Hedera’s native token climbed 2% in a steady 24-hour advance, capped by a late-session breakout fueled by renewed volume.

By CD Analytics, Oliver Knight

Updated Oct 8, 2025, 3:29 p.m. Published Oct 8, 2025, 3:29 p.m.

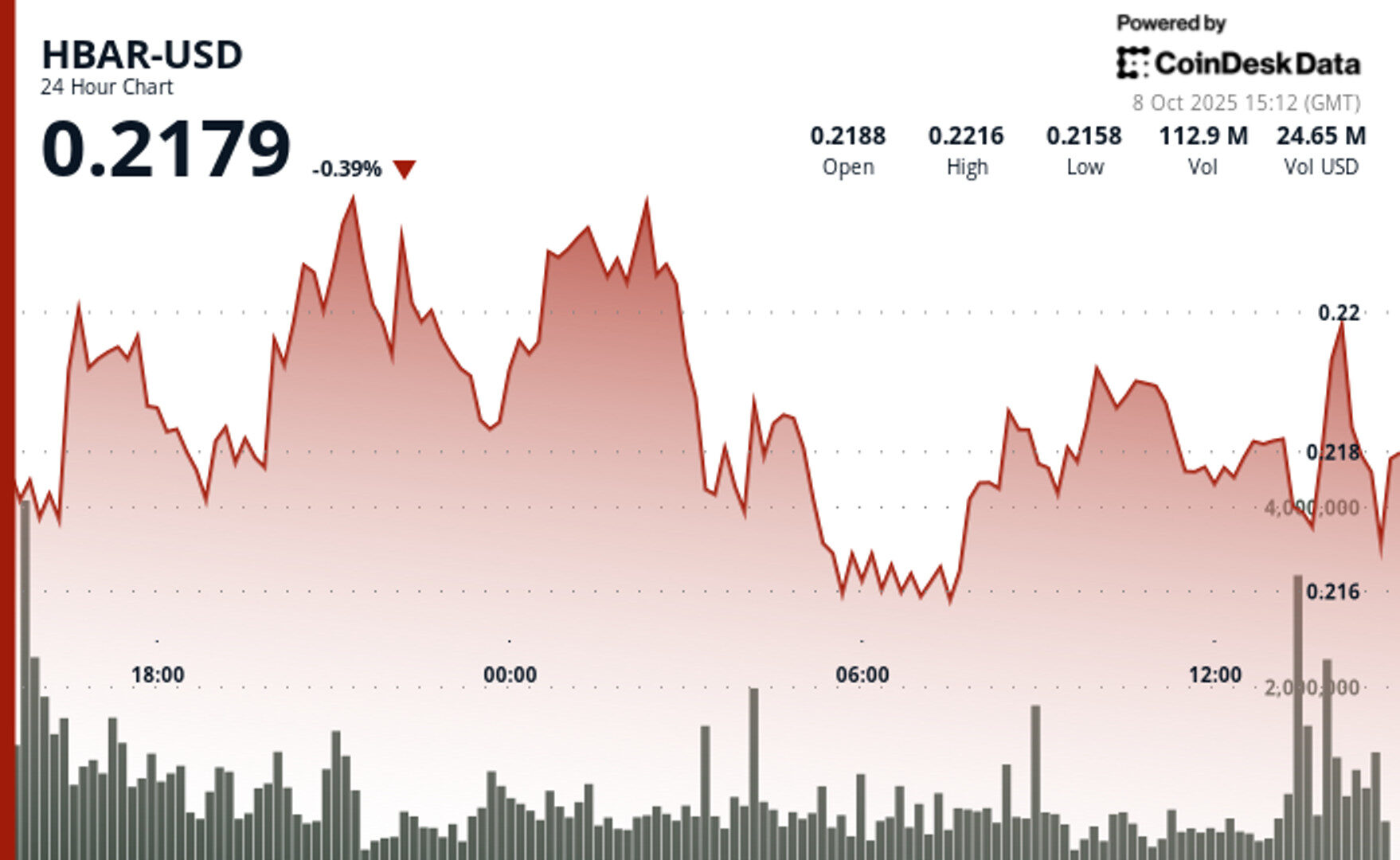

- HBAR surged from $0.22 in the final hour of trading on Oct. 8, breaking through resistance after a prolonged consolidation phase and sharp uptick in volume.

- Canary Capital’s proposed spot HBAR ETF—with a 0.95% management fee under ticker “HBR”—is nearing completion, though SEC review remains delayed by the U.S. government shutdown.

- XRP holders and altcoin traders are increasingly adding HBAR to balanced portfolios alongside ADA and XLM, signaling growing interest in utility-focused blockchain assets.

HBAR exhibited notable resilience in the 24-hour period between Oct. 7 and Oct. 8, climbing roughly 2% from session lows near $0.22 to settle around the same level. The token traded within a tight range, repeatedly testing support and resistance at $0.22.

Despite a steep decline in trading volume—from 138.43 million to 19.74 million tokens—HBAR maintained a steady consolidation pattern, hinting at reduced short-term participation but a stable accumulation phase.

STORY CONTINUES BELOW

Momentum built decisively during the final hour of trading, when HBAR broke out of its compressed formation between 13:12 and 14:11 UTC on October 8. After briefly retreating to an intraday low of $0.22, the cryptocurrency reversed sharply, breaching resistance levels and printing new session highs above $0.22.

The technical breakout coincided with broader market optimism surrounding Hedera’s ecosystem. Institutional enthusiasm continues to grow as Canary Capital nears completion of its spot HBAR ETF filing—proposed under the ticker “HBR” with a 0.95% management fee—though regulatory progress has been temporarily delayed by the ongoing U.S. government shutdown that has slowed SEC operations.

- HBAR maintained trading activity within a constrained $0.01 bandwidth throughout the 24-hour session, fluctuating between $0.22 and $0.22.

- Repeated examinations of support foundations around $0.22 and resistance barriers near $0.22 defined crucial technical parameters.

- Decisive rejection from $0.22 at 01:00 succeeded by retracement to $0.22 validated resistance positioning.

- Trading volume contracted substantially from 138.43 million to 19.74 million tokens during initial phases, indicating reduced momentum.

- Enhanced volume surpassing 4.3 million tokens throughout the 14:02 interval indicated institutional engagement.

- Decisive reversal from session minimum of $0.22 at 13:45 validated the conclusion of consolidation dynamics.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Sep 9, 2025

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

By CD Analytics, Oliver Knight

14 minutes ago

XLM climbed back above $0.39 after a brief sell-off, with rising open interest signaling renewed institutional confidence.

What to know:

- XLM fluctuated between $0.38 and $0.39 over the past 24 hours but closed near session highs, confirming strong recovery momentum.

- Open interest has surpassed $300 million, pointing to growing engagement from professional traders and funds.

- As an ISO 20022-compliant crypto, Stellar is well placed to benefit from the 2025 Fedwire and SWIFT modernization, bolstering its long-term utility narrative.