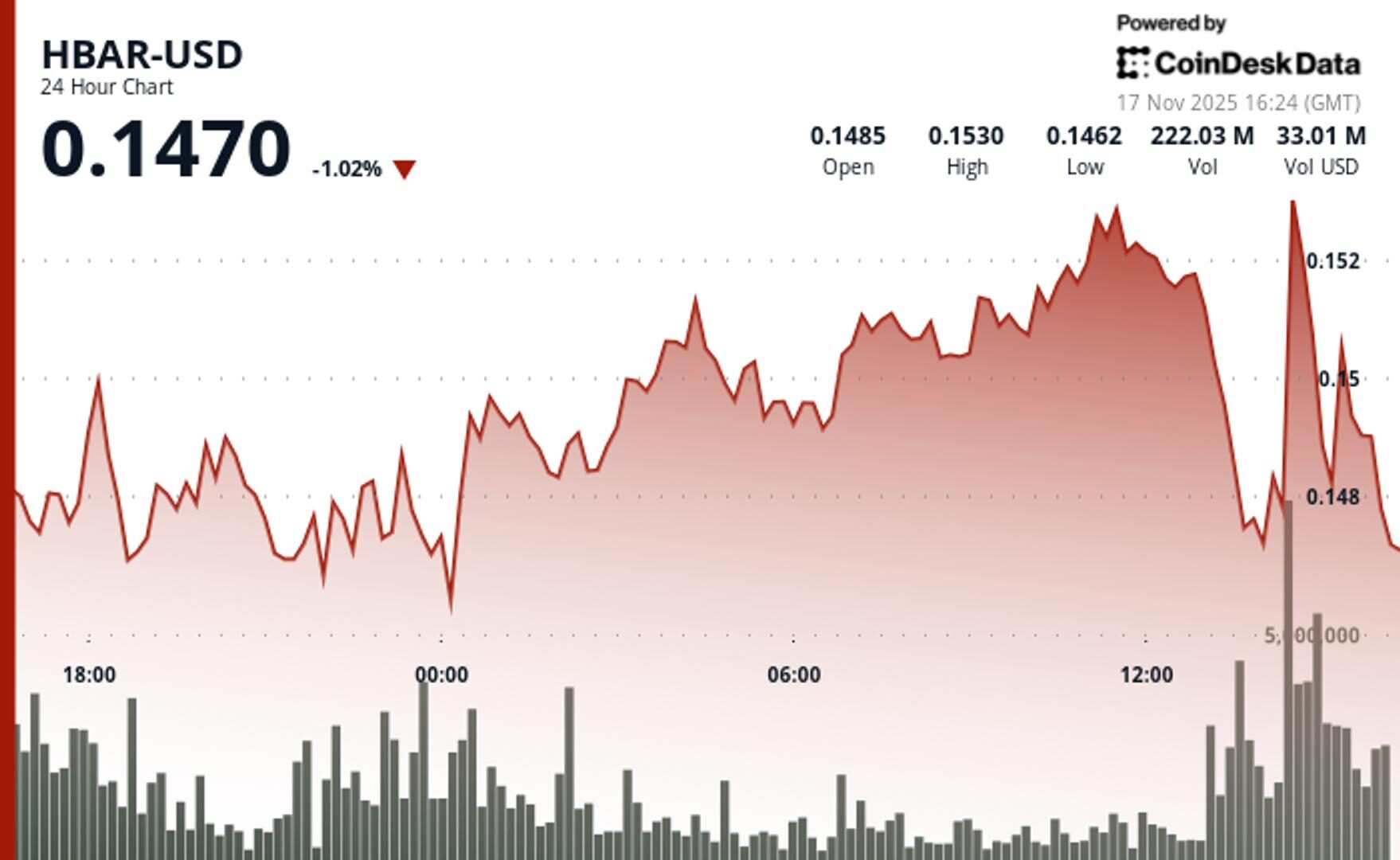

HBAR Declined 2.5% to $0.1480 Breaking Key Support Amid Volume Surge

By CD Analytics, Oliver Knight

Updated Nov 17, 2025, 4:30 p.m. Published Nov 17, 2025, 4:30 p.m.

- HBAR fell from $0.1518 to $0.1480, breaching critical support at $0.1480.

- Volume surged 180% above session averages during steepest decline phase.

- Analysis coincided with reports of WBTC integration enhancing DeFi functionality.

HBAR fell sharply on Tuesday, sliding 2.5% from $0.1518 to $0.1480 after breaking below a key support level that triggered a wave of fresh selling. The move followed a spike in trading activity late on Nov. 16, when 168.9 million tokens changed hands — a 94% jump above average — signaling heavy institutional distribution.

Short-term charts show the decline accelerating, with HBAR dropping another 2.2% to $0.1472 as volume surged 180% above normal. A series of lower highs carved out a clear descending channel, reinforcing the bearish technical picture traders used to time short setups.

STORY CONTINUES BELOW

The sell-off came despite renewed optimism around Hedera’s planned Wrapped Bitcoin integration, which aims to expand the network’s DeFi capabilities heading into 2025. For now, however, technicals remain in control, and support at $0.1457 has become the crucial level for bulls attempting to stabilize price action.

Support/Resistance Analysis:

- Primary support established at $0.1457 following volume surge rejection.

- Resistance remained intact near $0.1488 after sharp rejection on elevated volume.

- Descending channel pattern confirmed with lower highs sequence.

Volume Analysis:

- Peak volume of 168.9M tokens (94% above 24-hour SMA) marked key reversal point.

- 60-minute selling pressure peaked at 6.2M tokens during steepest decline phase.

- Distribution pattern confirmed by 180% volume surge during breakdown.

Chart Patterns:

- Range-bound consolidation between $0.1460-$0.1530 broken to downside.

- Descending channel formation with sequential lower highs established.

- Institutional distribution pattern extending broader consolidation breakdown.

Targets & Risk Management:

- Next major support target: $0.1457 (established volume-based level).

- Risk management level: $0.1465 (recent steep decline low).

- Upside resistance: $0.1488 (proven rejection zone on elevated volume).

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy..

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By James Van Straten, AI Boost|Edited by Stephen Alpher

37 minutes ago

Rising whale activity hints at strategic positioning during bitcoin’s downturn.

What to know:

- The count of entities holding at least 1,000 BTC has risen to 1,436 over the past week as bitcoin has plunged to multi-month lows.

- This is a reversal in trend from most of 2025, which saw net selling from larger holders.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language